.

.

"(Jeffry) Picower was the only one that might have

known (of the fraud),"

“I mean how could he not?” Bernie Madoff as quoted by

NY Times reporter Diana B. Henriques

Original research analyzing Picower Foundation stock

portfolios

Review

of 501(c)(3) Picower Foundation 990 filings 2001 thru 2007

Picower Foundation's Mind Boggling Short Term Investment Gains

9/11/09

(pdf

format with hi-lited portfolio attachments)

Analysis

of early Picower Foundation investments (1989-1990) --- more evidence of

fraud 3/12/10

Emails to MIT

Jeffry

Picower's association with MIT 7/20/09

Question

to MIT 8/19/09

MIT

reply 8/19/08

Re:

Jeffry Picower's association with MIT? 8/20/09

CBS's

60 Min story features Picower 9/27/09

Recent

revelations about Jeffry Picower and the Picower Foundation

9/28/09

Jeffry

Picower and the Forbes 400 10/8/09

Picower

Foundation Trustee's son leads Madoff investigation

10/11/09

Open

letter to MIT Treasurer, Theresa M. Stone, about Jeffry Picower Donations

10/14/09

Please

Mr. Picower can we have some more, or Jeffry Picower makes a quick 39 million

10/14/09

Curious

case of Picower Foundation Trustee Gerald C. McNamara

10/21/09

Reporter

Mary Jacoby on Jeffry Picower 10/30/09

William

Zabel's amazing effort to save Picower's ass 11/4/09

Reading

Picower's Will --- a new Picower Foundation

or

Time to kiss April Freilich's ass?)

12/10/09

Ask

his brother-in-law? 1/4/10

Barbara

Picower speaks 1/20/10

Picower

money is too dirty to accept 2/1/10

Where

did the money to fund the Picower Institute at MIT really come from?

2/8/10

Did

Barbara Picower trigger the Madoff ponzi collapse?

2/15/10

Latest

Madoff news 2/25/10

Analysis

of early Picower Foundation investments (1989-1990) --- more evidence of

fraud 3/12/10

Another

view of Jeffry Picower's role in the 65 billion dollar fraud

12/17/10

Meet

Picowers' (newly arrested) account manager

12/xx/10

Posting and emails when 7.2 billion Picower

settlement announced 12/18/10

Picower

settles for 7.2 billion --- Some perspective on Barbara Picower's statement

12/18/10

Picowers

as philanthropists 12/18/10

Earnings

on Madoff money not returned 12/18/10

Ridiculous

claim that settlement is 'what Jeffry would have wanted'

12/18/10

Why

future Picower grant should be considered tainted

12/18/10

Letters published in MIT newspaper 'The Tech'

letter

#1 "Picower Money

Tainted" 8/28/09

letter

#2 "Open letter to MIT Treasurer, Theresa M. Stone,

about Jeffry Picower Donations"

changed by The Tech editor to "MIT can benefit from Picower"

10/20/09

letter

#3 "Should MIT accept Picower Money?" 11/30/09

letter

#4 "Picower money is too dirty to accept"

2/2/10

Summer 2009 article on Picower by Tech Editor

Postings

Various

postings

References

Of particular

note is that each annual Picower Foundation 990 filing (links below) contains

in just a couple of pages detail information on the foundation's huge portfolio

(trade dates, shares, price/share, gain/loss, etc). This nearly 20 years

of portfolio information is all fake, riddled with errors and implausible

gains. The foundation's investments were always managed by Madoff, so there

were no trades, none, these records were fabricated by a handful

of people in Madoff's backroom. These portfolios long in the public domain

provides a unique window into the Madoff ponzi, and it beggars belief that

over nearly two decades that neither Barbara Picower, Jeffry Picower, all

the trustees of the foundation and MIT itself never picked up on this fraud.

First two years

of the Picower Foundation IRS 990 filings (partial) (from IRS 990's archive)

Picower

Foundation 990 filing 1989

Picower

Foundation 990 filing 1990

Downloaded

Picower Foundation IRS 990 for years 1996 to 2004 (also available online)

Picower

Foundation 990 filing 1996

Picower

Foundation 990 filing 1997

Picower

Foundation 990 filing 1998

Picower

Foundation 990 filing 1999

Picower

Foundation 990 filing 2000

Picower

Foundation 990 filing 2001

Picower

Foundation 990 filing 2002

Picower

Foundation 990 filing 2003

Picower

Foundation 990 filing 2004

Picower Foundation

IRS 990's original filings. (At Foundation Center 990 repository only amended

filings are available for these years.)

2005

Picower Foundation original 990 filing

2006

Picower Foundation original 990 filing

2007

Picower Foundation original 990 filing

=========================================================================

Overview

MIT accepted

50 million from the private family foundation of Barbara and Jeffry Picower

(2001 to 2005) to fund the Picower Institute for Learning and Memory at

MIT. MIT will soon be offered another 25 million according to the terms

of Jeffry Picower's Will. Should MIT accept more money from the Picowers?

Absolutely not! It's stolen money, money stolen from other Madoff investors,

and in the simplest of terms you don't take money from crooks!

I don't mean crooks in the left-wing sort of way that all capitalists are crooks, I mean an insider in the largest financial fraud of all time, the 60 billion dollar Madoff ponzi scheme. A forensic analysis of Madoff's files produce a mountain of detailed and credible evidence that Jeffry and Barbara Picower were active participants in fraud with Madoff, and that "Picower accounts with the Madoff firm were “riddled with blatant and obvious fraud” that a finance professional like Mr. Picower should have detected immediately." (NYT 11/9/09) My own analysis of its 990 portfolios confirms this.

Prior to MIT accepting 50 million to build the Picower Institute of Learning and Memory Picower's public reputation was not good. Clues that something was not right with the Picower Foundation's source of income have been available in the public domain for years. The Foundation's investment portfolios included in their IRS 990 filings show strange inconsistencies and improbable gains. Immediately following Madoff's arrest for running a ponzi scheme in Dec 2008 the Picowers suddenly cut off all funding to researchers and charities they traditionally supported, claiming they were Madoff's biggest victim, even though it would have taken less than 1% of their wealth per year to maintain 100% funding.

Come summer 2009 the court appointed Madoff Trustee disclosed detailed and credible allegations of participation in fraud with Madoff by all those running the Picower Foundation [Jeffry & Barbara Picower and their business associate April Freilich] and sued the Picowers for return of 7.2 billion in ill gotten gains. Earlier the Wall Street Journal reported on the front page that Jeffry Picower was one of eight Madoff insiders that criminal investigators were looking at. Two months later the Picowers made a rebuttal court filing to the Trustee's allegations of fraud.

I found the Trustee's allegations convincing, but wrote nothing until I had a chance to read the Picower's rebuttal (I found it very unconvincing). I then began writing a series of emails to the MIT treasurers office and researchers at the Picower Institute at MIT. I did my own original analysis of the Picower Foundation stock portfolios included in their IRS 990 filings, which I distributed widely after making a significant finding: a pattern of short term gains that are for all practical purposes statistically impossible. I also sent letters to the independent MIT newspaper 'The Tech', several of which have been published.

In Oct 2009 Jeffry Picower died suddenly, His Last Will and Testament laid out plans for a new Picower Foundation that he "requests" grant MIT an additional 25 million dollars in its first year of operation. To the best of my knowledge MIT has said nothing publicly about any of this. No comment as to whether they would, or would not, accept an additional 25 million dollars from the Picowers. (It is, I suppose, possible that they may have already accepted it, or agreed to accept it, and have kept quiet about it.)

Picowers at MIT

Left in front

of the new building they funded, and right with MIT president at the building's

dedication in 2005.

.

.

=========================================================================

7/20/09 (first email to MIT, sent only to press contact

on Picower Institute web site)

Picower Institute

As an MIT alumni I am embarrassed to have Jeffry Picower's name associated with MIT. The Madoff scandal has produced credible allegations that Picower is a world class tax cheat and major participant in one of the largest frauds in history. The 50 million he gave MIT, the Maddoff trustee alleges, was other peoples money that Picower obtained by (effectively) blackmailing Madoff (read the trustee filing below carefully).

MIT should take steps to separate itself completely from this crook. Ideally return the 50 million to the Madoff trustee, but baring that remove Picower's name from the Institute and remove his portrait.

I sent the letter below this day to the 'Tech'

Jeffry Picower is emerging as the #2 man in the Madoff scandal. The suit filed by the Madoff trustee against Picower says the huge phony gains and huge fraudulent tax loss statements delivered to Picower at his request were nothing more than payoffs for “perpetuating the Ponzi scheme". Picower ended up with more cash from Madoff's ponzi in his pocket than anyone (blackmail?): 5.1 billion cash, not phoney paper gains, but cash.

The roughly 1% of that 5.1 billion that MIT accepted from Picower for the Picower Institute for Learning and Memory is clearly tainted.

The trustee's filing makes interesting reading, I suggest everyone at the Picower Institute read it, and then reconsider whether Picower's portrait should hang in the lobby.

http://www.scribd.com/doc/15282761/Madoff-Trustees-Suit-Against-Picower

Don Fulton, MIT 64

----------------------------------------------------------------------------------------

8/19/09

Question to MIT email

Judith Korch

If you didn't see

it, here are links to the Picower's July 31 court filing replying to charges

by the Madoff

Trustee:

http://www.scribd.com/doc/17924529/Jeffry-Picower-Response-to-Madoff-Trustee

http://s3.amazonaws.com/propublica/assets/docs/PicowerMTDFINAL.pdf

Here (again) are links to the

Madoff Trustee's suit aginst Jeffry and Barbara Picower, individually and

as

trustees of the Picower Foundation, and including the

Picower Foundation:

http://www.scribd.com/doc/15282761/Madoff-Trustees-Suit-Against-Picower

http://online.wsj.com/public/resources/documents/20090512picard.pdf

Has MIT (at any level) issued

a statement, or is it planning to issue a statement, about accepting what

appears to have been (in part or in toto) 'stolen' money

to fund the Picower Institute for Learning and Memory

and various other MIT programs funded by the Picower

Foundation?

Don Fulton, MIT 64

----------------------------------------------------------------------------------------

8/19/09 MIT reply

email

Subject: Re: Jeffry Picower's association with MIT

Date: Wed, 19 Aug 2009 08:37:40 -0400

Dear Mr. Fulton:

Thank you for your recent email; I know from Martha Ruest that you have expressed your concerns to us earlier, as well. MIT has not made a statement; we are following the matter as it continues to unfold.

Regards,

Judith Korch

***************

Judith Korch

Assistant Director of Administration

Picower Institute for Learning and Memory

Massachusetts Institute of Technology

77 Massachusetts Avenue, 46-1303

Cambridge, MA 02139

617.452.3342

----------------------------------------------------------------------------------------

8/20/09 email

Judith (Korch)

Given the two court filing

now on the public record, the fact that the sums involved (5.1 billion

net cash) must represent the bulk of Picower's wealth, the fact that Picower

'withdrew' hundreds of millions of dollars (up to 1 billion) per year out

of the ponzi during the years that MIT had its hand out, I'd say it would

prudent to at least now throw a sheet over the Picowers' portrait.

If your son steals a car and hands you the keys, saying pop here's a gift, how long to you think the police will let you keep the car? The fact that you did not know the car was stolen counts for nothing. What's the difference between this case and MIT accepting money from Picower that appears at this point to have been in essence stolen? The Trustee calls Picower's 5.1 billion cash withdrawal "other peoples money"

I suggest MIT prepare a statement,

and perhaps plan to cough up the 50+ million, because I am going to press

this matter, hard.

Don

Footnote

Did you notice

who headed legal team Picower picked to write his response? He is one of

the 'independent', outside trustees of the Picower Foundation. My understanding

is trustees of any tax exempt foundation have obligations to see that the

money is prudently (& likely honestly) invested, so not only do we

have a massive failure by Jeffry Picower and Barbara Picower in the loss

of the one billion of the Picower Foundation, but by Picower's lawyer as

well in his capacity as trustee.

Even on paper

the Foundations assets were not well diversified. I looked at the Dec 2007

990 filing by the Picower Foundation, and it shows that nealy half of the

almost one billion in assets were in (supposedly) only seven stocks.

----------------------------------------------------------------------------------------

9/27/09 email

All

Picower Institute

portrait boy, Jeffry Picower, was featured in a long story on CBS's 60

min last Sun about the Madoff recovery effort. Below is a link to the full

story. You'll notice the two lawyers leading the Madoff recovery effort,

who now know how Jeffry Picower earned (to use the term loosely) much of

his money, are a tad less admiring of him than MIT officials and Picower

Institute directors in the past have been. They are suing him for return

of 5.1 billion, about 1% of which funded the Picower Institute at MIT.

Picower appears about 10 min into the 13 min video (one 1 min commercial near start).

http://www.cbsnews.com/video/watch/?id=5345013n&tag=related;photovideo

Don Fulton

----------------------------------------------------------------------------------------

9/28/09 first email to wider distribution (Picower profs

and post docs)

Memo

To: Picower Professors and Researchers

From: Don Fulton, embarrassed MIT alumnus

don_fulton@hotmail.com

Date: Sept 28, 2009

Recent revelations about Jeffry Picower and the Picower Foundation

As a hard working researcher all you may know of Jeffry Picower is that he was a generous benefactor that made the Picower Institute for Learning and Memory at MIT possible and that he and his wife's private granting foundation, Picower Foundation, had to close because it had invested all its assets with Madoff.

But in the last few months new information about Jeffry Picower and the source of his wealth has come to light from the Madoff investigation. Maybe you don't care since Building 46 and the Picower professorships are fully funded, but I think you should, at least as long as the Picower name is connected to MIT. And, of course, there is also the ethical dilemma that almost all the money accepted by MIT from the Picowers to built the Picower Institute and fund the professorships was according to the Madoff Trustee "other peoples money", in essence the money was stolen (by Madoff).

I am a retired MIT engineer (EE 64) with time to pursue what interests me, so in Dec 2008 when Madoff was arrested claiming 'I did it alone' and victims were popping up everyday claiming never to have noticed anything amiss, I smelled a good story and have followed the Madoff developments closely ever since assembling a large Madoff archive on my home page (link below). And was I surprised when in spring 2009 the Madoff money trail led straight to Jeffry Picower and back to my alma mater.

To a follower of the twists and turns of the Madoff saga and a reader of primary documents (like me), which in this case includes court filings and 990 filings, Jeffry Picower is not the innocent victim of Madoff he pretends to be. He's a Madoff insider, more like an associate of Madoff. My low opinion of Jeffry Picower is shared by others. In the excellent new Madoff book, Too Good to be True, by former Barrons writer Erin Arvedlund you find this entry in the Index {Picower, Jeffry, illegal activities of}. Picower, she says, "had a history of tax avoidance" and it's downhill from there with several pages required just to summarize all the charges against him by the Madoff Trustee.

Picower Foundation unique 990's

I think it's

little known that Madoff (probably with Picower's input) crafted and maintained

a unique investment portfolio just for use by Jeffry Picower. The Picower

Foundation investments as reported in its IRS 990 filings are thus quite

interesting because they provide a unique public window into how Madoff

operated. The 990 portfolios of other charities who invested with Madoff

are far less interesting, because they were supposedly invested using the

famous Madoff split-strike strategy, which always took the entire portfolio

to cash on the reporting dates. The Picower Foundation portfolio was structured

(fabricated) to look real while at the same time producing super returns,

not an easy thing to get right for a portfolio that purports to buy and

hold stocks for years.

My 990's review

Recognizing

the importance of the 990's as a window into Madoff and that the fact 990

information had been available to MIT and online for a long time, I began

a detailed review of the Picower Foundation 990's. I sent a report recently

to MIT of my findings covering years 2001 thru 2007.

The Picower Foundation 990's (2001 to 2007) did not indicate, at least not clearly, that the foundation's assets were managed by Madoff. Perhaps this is because Madoff didn't like his name used and perhaps also it was to give the illusion to grantees that the investment manager and master stock picker of the Picower Foundation was Jeffry Picower. But a search for 'Madoff' in these years 990's does produce some hits. For example, in 2001 the bulk of the foundation's assets are shown residing at 'B. Madoff', and the grantee list several times shows 'Ruth Madoff' as the contact for contributions (really little kickbacks) to her pet charities.

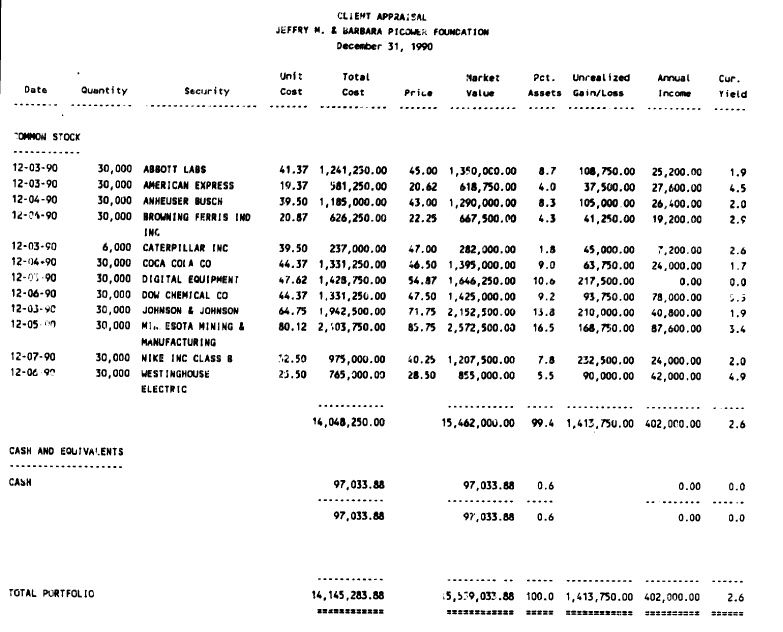

Picower's ponzi withdrawals

Picower's

withdrawals from the ponzi (7 billion) far exceeded his input (2 billion)

leaving him with 5 billion net cash. Most of the well known Madoff feeders

like Merkin (Ascot Partners), Noel (Fairfield Greenwich) were enriched

to the tune of 100 to 200 million dollars. Madoff and his extended family

are thought to have extracted 100 to 300 million. Compare this to Picower's

net 5,000 million dollars from the ponzi, more cash by far than anyone

else! The only other person even close in net cash is Madoff insider Stanley

Chais of LA, who received about 1/5th of what Picower got. If you 'Follow

the Money' in the Madoff investigation, it leads directly to Jeffry Picower.

Note, that Picower received billions (net) from Madoff is not really contested. The court appointed Madoff Trustee, after a forensic analysis of Madoff's books, determined that Picower had received a net of 5.1 billion in the last thirteen years and sued Picower for its return. Picower in his reply to the court confirmed that he had received "billions" from Madoff.

Is Jeffry Picower the world's cheapest philanthropic bastard?

Why did Jeffry

Picower and his wife Barbara last Dec just suddenly cut off funding and

leave hanging all the medical researchers, including those at MIT, they

were currently supporting and to whom they had promised future support?

Because the assets of the Picower Foundation suddenly vaporized with the

Madoff ponzi collapse? Please.... if you believe that I have bridge

you might be interested in.

Jeffry Picower has wealth beyond anyone's imagination. He could have paid for every item bought online from WalMart last year and still had billions left over! His contributions to the Picower Foundation over the last decade (50 million) were less than 1% of his reported wealth. So is the explanation simply that he is the world's cheapest philanthropic bastard?

Or is he running for cover?

My theory

is that Picower has decided to play the role of Madoff victim as his best

hope of staying out of jail. When Madoff was arrested and his files were

suddenly open to inspection by the authorities, Picower had more than a

little problem (for details see the Madoff Trustee's May 13 filing) and

immediately ran for cover. Even though Jeffry Picower could have financed

the few million in continuing medical/scientific programs of the Picower

Foundation with pocket change, his role as Madoff victim required that

the Picower Foundation be closed ("caused" by Madoff related losses says

his court filing) and medical researchers and research supported for years

by he and wife Barbara be abruptly cut off.

990's portfolio transactions

My review

of the Picower Foundation 990's shows its equity portfolio purchases in

the last seven years had to have been rigged (backdated) with 27 of 27

stocks rising after purchase with an average gain of 50% in just a few

months, and the 990's for 2000 and 2001 show strong hints of similar rigging

of equity sales. Anyone looking closely at the Picower Foundation investment

portfolio over the years as reported in its 990's can see that its success

in buying and selling of stocks is just not statistically possible, it

does not represent a real portfolio.

Picower Foundation grant money was nearly all ponzi money

You've probably

heard of Madoff's steady 10-15% returns, well that doesn't apply here.

Madoff paid his friend Jeffry Picower much higher rates of return (says

the Madoff Trustee). In 1993 the Picower Foundation assets were in the

range of 27 million and by the end of 2007 had increased to 958 million.

This is an increase of x35 in fifteen years, an average annual increase

in assets of about 27%! I don't know how much Picower contributed 1993

to 1997 because the 990's for those years are not available online, but

from 1998 to 2007 his contributions were small. In these years Picower's

contributions came nowhere near covering the grants of the foundation,

all the foundation's 600 million dollar increase in assets plus the bulk

of its 230 million or so in grants in these years came from the (so-called)

returns of its portfolio. Madoff just shoveled money into the Picower Foundation.

The Picower Foundation grant money was nearly all Madoff ponzi money.

Did MIT ever look at the Picower Foundation 990's, even notice its 'almost too good to be true' investment record? Or perhaps they did notice and concluded professional investor Jeffry Picower must be one hellva of a money manager? His investment returns were likely better than the MIT endowment returns, so I wonder if maybe they considered recruiting him to help out with the endowment? (Of course, I'm being sarcastic, but it's to make the point that the Picower Foundation 990's returns history should have raised a red flag, a red flag that was either missed or dismissed by MIT.)

Picower's knowledge

At the minimum Jeffry

Picower had to know the Foundation's portfolio was rife with fraudulent

transactions and gains (though he does not admit this), but the court appointed

Madoff Trustee (Irving Picard) in his May 13th court filing does not mince

words and goes much further. He accuses Jeffry Picower of being directly

responsible for the (illegal) portfolio manipulations. The Trustee's allegations

against Picower are too numerous to even summarize here. (See Arvedlund's

book for a summary and the Trustee's link below for details. I also have

include the link to Picower's content-free rebuttal).

In simple terms the Madoff Trustee is alleging that the Picower Foundation was not honestly run by the Picowers, Jeffry and Barbara (both are defendants, as is the Picower Foundation, in the Madoff Trustee's suit to recover 5.1 billion), that the investment gains of the Foundation's portfolio, which is where most of the Foundation's money came from, were phony ("payoffs" from Madoff to Jeffry Picower says the Trustee), and that Jeffry Picower knew they were phony and had a hand in directing them.

Why should you care?

The Picower

Foundation was more than a gift machine, a supporter of good research.

It may very well be that in its research support the Foundation was excellently

run (by Barbara Picower), but an assessment of the Picower Foundation cannot

ignore the source of its money. If the Picower Foundation acquired the

bulk of its assets in a manner that its investment manger, Jeffry Picower

in his capacity as Picower Foundation trustee, knew, or as the lawyers

like to say 'should have known', at the time to be illegal, should MIT

continue to permanently and eternally (quoting Prof Bear, see footnote

below) carry the name 'Picower' on a major research lab and professorships

(not to mention honoring the Picowers with a portrait in the lobby)? I

think not.

One possibility is MIT take its cue from the Jewish Theological Seminary in the 1980's. They took the name Boesky off their Boesky funded library after they, and perhaps more importantly the rest of the world, found out how Ivan Boesky made his money.

And what of the 50+ million of Madoff ponzi money accepted from the Picowers? Is MIT's position 'we've got it and we're going to keep it', the other Madoff investors be damned?

Are you embarrassed?

With all the

new information that has come to light in the last six months about the

Picower/Madoff connection, aren't you (Picower professor or researcher)

the slightest bit embarrassed to be a 'Picower' professor and to work at

a lab named for Picower? What if Picower gets criminally indicted, what

if he goes to jail, does that change your thinking? I would like

to see MIT and the Picower Institute begin to address the new information

about the Picowers and how the Picower Institute at MIT was funded. To

just sit mute as MIT has been doing is unacceptable.

----------------------

Footnote --- After drafting this letter, I came across

laudatory comments (below) about the Picowers by Prof Bear in his 'From

the Director' column of the Winter 2009 issue of Neuroscience News. The

column was apparently written in early winter 2009 after Madoff was arrested,

but before Picower's inside status with Bernie became known.

-- "Picower

Institute for Learning and Memory at MIT is a permanent monument to the

vision and generosity of Barbara and Jeffry Picower and The Picower Foundation."

--(our current

and future scientific accomplishments will be a part of the) "legacy of

Picower philanthropy."

-- "I have

greatly admired the Picower's deep commitment" (to great societal causes

including lessening human suffering from diseases of the brain.)

-- "We will

be eternally grateful for all the Picowers did" (to make our Institute

the best of its kind in the world.)

Footnote II --- It will be interesting to see the 990 filing of the Picower Foundation for 2008. Picower's recent court filing strongly plays up his role as Madoff victim, claiming the collapse of the Madoff ponzi "caused" the closing of the Picower Foundation, while simultaneously dancing around the issue of what fraction of the Foundation's assets were lost to Madoff. There are hints in the court filing that significant Foundation assets may not have been invested with Madoff when the ponzi collapsed. (Examples of the language: more than "half a billion" was left with Madoff in various accounts, close to a billion was invested with Madoff "at one time", and withdrawals would have been "accelerated" if he had known it was a ponzi.) If not all the Foundations assets were lost on Dec 11, 2008, then obviously concealing this fact for as long as possible would be consistent with Picower portraying himself as a major Madoff 'victim' who is deserving of sympathy not jail time.

Links

Madoff Trustee (Picard) suit against

Picower (May 13, 2009)

http://online.wsj.com/public/resources/documents/20090512picard.pdf

Picower's reply to court (July

31, 2009)

http://s3.amazonaws.com/propublica/assets/docs/PicowerMTDFINAL.pdf

my Madoff page

http://twinkle_toes_engineering.home.comcast.net/ponzi_madoff.htm

----------------------------------------------------------------------------------------

10/8/09 email

To: Picower Foundation people

Jeffry Picower is included in the newly released 2009 Forbes list of 400 richest men in America at rank #371 with (conservatively) estimated wealth of 1 billion, but Forbes isn't counting the billions in Madoff money. Forbes notes Picower is "likely worth billions more" saying he is "alleged" to have extracted billions of dollars from Bernard Madoff's fund before it collapsed. I would point out that it's not just alleged, in Picower's court filing he confirms he received "billions" from Madoff.

The latest estimate by the Madoff Trustee is Picower 'netted' 6 to 7 billion from the Madoff ponzi. At that wealth level Picower's rank on the 400 list would rise from #371 to around #30 putting him near Jeffrey Bezos, founder of Amazon (@ 8.8 billion), Edward Johnson, founder and owner of fidelity investments (@ 8 billion), Rupert Murdoch, owner of a media empire including Wall Street Journal (@ 6 billion), and Steve Jobs of Apple (@ 5 billion). Everyone knows what Bezos, Johnson, Murdoch and Jobs do, what they have contributed to society. What has Picower done, what has he contributed to society? How does Jeffry Picower belong with these people?

Is it even remotely possible that a person starting as an accountant and lawyer (with no known, or at least no known substantial, inheritance), who never ran a large company, who never invented anything, could honestly accumulate so much wealth that he is now the 30th richest man in America? What are the odds!

From the little we know about Picower it appears he likes to invest with crooks. He invested in the 1980's with Ivan Boesky, and Boesky was a crook. In later years Picower invested most of his money (24 accounts, including the Picower Foundation) with Madoff and Madoff was a crook. Nor was Picower just another investor with Madoff, Madoff created a phony 'buy & hold' portfolio exclusively for Picower and over the years showered more ponzi cash on Picower than anyone else.

My review of the Picower Foundation IRS 990 filings (Picower Foundation's Mind Boggling Short Term Investment Gains, 9/11/09) shows 27 of 27 stocks added to the portfolio from 2001 to 2007 go up in value in the first year with the minimum gain 14% and an average gain of 50%. What are the odds? Picower in his court filing says (I quote), "Defendants account returns (includes Picower Foundation account) were not implausible". So I ask again is Picower: Insane, Senile, Nitwit, or Slimeball?

So given the

facts on the table about Jeffry Picower, facts that are pretty well established

and independent of whether or not Picower is criminally indicted, what

are the odds that the bulk of his wealth and the money he gave MIT was

honestly acquired?

----------------------------------------------------------------------------------------

10/11/09 email

The well known fake Bernie blog (link below) leads with a Picower story. The guy who writes this blog, pretending to be Bernie Madoff, is close to the Madoff investigation. He reports that the son of Picower Foundation trustee, and long time lawyer for portrait boy Jeffry Picower, William D. Zabel, is now a key player in the U.S. Attorney's Office that is leading the Madoff investigation.

He gossips about Picower being a possible "person of interest" in the Madoff investigation and that Picower in Zabel's son might have an inside man who could possibly tip him off in time to flee the country if he was about to be criminally indicted.

http://bernard-madoff-scam.blogspot.com/

----------------------------------------------------------------------------------------

10/14/09 email to Theresa M. Stone, MIT Treasurer &

letter published in 'The Tech' (10/20/09)

Open letter to MIT Treasurer, Theresa M. Stone, about Jeffry Picower Donations

MIT's favorite individual donor, Jeffry Picower is likely soon to be bankrupted. The Madoff Trustee has a 7.2 billion clawback suit against him (his lawyer has already said he's ready to make a deal), and it's likely the IRS will have big claims too, because Picower got billions in phony tax loss statements from Madoff.

As I see it, Picower's a motivated donor if ever there was one! Here's my suggestion: Ask for the 39 million that Picower 'earned' in 2006 in just two weeks via the accounting magic of stocks bought four months before the account was opened. The Madoff Trustee repeatedly uses this example to show that Picower was in bed with Madoff and his gains were fraudulent. Perfect. If MIT can get this 39 million, it can clean it up. Do you really think the Madoff Trustee would sue MIT for the return of a few measly million Picower dollars?

Sure the Picowers' money might be tainted, but that didn't stop MIT from accepting 10 million a year from the Picowers 2001 to 2005. MIT has made no public comments that it regrets accepting this 50 million for the Picower Institute for Learning and Memory, so why not ask for more? It's probably as close to free money as MIT is ever going to see. Offer to name something else after them, they seem to like this.

Don Fulton, MIT 64

http://tech.mit.edu/V129/PDF/N46.pdf

(Oct 20, 09 issue of 'The Tech', top of page 4)

----------------------------------------------------------------------------------------

10/14/09 email

To: Picower Foundation people & MIT Treasurer

Please Mr. Picower can we have some more, or Jeffry Picower makes a quick 39 million

In middle of April 2006 Jeffry Picower opens a new Madoff account (called 'Decisions 6') and funds it with a wire transfer of 125 million dollars. The account statements show the money is invested in 57 stocks that with a little accounting magic were purchased (near their lows) in Jan 2006 "four months before" the account was opened! Within two week after the account has been opened there's a sweet 39 million (31%) gain. A few months later Picower removes his original 125 million, leaving the phony profits to continue growing. That's how it done in Picower land: huge quick guaranteed gains with virtually no downside risk.

So my suggestion to MIT, if it doesn't mind accepting dirty money, which the record seems to indicate is not a problem, why not send Jeffry or Barbara Picower an email and ask for this 39 million to fund a new lab or building. Maybe offer to name something after them, they seem to like this. After all, from Picower's point of view it's easy come easy go, since it's probably going to get clawed back. From the Madoff Trustee's point of view this 39 million was 'earned' a little too easily and belongs to the victims. From MIT's viewpoint a motivated donor! It's almost free money.

Picower's lawyer has already indicated he wants to make a deal to settle the 5.1 billion claim (whoops, I forgot, the Madoff Trustee has just raised the claim to 7.2 billion) that the Madoff Trustee has against him. If MIT doesn't grab more Picower cash now, the Madoff Trustee and IRS are probably going to get nearly all of Picower's money. MIT doesn't want this, does it, when a few million more Picower dollars could be doing good work right here at MIT? What's the likelihood the Madoff Trustee will sue MIT for return of a few measly million Picower dollars? If 0.039 billion goes missing, who's going to complain or even notice? It's just a rounding error when the claim is 7.2 billion. Here's a sample email you could send the Picowers:

Dear Jeffry and Barbara

You know that 39 million you made in two weeks in 2006 that the nasty Madoff Trustee keeps going on and on about saying the gain was fraudulent. Well we here at MIT have some cool ideas (-- ideas here --) as to how that 39 million could be put to good use right here on our campus. And we'll name (--labs or buildings here --) after you too, if you want. So how about it, could you send us a check for that 39 million real soon before the nasty Madoff Trustee grabs it? It can only improve your reputation as a great philanthropist. How about if we arrange for another picture with President Susan Hockfield?

And so maybe the money's a little hot, but we won't complain. Have we said anything about the 50 million you gave us for the Picower Institute for Learning and Memory? Good luck, hope you can stay out of jail without having to flee your 28 million dollar Florida home. Go Picower!----------------------------------------------------------------------------------------Your friends and supporters at MIT

Curious case of Picower Foundation Trustee Gerald C. McNamara

Gerald C. McNamara, Picower Foundation trustee for at least the last decade, is apparently (see footnote below) a Managing Director of Goldman Sachs. In other words McNamara, unlike all the other Trustees (excluding Jeffry Picower), is a financial guy. If any of the independent trustees would be likely to notice funny business in the Picower Foundations 990's investment portfolios I would think it would be him. What's really curious is McNamara works at Goldman Sachs. Why is this curious? Consider this news story (with confirmation by Madoff whistle blower Markoplolos):

"More than a decade ago bankers from Goldman Sachs' asset management division were despatched to Bernard Madoff Investment Securities to discover how the legendary fund manager maintained such consistently good returns ... One former Goldman partner said: "I remember the guys came back baffled. Madoff refused to let them do any due diligence on the funds and when they asked about the firm's investment strategy they couldn't understand it. Goldman not only black-listed Madoff in the asset management division but banned the brokering side from trading with the firm too." (UK Telegraph, 20 Dec 08)So here we have a Picower Foundation trustee for a decade who is a senior financial guy (Managing Director) of a firm that for a decade has black listed Madoff and will not deal with him! Isn't this interesting! Did McNamara know that Picower Foundation's assets were managed by Madoff? How could he not know? Didn't he have a responsibility to know? Picower Foundation 990's (at least one of them), easily found online, showed the bulk of the Foundations assets residing at "B. Madoff".Markoplolos, the famous Madoff whistle blower, confirms this. One of his red flags in his 2005 SEC filing was that Goldman Sachs would not deal with Madoff.

Has anyone

at MIT picked up the telephone to see what Picower Foundation trustee Gerald

McNamara at Goldman Sachs has to say about the 'too good to be true' performance

(& other weird anomalies) of the Picower Foundation's portfolios as

reported in its 990s during his tenure as trustee?

Footnote -- Identifying trustee 'Gerald C. McNamara'

For the last seven years the Picower Foundation 990's list the address of its trustee 'Gerald C. McNamara' as simply c/o Picower Foundation, but in earlier years 990's an address was given. A little searching finds a 'Gerald C. McNamara, Jr', age 55, with the same street address for Picower Foundation trustee 'Gerald C. McNamara' shown in the 990's for years 1998 to 2000 (300 West End Ave, Apt 8A, New York, NY 10023). In a 1984 New York Times wedding announcement we find the wedding of 'Gerald C. McNamara, Jr', an employee of Goldman Sachs and son of late Gerald C. McNamara a securities broker. Goldman Sachs currently lists a 'Gerald C. McNamara, Jr' as a Managing Director (appointed 2001).----------------------------------------------------------------------------------------

Mary Jacoby is a reporter (bio below) who has followed Jeffry Picower longer than anyone else. She did a pre-Madoff expose on his medical "self-dealing" in 2001 (story link below) Her story explores how the rights to a potentially valuable drug developed by research funded by the Picower Foundation 'somehow' ends up back in Jeffry Picower hands. Her opinion of Jeffry Picower since then, I think's fair to say, has been pretty low, examples

--- "It took me about 30 minutes looking at public records to figure out that (Jeffry) Picower was likely engaged in massive self-dealing"

--- "There were red flags around Palm Beach billionaire Jeffry Picower for years"

As top medical/scientific researchers this should be right up your alley. Were you aware at the time (2001) of Picower's alleged self-dealing involving drug rights? Did you inform MIT of your concerns?

Don Fulton

http://www.sptimes.com/News/070801/Worldandnation/Complex_web_benefits_.shtml

(2001 Picower self-dealing story)

----------------------------------------------------------------------------------------

11/4/09 email

If Jeffry Picower can be said to be the benefactor, or 'father', of the Picower Institute (ignoring for the moment the regrettable fact that nearly all the wealth the Picower Foundation showered on MIT came from an illegal ponzi scheme), then William D. Zabel is the Picower Institute's 'godfather'. William D. Zabel, age 73, is not exactly a legal unknown. Zabel, Harvard Law School cum laude and Princeton Univ BA summa cum laude, is a name partner of a 350 lawyer NYC law firm (Schulte Roth & Zabel) founded in 1969, trustee of 100 million dollar Soros Charitable Foundation, trustee of New York University, trustee of The New School, chair of board of directors of Human Rights First, and many other honors. He even wrote a book, "The Rich Die Richer and You Can Too", by William D. Zabel, 1996. And Zabel and Madoff were both trustees of the Picower Institute for Medical Research.

Zabel in his personal legal work has long specialized in working with the super rich. He did George Soros' divorce (Soros is the 29th richest person in the world says Forbes) and is a trustee of Soros' charitable foundation. And of course Zabel has been closely associated with Jeffry Picower for at least 20 years, some call him Picower's consigliere. Zabel and his firm wrote the Picower defense to Madoff Trustee's 7.2 billion clawback lawsuit. William D. Zabel filed the papers in 1989 establishing the Picower Foundation and has been a trustee of the Picower Foundation for all its years. Statements released to the press by the Picower family at Jeffry Picower's death came from Zabel, who identified himself as Jeffry Picower's personal lawyer.

In an 9/29/09 email to me from Sam Cooke (& indirectly Prof Bear) of the Picower Institute for Learning and Memory it was suggested that Jeffry Picower should be considered innocent until proven guilty. But I say look at the facts, including Picower's 60+ page reply to the court that doesn't even attempt to rebut or explain the detailed allegations of fraudulent account manipulations leveled against him by the Irving Picard, the court appointed Madoff Trustee. Consider the following, which is either the most amazing coincidence or a demonstration of the kind of legal protection you can buy when your a billionaire.

Amazing lawyering

Consider the amazing feat

of lawyering Picower's lawyer Zabel just pulled off. Zabel managed or helped

(for details see articles by Mary Jacoby at MainJustice) to get his own

son, Richard B. Zabel, appointed in early Oct 2009 by U.S. Attorney (Preet

Bharara) to head the Southern District of New York Criminal Division. That's

right Zabel, whose client Jeffry Picower is facing indictment as one of

the Madoff insiders and main beneficiary of the ponzi, manages to get his

own son (!) appointed to head the prosecutors office that is running the

Madoff investigation and is responsible for issuing Madoff related criminal

indictments!

Is this unbelievable lawyering or what? Maybe it's a first. Billionaires just do not live in the same world as the rest of us folks. Of course, Richard Zabel recused himself from the case because his father is Picower's lawyer, but somehow I remain skeptical. As a little side benefit William Zabel gets some protection for himself too, because as trustee of the Picower Foundation he had a responsibility to see to it that foundation's assets were prudently invested. (And he kind of screwed up on that one.)

And how does Jeffry Picower reward his long time lawyer for this incredible lawyering? He drops dead two weeks later! You can't indict a dead man, so all of Zabel's incredible lawyering is wasted. I wonder if Jeffry mailed the check to Zabel for 'services rendered' before going for his last swim.

Picower Institute's 'godfather',

William D. Zabel, has been looking at the Picower Foundation's 990 fabricated

portfolios for 20 years! These portfolios with their too good to be true

gains and inconsistencies were a revealing and unique window into Madoff.

Zabel was in the perfect position to see these red flags. If he didn't

see them, maybe it's because lawyers often make it their business not to

'see' certain things that could be troublesome. A lot of Madoff insiders

and hangers on in their quest to get filthy rich apparently decided it

was better not to know exactly what Madoff was doing, even though it was

probably clear to most of them that Madoff was running a scam of some sort.

----------------------------------------------------------------------------------------

12/10/09 email

Reading

Picower's Will --- a new Picower Foundation

(or Time to kiss April Freilich's ass?)

Introduction

At Jeffry Picower's

death he was one of the richest men in the country. He is known to have

netted about 1 billion from the sale of Alaris Medical and 7.2 billion

from the Madoff ponzi in just the last 13 years alone. This means the source

of 90% or more of Picower's wealth (remember, he had been 'investing' with

Madoff long before 1995) was the Madoff ponzi. For reasons not yet explained

Madoff dumped a large fraction of all the cash his ponzi ever raked in

into the various accounts of Jeffry Picower including the account of the

(old) Picower Foundation. The Picowers have voluntarily returned none of

this money to the Madoff victim pool and are now being sued by the Madoff

Trustee for return of 7.2 billion. The news headlines say the Picowers

would consider returning only the money withdrawn in the last six years

(about 2.4 billion) to settle the case. In other words Jeffry and Barbara

Picower's position has been, and with Jeffry Picower's death remains Barbara's

position, that any Madoff money stolen more than six years ago that somehow

(mysteriously) ended up in their Madoff accounts is now theirs to keep!

I think this one fact should tell anyone all they need to know about the

character of Jeffry and Barbara Picower.

Picower updated his Will on Oct 15, 2009 incredibly just ten days before he is found dead at the bottom of his swimming pool. The Will specifies that all his wealth remaining after family, friends and employees are provided for is to be used to fund a new non-profit foundation, a new Picower foundation, whose scope, directors and trustees are outlined in the Will.

MIT was the

major grantee of the old Picower Foundation, receiving 51 million dollars

since 2001, and MIT is even mentioned in the Will. Picower in the Will

"requests", but importantly does "not direct" (a distinction he makes)

25 million go to MIT in the future for the Picower Institute for Leaning

and Memory. Hence, I suspect there's some interest at MIT as to how the

new Picower Foundation will be set up. In that vein I have read the Picower

Will (available online) and hereby offer a little summary, a decoding if

you will, of Jeffry Picower's Last Will and Testament in the context of

his dirty Madoff connections.

------------------

Decoding Jeffry Picower's Will

Firstly, the

old Picower Foundation that funded the Picower Institute at MIT is dead,

"in no event (are funds to go to) Picower Foundation created 1989", says

the Will. However, a new charitable tax exempt foundation is to be set

up, identified only as the "New Foundation", that will do pretty much what

the old Picower Foundation did. The Will says, "I request, but do

not direct, that directors allocate half of the funds for medical research

and the remaining half for charitable purposes." Picower sets aside

about 1/4 billion for family, friends and employees with the balance of

his estate to fund the "New Foundation."

The 64 dollar question is, of course, how much in the way of assets will Picower's new foundation have. Currently the court appointed Madoff Trustee is suing Jeffry and Barbara Picower for return of 7.2 billion, and the IRS may very well have big claims too considering the billions in phony tax loss statements Madoff is known to have generated for Picower (at his request). Hence the assets of the new foundation could be anywhere from zero to many billions of dollars. Potentially it could be much larger than the old Picower Foundation and a behemoth in the non-profit foundation world.

From the bequests in the Will the scope of the Picower's organization is laid bare. The bequests fall into three groups: family, foundation related, and minor employees. Picower gives 200 million (plus property) to his wife Barbara Picower (age 67), 25 million to his daughter Gabrielle Picower (age 37), 2.5 million to each grandchild (if any, none are named), and 200k to his niece Rhonda Bienes (who may be disabled). Five minor employees (maybe household help) get bequests ranging from 200k to 50k plus 25k to five of their children.

Barbara is to continue on about as before as director of the New Foundation. There is no evidence that Picower's daughter Gabrielle has ever been involved in the family's (charity) business, or will be seriously involved in the New Foundation, although she is allowed to apply to be a trustee if she wishes. Gabrielle Picower as of 2006 is listed by New York University School of Education as an instructor and candidate for PhD.

Foundation related bequests

Two long time

Picower Foundation trustees who are not to be trustees of the New Foundation

get small bequests: Martin Post MD gets 100k and William Zabel, who is

also the Picowers' personal lawyer, gets 200k.

One big winner in the foundation related bequests is a new trustee for the New Foundation, Joshua H. Hochschuler (age 36) & family, who get bequests totally about 4.5 million. Joshua, who owns a few ice cream stores in Dallas (featuring premium gelato!), gets three million. Three million is probably a lot of money to a man running a small business. He is the son of Dr. Stephen Hochschuler (age 67) who gets 1 million. Dr. Stephen Hochschuler is a well known back doctor and probably is either a buddy of Picowers or maybe he once treated Picower. An additional 450k is split by three kids in the Hochschuler family. The Will identifies the Hochschulers, father and son, simply as "my friends" even thought they live in Arizona and Texas while the Picowers live in Florida. Dr. Stephen Hochschuler has visited MIT. In 2005 he was a member of the Picower Advisory Council created to advise the leadership of the Picower Institute and MIT.

The really big non-family bequest winner in the Will is Picower's long time assistant and business partner April Freilich (age 56), who gets about 14 million. Ms. Freilich gets 10 million, plus principal on 1.5 million loan to her and husband forgiven, plus her daughter, Samantha Freilich (age 25) gets 500k. April Freilich is appointed co-executor of the estate, jointly with Barbara Picower, and for this she gets another two million. In the New Foundation not only is she to be a trustee (replacing Jeffry Picower), but she is second in line behind Barbara Picower to run the New Foundation. The Will says, "If she (Barbara Picower) ceases to act, April (Freilich) shall act as Chairman of the Board of the foundation."

April Freilich is listed on SEC filings as CEO of several of Picower's business entities, but her main claim to fame is in the court filings of the court appointed Madoff Trustee, Irving Picard. He spends considerable ink describing in detail her participation in various, and fraudulent, Picower/Madoff account manipulations, like her making specific requests to the Madoff team to 'adjust' past months returns to achieve the desired degree of phony gain (or sometimes losses) in Picower accounts. The Madoff Trustee's clawback suit (5/12/09) says "Freilich and Defendants (Jeffry and Barbara Picower) knew or should have known that they were participating in fraudulent activity". The basis for the charges of Freilich's participation in fraud is strong as Madoff kept detail records of communications with Picower and the Madoff file record is supported by a cooperating witness, Frank DiPascali, Bernie's chief fabricator (now in jail), who was Freilich's main Madoff contact.

Combining the Will's bequests with info from the Madoff Trustee court filings it's pretty clear the (old) Picower Foundation was run by just three people: Jeffry Picower, Barbara Picower and April Freilich. With Jeffry Picower dead it looks like the New Foundation will be run by two people: Barbara Picower, with title of chairwomen but doing pretty much what she did in the old foundation, and backing her up April Freilich, who is to be a trustee and will replace Barbara as chairwomen if she steps down. There are five named trustees for the New Foundation: Barbara Picower, April Freilich and Gerald McNamara (of Goldman Sachs), who is held over from the old Picower Foundation, plus new trustees: Joshua Hochschuler, the Dallas ice cream man who was showered with 4.5 million in bequests, and Susan C. Frunzi (no bequests) who replaces lawyer William Zabel as a trustee. Frunzi (age 50) is a lawyer in Zabel's large NY law firm (Schulte Roth & Zabel) and specializes in setting up tax exempt foundations.

Forgive my skepticism, but my take on the Picower's multi-million dollar bequests to new trustees ice cream man Hochschuler and assistant Ms Freilich (plus their family members showered with big money too), is Picower buying loyalty. The fact that most money is passed not as cash but via trusts, no doubt helps insure future loyalty giving Picower influence from the grave. Historically loyalty in the Picower/Madoff world has meant looking the other way when fraud is involved.

April Freilich is

a decade younger than Barbara Picower (age 67), is co-executor of the Picower

estate and is designated to run the new Picower foundation (New Foundation)

if, or when, Barbara steps down. So MIT, is it time to start kissing April

Freilich's ass to be sure of a seat on the new (dirty) Picower foundation

gravy train?

------------------

Jeffry Picower Last Will and Testament bequest summary

Bequests -- family

Barbara Picower (wife) --- 200 million + property

Gabrielle Picower (daughter) --- 25 million

Grandchildren (if any) --- 2.5 million each

Rhonda Bienes (niece) --- 200k

Bequests -- foundation related

April Freilich (30 year business partner) --- 10 million, forgivness of

1.5 million loan,

2 million as co-executor of estate

Samantha Freilich (daughter) --- 500k

Joshua Henri Hochschuler (new trustee) --- 3 million

(Dr.) Stephen Hochschuler (father) --- 1 million

Jessica Hochschuler (daughter) --- 250k

Jonah Hochschuler (son) --- 100k

Caleb Hochschuler (son) --- 100k

William Zabel (retiring trustee & personal lawyer) --- 200k

Martin Post MD (retiring trustee) --- 100k

Bequests -- minor employees

Joel Clark --- 200k

Madison and Zoe Clark --- 25k each

Saliha Hernandez -- 150k

Corey, Yasmina, Blake Hernandez --- 25k each

Yvonne Yu -- 200k

Ana Leston --- 75k

Christina Bertuccio --- 50k

----------------------

Link to Jeffry Picower's Will

http://www.scribd.com/doc/22423463/Jeffry-Picower-s-Will-Dated-10-15-2009

25 million for MIT is found on top of p13.

----------------------------------------------------------------------------------------

1/4/10 email

Michael Bienes was featured on camera in the hour long Frontline show on the Madoff ponzi (5/12/09). He was the only Madoff insider who would talk to Frontline. He was the Mr. "Easy, peasy... I never worked hard... God wanted me to be rich" guy, who a Florida newspaper has characterized as the "fabulously wealthy Fort Lauderdale benefactor." When Frontline asked him if he understood how Madoff made his money, he said no, saying, 'I probably wouldn't have understood if he had told me', adding ''I don't know how an airplane flys, but I know it flys.'

Bienes started off as an accountant working for Madoff's father-in-law (Saul Alpern) and later with his partner (Frank Avellino) the two were key players in the 60's and 70's establishing Madoff as a money manager, steering thousands of their small accounting customers to Madoff, bringing Madoff hundreds of millions, until the SEC shut them down in 1992 for operating without a license. The SEC found Avellino & Bienes had "kept almost no records" even though they were managing 440 million dollars (all given to Madoff) of their customers money ( “my experience has taught me to not commit any figures to scrutiny” said Avellino, also an accountant!) and Madoff sent in his personal lawyer (Ira Lee Sorkin) to represent them. (NYT 1/16/09)

And what's this got to do with Picower and MIT? Michael Bienes was Jeffry Picower's brother-in-law! Perhaps Bienes should have asked his big time investor brother-in-law Picower to explain what Madoff was doing. And surely Picower must have learned from his brother-in-law Bienes that Madoff's returns were so unbelievably steady & high that Avellino & Bienes in the early days were offering to their customers "guaranteed returns" up to 20% per year. Did Picower smell a rat? Or maybe like Feynman he liked the smell of rat.

This little

family tie-in between Picower and the Madoff team just recently came to

light with the release of Picower's Will showing a bequest to Rhonda Bienes,

identified as Picower's niece. Drip, drip, the more we learn about the

Picowers the deeper their hip boots sink in the Madoff slime.

----------------------------------------------------------------------------------------

1/20/10 email

Barbara Picower speaks

For most of

the last year following the arrest of Bernie Madoff in Dec 2008 for running

the worlds largest ponzi Barbara and Jeffry Picower said virtually nothing

on the public record (aside from a court filing). But with Jeffry Picower's

death in Oct 2009 and the filing of his Will in Nov 2009 Barbara Picower

released a public statement, undoubtedly vetted by her consigliere and

Picower Foundation trustee, William Zabel, that purports to give Jeffry

Picower's views. Here it is as reported by the New York Times:

In a statement released Monday night, Mrs. Picower said her husband “was determined that we would put Madoff behind us, reclaim our good name and reverse the damage Madoff’s fraud had, not only upon our lives, but upon the many deserving institutions and people we were blessed to support.” The new foundation will allow his “charitable legacy” to continue after a settlement is reached with the (Madoff) trustee, she said. (New York Times 11/9/09)Let's parse this statement. She starts talking about trying to 'Reclaim our good name' (see postscript), but what I find most interesting is the second part of the sentence:

"reverse the damage Madoff’s fraud had, not only upon our lives, but upon the many deserving institutions and people we were blessed to support."'Deserving institutions', of course, includes the Picower Institute for Learning and Memory at MIT, which has been the largest recipient of Picower Foundation cash. Did Barbara accidentially blurt out the truth in this statement? That MIT, by accepting stolen money, has been irresponsible and has damaged its reputation for integrity. This is the song I have been singing in my mini-MIT/Picower email campaign of recent months. And here we apparently have Barbara Picower, quoting Jeffry Picower, telling you the same thing! If anyone should know about taking money from crooks, it's Barbara and Jeffry Picower.

Remember Picower Foundation assets were not 'invested' with Madoff in the usual business sense. The court appointed Madoff Trustee, Irving Picard, using the results of a massive forensic accounting of Madoff records, says the three people who ran the Picower Foundation (Barbara & Jeffry Picower and their associate April Freilich) were active participants in fraud with Madoff. "The Trustee's lawsuit contended that the Picower accounts with the Madoff firm were “riddled with blatant and obvious fraud” that a finance professional like Mr. Picower should have detected immediately." (NYT 11/9/09) My own little analysis of the 990 portfolios confirms this.

The facts are that Madoff, for reasons as yet unexplained, simply handed over to the Picowers huge wads of ponzi cash year after year for a net total of 7.2 billion says the Madoff Trustee in the last 13 years alone. To put this in perspective the Madoff Trustee has traced, and is suing to recover, all the money Madoff paid to his immediate family who worked at the Madoff business (Madoff's brother, two sons, and niece), and it totals only 199 million.

Picower gets 7.2 billion and the immediate Madoff family gets 0.199 billion or less than 3% of the money Madoff shovelled to Picower! Does this pass the smell test with you? It doesn't with me.

Aside --- Stanley ChaisHey Barbara, if want to reclaim your good name, how about starting by issuing a statement explaining this: How is it that for 20 years you ran a foundation whose 'investment earnings' were completely phony and you and Jeffry (supposedly) never noticed? Explain how this was possible, given that the phony portfolios were actually detailed in all your 990 filings. My own study of your Picower Foundation 990 portfolios for the last seven years showed statistically impossible (Mind Boggling) short term gains. Barbara, are we supposed to believe you (or Jeffry) never questioned how it was that every stock added to the Picower's Foundation portfolio went up (a lot) in its first year, year after year after year?

The only other Madoff investor known to have gotten wads of ponzi cash beside Picower is Stanley Chais. Chais net cash was about 1/7th of what Picower got. Chais is in his 80's and reportedly in bad health, but nevertheless the government has formally indicated that he is the subject of a criminal investigation for his Madoff related activities. (Jeffry Picower is dead and you can't indict a dead man.)

Where is IRS 990 filing for 2008?

It's now 2010

so where is the Picower Foundation IRS 990 filing for 2008? It was due

Aug 15, 2009. The government barely taxes earnings of private foundations

if they agree to give a few percent of assets to charity each year and

to make public their finances. This is the deal. The Picower Foundation

was in business at least for 50 of 52 weeks in 2008, so where is the 2008

IRS 990 filing disclosing its finances?

You say maybe the Picowers were too busy (doing what?) to file Picower Foundation IRS forms. Nay, nay. I suggest you looks at the nation's 990 filing repository (http://foundationcenter.org/findfunders/990finder/, enter 'Picower Foundation'). What you will find (as of the date of this writing) is that in 2009 the Picowers filed amended returns for 2006 and 2007. For 2006 and 2007 those pesky (phony) stock portfolios with their Mind Boggling Short Term Gains are now gone. If someone was of a skeptical turn of mind, like me, they might think the Picowers' were burying the evidence. Too bad someone didn't archive the original 990 filings. Oh, wait, someone did, me. And I will put them online if there is a need.

Don Fulton

Full MIT Picower email trail and Tech letters at this link:

http://twinkle_toes_engineering.home.comcast.net/mit_picower_mini_campaign.htm

postscript --- Funding cutoff in Dec 2008

Barbara might also

explain why with billions of Madoff assets in the bank (so to speak) she

and Jeffry in Dec 2008 chose to suddenly cut off funding to those whom

they had regularly supported. Other big Madoff losers didn't do this: Carl

and Ruth Shapiro Foundation said, "all current pledges will be honored."

Mark Bear is reported to have called the loss of Picower funding a "huge

setback" and for some in the Parkinson's Consortium the sudden cutoff in

funding was traumatic. To continue funding at the 2007 level would have

cost a tiny 0.023 billion per year. This was what, too much, for a couple

of 'big philanthropists' like Barbara and Jeffry sitting on assets of 2.4

billion to 7.2 billion? (The Picowers' lawyer, Zabel, has talked publicly

about offering 2.4 billion to settle the lawsuit by the Madoff Trustee,

saying even after setting aside 0.2 billion for Barbara to live on, this

would still leave plenty left over for a new foundation specified in Picower's

Will.)

The sudden

funding cutoff wouldn't by any chance have been motivated by the desire

of Barbara and Jeffry to portray themselves as victims of Madoff would

it? Were they perhaps hoping that their status as Madoff's biggest 'victim'

would dissuade investigators from looking too closely at Jeffry's smelly

Madoff accounts? (Hint, this didn't work!)

----------------------------------------------------------------------------------------

2/1/10 email (The Tech appears to have reedited this

letter after this email causing the URL to this page to disappear from

the published version) (see Tech letter #4)

Dear Don,

Thanks again for your continued watchfulness on this issue. I’ve made a few, slight stylistic changes to your original submission, but by and large it’s what you’ve sent us. The updates are attached, and also included below. We’ll run this in our next issue, which is the first one of the spring term, on Tuesday, 2/2/2010.

Best,

Joseph Maurer

Opinion Editor, The Tech

jmaurer@mit.edu

MIT Class of 2012

610-301-1970

Picower Money is Too Dirty to Accept

When MIT is offered millions of dollars, I suspect there's strong pressure to just say 'thank you' and not look too closely from whence the money comes. The new Brain and Cognitive Sciences building at Main and Vassar Streets was in part funded by a 50 million dollar gift from Jeffry and Barbara Picower. Jeffry Picower recently died, and according to his Will, MIT is probably going to be offered an additional 25 million dollars of Picower money sometime in the next 12 months.

MIT should reject this money. The collapse of the Madoff Ponzi has laid bare how Jeffry Picower got to be so rich, and it's not pretty. The Picowers' money is too dirty to accept.

The court appointed Madoff Trustee (Irving Picard) is suing the Picowers for return of 7.2 billion and has made public in court papers a detailed and convincing case that Jeffry Picower and his wife Barbara, who ran the Picower Foundation that funded the Picower Institute of Learning and Memory at MIT, were active participants in fraud with Madoff. The Trustee found the Picowers' Madoff accounts riddled with blatant and obvious fraud (backdating, phony tax loss statements, and unrealistic returns), and he argues they knew their investments with Madoff were a sham.

I did my own analysis of the Picower Foundation stock portfolios (contained in IRS 990 filings) and found a pattern of (statistically) impossible short term investment gains. Madoff shoveled out billions to the Picowers, far more money than to anyone else, constituting about 90% of Jeffry Picower's wealth, 35 times more money than to Madoff's immediate family. It just doesn't pass the smell test. Before his death, Jeffry Picower had his chance to rebut the Trustee's allegations in his own court filing. I've read it and find it vague and unconvincing.

Over the last six months I have laid out to MIT in a series of emails the case that in accepting what amounts to stolen money from the Picowers, not to mention honoring them by naming buildings, labs, and professorships after them, MIT risks damaging its integrity. Say no to any additional Picower money, and start planning the erasure of their name and influence from MIT.

My full MIT/Picower mini-campaign can be found at this link: http://twinkle_toes_engineering.home.comcast.net/mit_picower_mini_campaign.htm

Don Fulton ‘64

---------------------------

references for the editor

http://www.scribd.com/doc/15282761/Madoff-Trustees-Suit-Against-Picower

http://www.scribd.com/doc/17924529/Jeffry-Picower-Response-to-Madoff-Trustee

----------------------------------------------------------------------------------------

2/8/10 email

Sure Jeffry Picower made a bundle from the sale of Alaris Medical Systems, but money is fungible. (If you don't know what this means, look it up.) Picower Institute for Learning and Memory at MIT was funded in years 2001 to 2005. In 2001 the Picowers' Madoff withdrawal was 821 million and 10.2 million goes to MIT. In 2002 922 million from Madoff and 10 million to MIT. In 2003 1,025 million from Madoff and 10 million to MIT. In 2004 480 million from Madoff and 10.2 million to MIT. In 2005 468 million from Madoff and 10.2 million to MIT. Total (2001 to 2005): 3,716 million from Madoff and 50.6 million to MIT.

On paper the Picowers' withdrawals from their Madoff accounts were just a change in asset allocation, a shift from equity to cash, but as the Picowers well knew the Madoff cash coming their way was not from legitimate investments. The Madoff cash flowing to the Picowers annually was really income (like dividend income); it was annual cash being throw off by whatever scam Madoff was running.

It's difficult for ordinary people to grasp the staggering amount of income this couple had in these five years. MIT's 50.6 million was 1.36% of the Picower's 3,716 million dollar income. The Picower Foundation IRS 990 filings for these years show non-MIT donations were about 100 million, so the fraction of their 3,716 million income the Picowers' gave away in these years was only 4%. A measly 4%! Really generous! Some philanthropists they are! I give a larger fraction of my income to charity than this, and I suspect many of you do too.

Could part

of the story be, as some suspect, that some of the withdrawals paid to

tax expert Jeffry Picower were for him to hide overseas in tax havens for

the Madoff family? Either way I look at it, it's just another data

point confirming my (really) low opinion of the Picowers.

----------------------------------------------------------------------------------------

2/15/10 email

Less than 72 hours before Madoff confesses to the FBI, we find Madoff in his NY office chairing a meeting with eight Madoff insiders, six of whom are on the Madoff victims list and are known to have been big investors with Madoff. These are people Madoff made very rich. The richest of the rich there this day is Barbara Picower. The purpose of the meeting as listed on Madoff's personal calendar was support for a small Florida charity, Gift of Life, that provides help to jewish leukemia victims. (Information about this meeting comes from Bernie Madoff's long time personal secretary, Eleanor Squillari, in a Vanity Fair article, June 2009.)

Madoff's ponzi did not collapse overnight. As the financial crises of 2008 deepened, deposits faltered and withdrawals rose causing Madoff's bank account to shrink and shrink. By Thanksgiving 2008 Madoff was desperate to raise cash, and he began putting the squeeze on his insiders and feeders. Fairfield Greenwich, Madoff's biggest feeder, responded to Madoff's pressure in late 2008 by starting a new Madoff fund that they marketed heavily, but with disappointing results. One of the attendees at the meeting was feeder and pretty boy Robert Jaffe (now being sued by the SEC). His father-in-law, Carl Shapiro age 95, who was one of Madoff's earliest investors, is known to have responded to Madoff's call for cash with an additional 250 million only a week earlier. It's now known that Madoff needed much more cash than Shapiro's 250 million to stay afloat. But there was someone at the meeting who could potentially provide the cash Madoff needed, Barbara Picower.

The Picowers had received 2.4 billion in the last six years from Madoff and an additional 4.8 billion in the previous seven years, a substantial fraction of all the ponzi cash ever paid out. While the ostensible purpose of the meeting that day in Madoff's office was charity, it was a charity that Barbara Picower apparently had little interest in, because the Picower Foundation records show only tiny grants to the Gift of Life in the last three years. Yet there she is, the ultimate Madoff insider, Barbara Picower, 1,500 miles from home, sans Jeffry, summoned by Madoff supposedly to help his pet leukemia charity. (Leukemia runs in the Madoff family. It attacked one of Madoff's sons, who recovered, and Madoff's nephew, Peter Madoff's son, had died from it.)

It's (almost) inconceivable to me that Madoff, now desperate for cash, doesn't have a side meeting with Barbara Picower this day to try and recover some of the billions he had paid out to her and her husband over the years. Had the Picowers given away the Madoff cash to charity? Not by a long shot. At 0.023 billion/year in charity giving (990 number for 2007) 7.2 billion dollars will last a long, long time. What had the Picowers done with all the billions Madoff had showered on them? Did Jeffry hide some overseas for Madoff? Was it liquid? The answer is (outside of the principals) nobody knows.

I sure would like to have been a fly on the wall at that side meeting. Note Madoff had leverage over the Picowers too. The Picower Madoff files contained evidence of backdating fraud and phony tax loss statements specifically requested by the Picowers' agent, April Freilich (who received over 10 million dollars in Picower's Will). However, there is no indication that the Picowers returned any of their cash to Madoff near the end, and in fact there are hints in their court filings that they may have been doing the opposite, continuing to make withdrawals. Maybe she (and/or Jeffry) thought Madoff was bluffing or exaggerating his need for cash.

Summary of the argument --- Did Barbara Picower trigger the Madoff ponzi collapse?

Relevant facts:

a) Madoff

Trustee says Picowers are a 'net winners' of the ponzi, and sues the Picowers

for return of 7.2 billion they received from Madoff in the last 13 years.

b) Picower

Foundation IRS 990 filings show Gift of Life received 5,000 in 2008, 1,500

in 2007, 5,000 in 2006. For the Picowers these are tiny gifts; the average

Picower donation is 160,000 = [23 million/144 charities]

Timeline

Dec 8, 08

(Mon) --- Madoff's personal secretary in an eight page Vanity Fair article

(June 2009) makes a fleeting mention of Barbara Picower, saying Barbara

Picower attends a meeting in Madoff's office on Mon the week he is arrested

for a charity the Gift of Life.

Dec 9, 08

(Tues) --- Bernie reportedly 'confesses' the ponzi to his brother Peter,

who does nothing.

Dec 10, 08

(Wed) --- Bernie reportedly 'confesses' the ponzi to his sons Mark and

Andrew, who turn him in.

Dec 11, 08

(Thur) --- Two FBI agents arrived at Madoff's apartment door at 8:30 AM.

Madoff in his bathrobe invites them in and tells them "it's all just one

big lie". (Bloomberg news)

Dec 12, 08

(Fri) --- "Madoff Turned in by Sons After Confessing $50 Billion Fraud"

(Bloomberg news headline)

Barbara Picower

was known to quip, 'Jeffry enjoys earning the money, and I enjoy giving

it away', but maybe, just maybe, Barbara Picower was not all that distant

from the crook who made her and Jeffry Picower filthy rich.

----------------------------------------------------------------------------------------

(2/25/10 email)