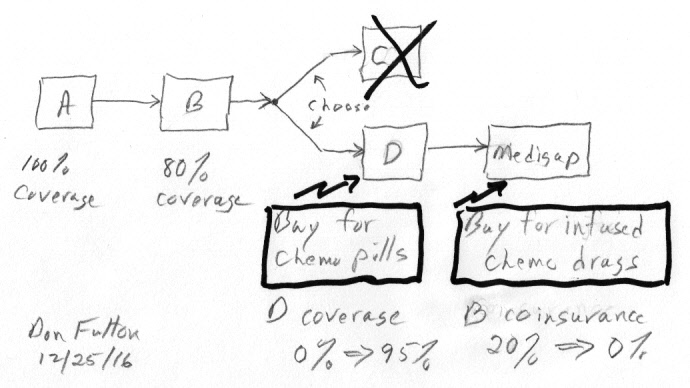

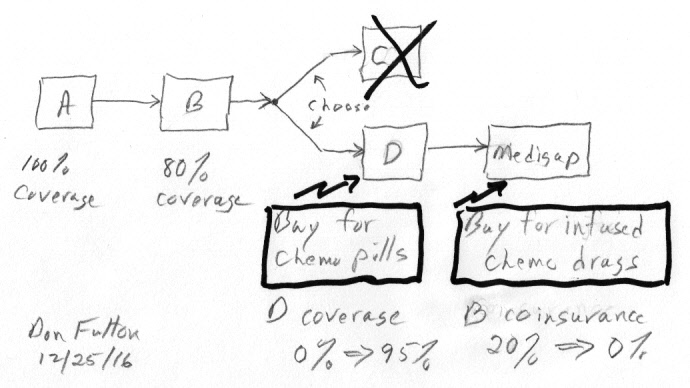

My Medicare road map sketch showing optional Medicare

plans:

Part C (Advantage), Part D (prescription drug plan),

and Medigap (supplemental) for part B coinsurance

created: 12/23/16

revised: 5/15/17

If you are over 65 with only basic Medicare A,B coverage and suddenly find you have cancer and will be taking horrendously expensive chemo drugs, your first step should be work to expand your Medicare insurance coverage otherwise the costs will eat you alive. Learn from my mistakes, twice it cost me more than 10,000 to figure out I needed more insurance when my chemo changed. Don't assume like I did initially that once you have cancer it's too late to expand your insurance coverage. Wrong! Sure Medicare Part D and Medigap insurance have to be bought from private insurance companies, but the insurance companies have to follow Medicare and state directives. A pre-existing condition can have some impact, but less than you might think. During annual open enrollment for Medicare Part D no medical questions will be asked and that is true also for enrollment in Medigap in some states. However, in many states a Medigap insurance company is allowed to ask if have been diagnosed (or treated) with internal cancer, they are also likely to check what medications you are taking, so a history of cancer is likely to lead them to reject you.

If a chemo drug you are taking is a pill, you need Medicare Part D (drug) coverage. The reason is this is a drug you buy yourself from the drug manufacturer (via a pharmacy). (Medicare's terminology here is less than clear, it says Part D helps "cover the cost of 'outpatient' prescription drugs".) However, if a chemo drug you are taking is given by infusion in a hospital outpatient setting, you need Medigap insurance (also called supplemental insurance). In this case the drug is purchased by the hospital, so it falls under Part B where the patient is responsible for 20% of the cost. 20% my not seem too bad until you do the math, a patient's 20% cost share (without Medigap coverage) of a 100,000/yr chemo drug covered by Part B is 20,000/yr!

My Medicare road map sketch showing optional Medicare

plans:

Part C (Advantage), Part D (prescription drug plan),

and Medigap (supplemental) for part B coinsurance

It may seem weird, but the Medicare insurance you need depends on whether the chemo drug is a pill or an infusion, but that's the way Medicare works. Medicare Part D pays only for drugs you buy yourself and will pay nothing for chemo drugs a hospital buys and gives in a hospital outpatient setting. In a similar manner Medigap insurance will cover your Part B 20% coinsurance for drugs given in a hospital outpatient setting, but will pay nothing for chemo in pill form that you buy yourself. Medicare is full of traps like this. You must match your insurance to the form of your chemo drug! Recently it took me several months to figure out I needed to add Medigap coverage to my Part D coverage after my chemo was changed to include a drug given by infusion. The change in chemo was decided by oncologists at two different hospitals, one of them a world class research institution for multiple myeloma (my cancer), yet neither of them mentioned the outrageous cost (retail cost of half million dollars a year!) of the new drug (carfilzomib) being prescribed or the impact it might have on my Medicare insurance needs.

As is usual with Medicare nothing is ever simple. Some chemo pills can fall under Part B if an infusable form of the drug exists (see footnote -- Chemo pills covered by part B)Here's are the basics of Part D insurance (for pills) and Medigap insurance (for infusions)

| Chemo pills -- Part D (prescription drug plan) | |

| Q: What insurance do I need for chemo in pill form taken at home? | Ans: Part D (drug) insurance |

| Q: How much coverage can I get? | Ans: 95% (max) catastrophic coverage (for most months of year after paying 4,850 in out of pocket donut hole related costs) |

| Q: Must a private insurer accept me without underwriting and waiting periods even if I already have cancer? | Ans: yes (in annual open enrollment period) |

| Q: When can I join? | Ans: Oct. 15 through Dec. 7 (each year) (same open enrollment period as Advantage plans). Coverage begins on Jan 1 of following year |

| Q: Is Part D coverage standardized? | Ans: Yes, all insurance companies offer the same Part D coverage categories |

Part D (drug) discussion

With pill

based chemo you need to get Part D coverage. For most of the year Part

D's catastrophic coverage will reduce your drug costs by a factor of 20.

However, the remaining 5% can still be a lot of money. In my case even

with Part D coverage my annual cost for super expensive Pomalyst chemo

pills is about 13,500 a year (13 x 682 (28 day cycle) + 4,850 donut hole),

but that is a lot less than 177,000 a year it would be without Part D coverage.

Since Part D coverages are standardized across all insurers, no higher

coverage than the 95% catastrophic coverage is available.

Limit of Part D drug coverage

What is important

for cancer patients is the maximum degree of coverage provided by Part

D above the donut hole called 'catastrophic coverage'. It is 95% coverage

in both the stand alone and embedded Part D plans. Since the Part D donut

hole is about 4,850 out of pocket costs, patients on expensive chemo like

me spend 11 out of 12 months in catastrophic coverage, paying 5% of the

retail price of chemo pills. It is still expensive, but paying 682 for

pills every 28 days is a lot better than paying the drug's retail cost,

which is x20 higher at 13,640.

Part C Advantage alternativeAccess only during annual open enrollment period

There's an alternate Medicare pathway to Medicare Part D (equivalent) for obtaining pill based drug coverage. This is Medicare Part C (also called Medicare Advantage plans). Medicare Advantage plans were authorized by congress about 15 years ago, and now about 1/3rd of Medicare recipients are in Advantage plans (from May 2017 NYT article). This is all inclusive insurance from a private insurance company that includes Medicare A,B and usually Part D drug coverage too. However, Part C Advantage plans have a problem, Part C means medical restrictions in the form of 'networks'. Medicare Advantage plans are generally organized as health maintenance organizations (HMOs) or preferred provider organizations (PPOs). Typically, in these types of plans you choose one doctor as your primary care provider, and your choice of doctors, hospitals and other health care providers is restricted. If you see providers outside of the plan’s network, you likely will pay more, or these providers’ care might not be covered at all. By the time I was looking to expand my my Medicare insurance coverage, my cancer medical care was already in place. I was not about to spend time decoding the myriad Advantage policies to find out if my doctor or hospital was included or what other restrictions I might run into. I determined to forget Part C and aim for (stand alone) Part D drug coverage.I like my insurance straight, so I am not going to discuss Advantage plans in this essay. For what it is worth I have seen some comments online that Part C drug coverage is not as good as Part D coverage, though other references seem to indicate that the drug coverage is basically the same. Part C (Advance plans), and Part D (drugs) share the same annual open enrollment dates. You cannot have Medicare drug coverage under both Part C and Part D, you must choose one or the other.

Doing more research it seems that the prescription drug coverage embedded in Part C (Advantage) is essentially the same as stand alone Part D drug coverage. For example, stand alone Part D and embedded Part D plans both have maximum catastrophic coverage of 95%, the same in all companies I checked. This can't be an accident, it must be dictated by Medicare.

I lucked out.

I was diagnosed with cancer and started pill based chemo in nov during

the Part D open enrollment period, and when I finally realized I needed

Part D coverage, I was able to sign up before the open enrollment closed.

I ended up paying the full retail price for Revlimid for just one 28 day

cycle (10,167), then by delaying the start of the second cycle 10 days

to Jan 1 my Part D coverage cut in. However, if I had been diagnosed with

cancer just a few weeks later after open enrollment closed on dec 7, it

would have been a different story. To get through the year I would have

been facing an out of pocket cost of about 132,000 while waiting for the

next open enrollment period to roll around! Yikes. It's the throw of the

dice. I can find no backdoor way to get into Part D, so my recommendation

is this. Since the cost of of going a year without Part D coverage to cover

pill based chemo can be so high (on average six months), the wise thing

to do is sign up for Part D coverage at the next open enrollment period.

| Chemo infusions -- Medigap (supplemental) | |

| Q: What insurance do I need for chemo given as an infusion in a hospital outpatient setting? | Ans: Medigap (supplemental) insurance to cover the 20% Part B coinsurance |

| Q: How much coverage can I get? | Ans: 100% (Part B 20% coinsurance reduced to zero) |

| Q: Is there an annual open enrollment period? | Ans: technically no, not after age 65. Access depends on the state where you live |

| 1) MA, MN, WI | In a few states, like MA where I live, you can apply any time. They must accept you regardless of pre-existing conditions and coverage begins quickly with no waiting period. (This is a really good deal for a cancer patient.) |

| 2) NY, CA | In some states you can join at any time, but the insurance company is allowed to impose a waiting period for pre-existing conditions, which means your chemo costs are likely not to be covered for up to six months. |

| 3) Most states | In the majority of states you can apply at any time, but the insurance company is free to accept or reject you, and if accepted they may impose underwriting (higher premiums) and/or waiting periods. |

| Q: Are Medigap policy plans standardized? | Ans: yes, but it depends on the state.

(Since coverage is standardized, Medicare's advice is buy the cheapest policy.) |

Medigap (supplemental) discussion

Remember what

Medicare documents call 'Medigap' plans ("Choosing a Medigap Policy") insurance

companies usually call 'supplemental Medicare insurance'. These are just

different names for exactly the same thing. A real stumbling block

when you are trying to first figure out Medicare options.

Medigap insurance covers the 20% patient coinsurance of Medicare Part B reducing it to zero, Chemo drugs given by infusion in a hospital outpatient setting fall under Part B. 20% my not seem too bad, after all basic Part B is reducing patient costs by a factor of five. But chemo drugs can be so expensive that it totally changes the perspective. Consider my numbers. I am currently taking a super expensive chemo drug (carfilzomib, brand name Kyprolis) given by infusion (2 infusions/wk, 3 wks out of 4, 78 infusions/yr). The hospital bills Medicare for each infusion is 6,374 and Medicare 'approves' nearly the whole amount. Do the math and this is an annual retail cost of almost 500,000/yr for this one drug (and I take other expensive chemo drugs), so my 20% share of this drug without Medigap coverage is (potentially) 100,000/yr. Yikes! Do I need Medigap coverage? I sure do.

Random Medigap facts

-- A substantial

fraction of Medigap policy holders sign up after the 6 month open enrollment

period at age 65.

-- Nationwide

15% of medigap applications are turned down.

-- UnitedHealthcare

publicizes the fact that it accepts more than 99% of all Medigap applications.

-- Seven states

that require community rating (everyone pays same premium) of Medigap policies:

Connecticut, Maine, Massachusetts, Montana, New York, Vermont and Washington.

-- In most

states there are up to ten (slightly different) standardized Medigap policies

(plans A to N). All except plans K and L provide 100% coverage of Medicare

Part B coinsurance. Since as a cancer patient this is what we want from

Medigap, avoid Medigap plans K and L.

-- Part B

covers a lot more than outpatient cancer chemo such as doctor visits, medical

diagnostic tests, home health services, durable medical equipment, and

ambulance services.

*** Recommendations

Don't

do what I did. I now realize that above age 65 partly self-insuring with

only Medicare A,B is just dumb. Works for small stuff and if you remain

in reasonably good health, but if you get cancer with its now common obscenely

expensive treatments, you can be in for a 100,000 or higher surprise. It's

just dumb not to have Part D (drug) with it 95% catastrophic coverage and

Medigap coverage too to cover the 20% coinsurance of Medicare Part B, both

of which I found out (the hard way) can come into play when you are taking

chemo for cancer. [Medigap forums --- you can find people on Medigap forums

arguing that Medigap insurance is not worth the cost, but when you look

at their calculations, you see they haven't consider what is perhaps the

most expensive medical cost covered by Part B, super expensive cancer chemo

given by infusion in an outpatient setting.]

Part D (Medicare prescription drug plan)

My strong recommendation is sign up for Part D at any age when the next open enrollment period (oct 15 to dec 7) rolls around. Don't wait until cancer hits, it can cost you a fortune (> 100,000) having to pay the full retail price of chemo drugs for up to a year while waiting for the next Part D open enrollment period to arrive. I have been unable to find any 'back door' entry into Part D outside of the open enrollment period.

Medigap (supplemental)Note Part D's maximum coverage is less than 100%. It exposes the patient to 5% of the drug's retail costs which can easily be thousands of dollars per year, and there is no lifetime limit. In my case each chemo pill has a retail cost of 650 dollars, and I take one of these pills 3 days out of 4 during the year. This works out to be an annual retail drug cost of 178,000. Even with Part D coverage my 5% share of this (in catastrophic coverage mode) runs to 8,900 per year. When the Part D donut hole cost of 4,850 is added in, my out of pocket cost of my pill chemo even with Part D coverage averages about 1,133/month (13,600/yr).

My strong recommendation is also sign up for Medigap (supplemental) too at any age now. Technically there is 'no open enrollment period' for Medigap after six months of getting Part B coverage. You can apply for Medigap at any time in most states, so do it now. There may be penalties or underwriting, just pay them. 'Underwriting' once you get cancer in most states is likely to mean insurance companies will not accept you. (This is not true in MA, WI and MN.) Another reason for signing up before you get seriously ill is you get through that nasty six month waiting period allowed by some states for pre-existing conditions. Having to pay 20% of the full retail price for chemo drugs given by infusion during a six month waiting period can be a killer with out of pocket costs up to 50,000.

It looks like 95% Medicare Part D catastrophic coverage is the best insurance coverage available for pill chemo, either with (stand alone) part D or part C (Advantage) with embedded Part D drug coverage. The reason is Part D coverage is standardized by Medicare. Some Advantage plans have an annual out of pocket cap. It might seem like this would give Advantage plans an advantage over stand alone Part D plans, but this is misleading the cap does not apply to embedded Part C drug costs.

Tip --- Automate paymentsMedigap access depends on the state where you live

A late payment for Part D or Medigap to the insurance company can cause the insurance company to drop your coverage. (I know someone who was one day late with their Part D payment and lost coverage for a year.) Therefore it is desirable to automate the premium payment process. One good way to do this is to have the premiums for both Part D and Medigap deducted from your social security check. This puts it on auto-pilot.In my experience the insurance companies barely (if at all) mention this payment option. You need to contact the insurance companies and request it. I am in the process of doing this now (it takes a few months). My annual end of year letter from social security reflects a check reduction for my Part D premium, and my medigap insurer has phoned me to say their payment will soon be paid via a reduction in my social security check too.

There is no annual open enrollment period for Medigap insurance as there is for Medicare Part D. Medigap access depends on state guidelines, as such it is difficult to know really how difficult or easy access is if you don't live in that state. The Medigap literature from Medicare just says you may be denied coverage or may face underwriting costs, but this is of little help. The wording in 'Choosing a Medigap Policy' is, "You may be able to buy a Medigap policy at other times (after age 65 open enrollment), but the insurance company can deny you a Medigap policy based on your health." [Translation: if you already have cancer you are likely to be rejected.]

An article by an insurance underwriter discussing how easy underwriting is with Medigap ('Medigap Underwriting – Is It Really All That Simple?') says, "The insurance company gives (insurance) agents a long list (hundreds) of medications and tells them to not sell a (Medigap) policy to people taking any of the medications on the list," so here we see the term 'underwriting' used to mean denying access to coverage. Cigna has online the key underwriting question it asks applicants for Medigap: "Do you have now or in the last two (2) years have you been treated for or advised by a medical professional to have treatment for the following conditions: internal cancer, leukemia, malignant melanoma, Hodgkin’s disease, or lymphoma?" Not surprisingly if you tell Cigna you have been diagnosed and/or treated for 'internal cancer', they are not going to accept you. There are companies like GoMedigap that claim they can help patients find Medigap policies.

Access to Medigap in MA

I know about access

to Medigap insurance in MA because I live in MA and have recently been

through the process. For a few months after my chemo was changed to include

a drug given by infusion, but before I figured out I needed Medigap insurance,

I was being billed by my hospital thousands of dollars a month, my Part

B 20% coinsurance. After getting Medigap coverage, I watched my Part B

coinsurance drop to zero.

Access to Medigap coverage in MA is easy, almost too good to be true. I called up an insurance company (not the same insurance company that provides my Part D coverage) and requested Medigap insurance. I was immediately accepted and asked no medical questions, hence no underwriting. I was told coverage would start at the beginning of the next month with no waiting period. Specifically I called up to join in mid oct and coverage started two weeks later on nov 1. The baseline premium (community rating) was 100/month. My infusion coinsurance for my oct 31 infusion was 430 dollars and the next day (nov 1) as my Medigap coverage cut in, my infusion coinsurance cost dropped to zero.

Technically what MA (also MN, WI) insurance regulation provide is a "guaranteed issue rights" to buy a Medigap policy with an insurance company that is mandated to cover pre-existing conditions and no increase in premium ('Choosing a Medigap Policy', p 21). 'Choosing a Medigap Policy' says, "Generally, Medigap policies begin the first of the month after you apply."

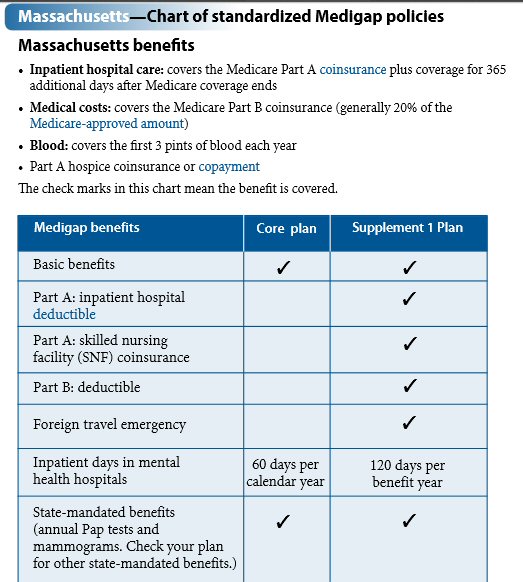

The 'Choosing a Medigap Policy' booklet details the unique Medigap policies in MA (see below). There are only two Medigap plans offered in MA both of which provide full coverage for Medicare Part B 20% coinsurance. The premium (2016) of the Core plan from local Medigap insurer, Tufts Health Plan, is about 100/month and its Supplement 1 Plan about 200/month. I chose the Supplemental plan to get skilled nursing, and it also picks up the Part A deductible (1,316) and Part B deductible (183). I see agents online listing Medigap plans with quite a bit higher cost than this, maybe this is what they do.

Medigap plans in MA

('Choosing a Medigap Policy' , page 42)

20% of 'Medicare Approved'?

Note the second

benefit listed above, which says, "Medical costs: covers the Medicare Part

B coinsurance (generally 20% of the Medicare-approved amount.")

I have found that my hospital billing for my outpatient infusions is NOT

20% of 'Medicare-approved' amount. It is much less, about 1/3rd of the

'Medicare-approved' amount, and thereby hangs a tale and another essay

I am writing about how the Part B 80/20 cost split is really figured.

Don't be put off by extra premium costsGaming the system?

A word about underwriting costs, late fees, etc. As a cancer patient, don't be put off by extra premium costs and late penalties that the literature plays up. In a world of super expensive chemo costs these dinky extra premium fees don't matter. What you need is insurance coverage, which means getting in and passing through any waiting period for pre-existing conditions, nothing else matters. Consider my numbers. I signed up for Medicare Part D at age 72 after I got cancer, seven years 'late'. A 1% premium late fee is added for each month after age 65, in my case an 84% late fee, meaning my baseline Part D monthly cost roughly doubled (x1.84). My baseline monthly Part D premium went from 36 dollars to 66 dollars, an extra 30 dollars/month, due to the late fee. This is not even worth considering since my Part D coverage (for 11 months of the year) is saving me more than 13,000/month, 95% of the retail cost of my super expensive chemo pills.

No insurance help from medical people or billing people

at hospital

I have two oncologists,

one at a world class cancer center and one at a large suburban hospital,

who prescribe these super expensive cancer drugs. Yet neither of them ever

mentioned I should look into getting more Medicare insurance coverage,

nor did my experienced infusion nurse, nor did three hospital financial

people. The fact that I only initially had Medicare A,B was, of course,

part of my medical record. Hence when super expensive chemo drug were prescribed,

it was (or should have been) obvious to the hospital people I deal with

that I was under insured. My experience with the medical people I come

into contact with is that they just won't talk about drug costs or the

insurance to cover it. This includes an all day (8:00 am to 3:00 pm) multiple

myeloma patient education seminar that I attended at at world class reseach

center dedicated to multiple myeloma, where except for a question or two

at the end, drug cost and insurance were not mentioned. Also the customer

financial people at my hospital didn't seem to have a clue that I was under

insured. The result is the patient is left all alone to figure it out.

I am not stupid, I am a retired design engineer, a graduate of one of the

top engineering schools in the world, I am good with numbers, yet

for a long time I could not bring myself to dig into the complexity of

Medicare. I suspect there are others in the same position as I was in,

hence this essay to share what I have learned.

Too passive?Quick overview of Medicare regulation

Could I have done more earlier to expand my Medicare insurance? With hindsight, possibly. One web site I found discusses insurance specifically for multiple myeloma, saying multiple myeloma, being incurable and chronic with a median survival time of years, is one of the most expensive cancers to treat. They give this tip: "Consult with a patient advocate, case manager, or social worker connected with your medical center or local agency on aging. These specialized professionals can help you find treatment, social support, and financial help for covering the costs."My experience with 'financial help' is that it generally means case workers (in my case hospital billing people and occasionally pharmacy people) giving patients the name of various organizations that will pay part of their chemo costs, but these plans are targeted toward lower income people. I think the real thrust, in fact the only thrust if you are not lower income, should be to expand your insurance coverage to drastically reduce your chemo cost rather than looking for some group to subsidize you.Ok, good advice, and I didn't do this. But this advice conflicts with how I have lived my life. In areas like investments and health care I don't want to rely on outside 'experts', I want to become the expert. And in rethinking my two chemo mistakes, I don't think it would have made any difference. In the first case after diagnosis, when I went to buy my first chemo pills, I immediately found out the pharmacy would only send me my first 21 pills if I paid the full retail price upfront (over 10,000 dollars). It was like being hit with ice water. It didn't take a genius to figure out I needed Part D drug coverage ASAP. In the second case the problem was I didn't recognize for a few months that anything had changed financially when my chemo was changed to include a chemo drug given by infusion. I later found out that a drug given by infusion (in a hospital outpatient setting) is not covered by Part D, but by Part B. Who knew? One of Medicare's little traps. You can't fix a problem until you realize you have a problem.

While Medicare Part D (drugs) is formally run by insurance companies, it is heavily regulated by Medicare, in fact Part D coverage options are STANDARDIZED. So for example in my case where I am taking a super expensive chemo pill, there is no point in shopping for a better deal. There is none. Every Part D insurer offers EXACTLY the same catastrophic coverage with a 95/5 cost split. (Of course this basic fact is well hidden in their advertising)

In Medigap (supplemental) insurance the Washington regulation is there, but the states have more control. State legislatures have some freedom to modify Medigap coverage and three states have done so extensively: MA, MN and WI. [Technically what the states do is specify that their residents have Medicare 'guaranteed issue rights' to acquire a Medigap policy.] I live in MA, and this ended up saving my ass financially. Unlike Part D and Part C (Advantage plans), there is no annual 'open enrollment' period for Medigap (after age 65). With my chemo changed to include a super expensive drug given by infusion I was facing a potential 100k/yr coinsurance (80/20 cost split) since the retail cost of the drug was about a half million dollars. Once I realized I needed Medigap coverage I was able to immediately sign up with guaranteed acceptance for a Medigap policy with a local insurance company. Two weeks later my coverage began, my chemo coinsurance dropped to zero, and without any underwriting or waiting period.

New York Medigap

A few other

states (like NY) go part way. In NY an insurance company must accept you

if you apply for Medigap, but when you dig in, you find their insurance

companies are allowed to impose a six months waiting period before coverage

of pre-existing conditions cuts in. Financially this waiting period, exposing

you to 20% of the retail cost, can be a killer.

"New York State law and regulation require that any insurer writing Medigap insurance must accept a Medicare enrollee’s application for coverage at any time throughout the year. Insurers may not deny the applicant a Medigap policy or make any premium rate distinctions because of health status, claims experience, medical condition or whether the applicant is receiving health care services." (NY insurance dept) (Note this begs the question of when coverage begins.) More clicking on the NY site brings up this: "Be aware that under national laws, Medigap policies can refuse to cover your prior medical conditions for the first six months." [Translation: six months before your infusion chemo cost will be covered,]My cancer story

Offered a clinical trialI soon realized that I needed Part D (drug) coverage pronto. Part D's catastrophic range for expensive chemo provides 95% coverage for most of the year, a factor of 20 reduction in out of pocket costs. Don't worry about premiums, late fees or underwriting. These are details when out of pocket costs are running thousands a month. What you need to do is sign up for Part D and get coverage ASAP. Easier said than done, since Part D has only one enrollment period of seven weeks each year.

As an aside on how hidden chemo costs are consider this. At one of my first meetings with my new oncologist I was told I was eligible for a phase 3 clinical trial and was handed a document describing the trial. The trial was to compare the baseline chemo pill Revlimid against Revlimid with an added proteasome inhibitor pill in development (now on the market as Ninlaro). The trial document said the developmental drug being studied would be provided free, but that I would be "billed" for the cost of Revlimid. There was no mention, no hint, that the billing for Revlimid would (presumably) be its retail cost over 10,000/month! The people who signed up for the clinical trial (not me) must have been in for a nasty surprise. I find this kind of stuff incredible, but this is how the medical world works. I have it in writing!

Here I was pretty lucky in my timing. I was diagnosed with cancer near the end of the calendar year, which is when the open enrollment period for Part D is (oct 15 to dec 7). It took me a while to realize that the insurance company during the annual open enrollment period had to take me even with a pre-existing condition, so I should apply. My pill based chemo started in mid nov, and the insurer's mail order pharmacy that handled tier 5 drugs would not send me my first 21 pills (for 28 day cycle) until they charged my credit card 10,167. This triggered a three hour hassle on the phone as my credit card had a 9,000 daily limit. Part D coverage starts at the beginning of the calendar year, so in consultation with my hematological oncologist the start of the second cycle of my chemo was delayed for ten days to jan 1 so the Part D coverage would apply to my next purchase of pills.With my Medicare coverage expanded to Medicare A,B & D I was feeling pretty good financially, my hospital bills were low and my drug costs were manageable since my potential chemo pill costs had been reduced from the retail cost of 130,000/yr to about 10,000/yr, which I could afford. But over time my cancer overtook my chemo, my first remission ended, I became a relapsed MM patient and new more aggressive chemo drugs were prescribed. Neither of the two doctors involved in the chemo change (at two different hospitals) mentioned that this chemo change might affect my insurance needs.

For several months after the chemo change my focus was on my health, watching my blood numbers and having a Pet scan to see if the newly prescribed chemo was going to work. But later when my hospital bills began to come in, I saw my monthly costs were now running thousands of dollars a month instead of a few hundred of dollars a month previously, and I could see the reason, it was the billing for the infusions. I was being billed about 430 dollars for each infusion of carfilzomib. Was this my 20% coinsurance for the infusion? The numbers didn't look right, 430 wasn't 20% of any other number on the bill. I asked the hospital billing dept (twice) for an explanation, and got no response. The hospital was billing Medicare 6,375 for each infusion, and my Medicare online account showed that 'Medicare-approved' nearly this entire amount. So why wasn't my infusion coinsurance 20% of 6,375 (or 1,275), instead it was about 1/3rd of this? Virtually all Medicare literature says coinsurance is generally 20% of the 'Medicare-approved' amount? For a long while I was puzzled, but I eventually I figured out what was going on. (And this will be the subject of another online essay: how Part B's 80/20 cost sharing is figured.)

What had happened? Answer was while one of my new chemo drugs was a pill, the other was given by infusion in the hospital as an outpatient. Part D (drug) was coverage was still providing good coverage of the pill, but I found a drug given by an infusion in a hospital outpatient setting is not covered by Part D, it's under Part B. Who knew! Part B coverage only pays 80% of the infused drug cost and exposed me to 20%. And here was the shock, the 'Medicare approved' cost of each infusion was 6,373 (90% of this was the cost of the drug), and I was on schedule to get 78 infusions/yr. This is an annual retail cost for this one drug of approximately 500,000! Yikes. This puts the patient's share of 20% in a whole new light, 20% of 500,000/yr is 100,000/yr just for this one infused drug.

So I realized I needed Medigap (supplemental) coverage pronto. I can't remember exactly how I found out, but I think I tripped over a mention somewhere online that MA had good Medigap coverage, so I called a local insurance company to ask about Medigap coverage. Medigap plans are standardized, (almost) all of them reduce the patient's coinsurance for infused drugs from 20% to 0%, complete coverage. I didn't worry about premiums or late fees or underwriting. These are details when out of pocket costs are running thousands a month. What I needed to do was sign up for Medicare Medigap insurance ASAP. In most of the country this is easier said than done. But here I was lucky I live in MA. Once I realized I needed Medigap coverage, which took four months (12 thousand dollar mistake), I was able to sign up immediately and coverage started at the beginning of the next month with no waiting period for pre-existing conditions. The states have a say in how Medigap is run, and MA is one of three states that allows signup for Medigap at any time with no waiting period for coverage of pre-existing conditions.Access to Medigap coverage in MA is so easy and fast (30 days max wait) you may not need to buy Medigap coverage in advance. It is not (totally) unreasonable to wait until you get cancer, or have scheduled some other Part B outpatient expensive procedure, before you sign up. In MA (also WI and MN) you can sign up and get Medigap coverage within one month guaranteed, no penalty, no waiting period! This is not true in most other states.

Footnote --- chemo pills covered by part B

Just to dot all the i's and cross all the t's I will mention a crazy Medicare quirk that puts some chemo pills (taken at home) under part B rather than Part D. These are drugs where the 'same' drug, meaning (presumably) the pill breaks down into the same active ingredients as the IV form, is available in both pill form and intravenous form. The fact that an intravenous form exists (magically) changes the insurance coverage of the pill from part D to Part B. But it get still weirder, from what I read even if the intravenous form used to be available, but is not now available, the pill form is still Part B! (I'm not making this up.) One reference puts it this way, (only) "Oral cancer drugs that were never administered via IV are covered under a Part D prescription drug plan." Translation: newer chemo drugs developed directly as pills, like Revlimid and Pomalyst (from Celgene), end up as Part D, whereas older chemo drugs that started life as infusions and later a pill form was developed end up as Part B. This is such a zoo of complexity that it takes UnitedHealthCare 28 pages to detail if a drug is covered under Part B or Part D! The only way a cancer patient can be absolutely sure if his pills are covered by Part D and not Part B is to ask his medical people, which makes their refusal to discuss insurance (in my experience) all the more serious.

This begs the question of whether a drug 'pair' like Velcade (infusion) and Ninlaro (pill) both from Millennium Pharmaceuticals are the 'same'? Ninlaro pill is a prodrug that changes to its biologically active form: ixazomib, whereas Velcade is bortezomib. These two drugs are both built around a single atom of boron, but chemically they are NOT the same. However, they are quite similar, both are proteasome inhibitors that share the same mechanism of action: their prescribing sheets show both bortezomib and ixazomib are "reversible inhibitors of the chymotrypsin like activity of the 26S proteasome." Hence Ninlaro can be viewed clinically as a more convenient pill form of Velcade, but with some dose enhancement and (probably) some reduction of side effects.References

Useful reference

on Medigap from Kaiser

https://kaiserfamilyfoundation.files.wordpress.com/2013/04/8412-2.pdf

Very interesting

long overview of Medicare by an individual

http://www.joebaugher.com/medicare.htm

Excellent low

down on Medicare costing by a doctor

http://truecostofhealthcare.net/medicare-supplemental-insurance

Amazing 2013

Time magazine article on the financial arrangements between hospitals and

Medicare by Steve Brill

http://www.uta.edu/faculty/story/2311/Misc/2013,2,26,MedicalCostsDemandAndGreed.pdf

====================================================================================================

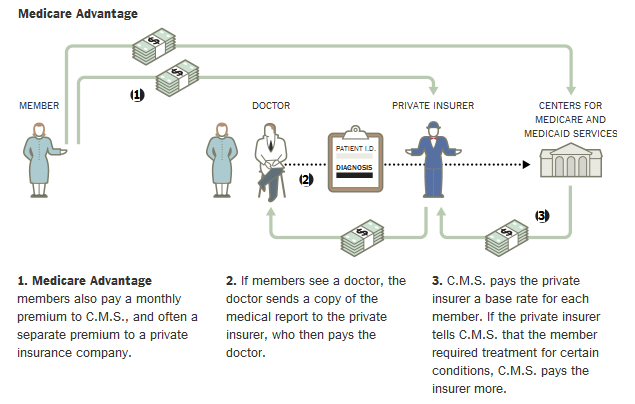

How doctors are paid by Medicare (5/15/17)

The NYT has

a story about huge sums (many, many billions) being bilked out of Medicare

by Advantage insurers who upgrade the 'risk assessment' of patients to

increase the amount Medicare pays them for those (sicker) patients. The

article includes these nice graphics that show the different money flows

in traditional Medicare vs Medicare Advantage.

Traditional Medicare

This is the

plan I am in. I pay Medicare via deductions from my SS checks. My doctor

and/or hospital send their medical report to the Center for Medicare and

Medicaid Services. In my experience playing this little 'game' usually

charging x3 to x5 higher than what they know Medicare will pay. Medicare

ignores the billing amount and pays what it has determined is a fair and

reasonable price for the services and tests rendered. The doctor and hospital,

if they accept any Medicare patients, MUST accept the Medicare determined

amount as payment in full.

Medicare Advantage

In Medicare

Advantage it is the Advantage private insurer who determines what the doctor

should be paid for services rendered. The income of the insurer comes both

from premiums charged customers and a per person payment from Medicare

for each person enrolled in their advantage plan. There is a complicated

formula where Medicare will increase its payments to the private insurer

for sicker patients,i.e. those with specific high risk diagnoses.

..