BillPay reply message to me in response to an inquiry

about whether or not a cashier's check had been cashed

Using BillPay

for charity giving

Draft

checks appear to be long gone

* Cashiers check

Benefits of

handwritten checks

Three methods of

payment

1) Electronic transfer

2) Draft mailed paper check

3) Cashiers mailed paper check

Sovereign

Online Banking Agreement

* With

cashiers check no way to verify online that the check was cashed

'Lost'

BillPay cashiers check (July 2015)

* Void time is bank

policy

** Does

the bank know when BillPay cashiers checks are cashed?

** How

to check on whether a cashiers check has been cashed

** Use

BillPay message service to inquire

Call the biller

How will the

bank pay the bill?

An

experiment --- sending myself two checks

Cashiers

check envelope

Cashiers

check details

Uncashed

cashiers check funds are returned in 90 days

Outrageous

reordering of payments

'Overdraft

protection' combined with reordering generate $200 in late fees

Summing up

Attempting

to pin down the bank

What?

I get a 'Draft' email

I get a 'Cashiers

Check' email

Cashiers

check goes uncashed -- unplanned experiment

My

bank's misleading advertising campaign to reinstate its cash cow Overdraft

protection

Federal

protection from Overdraft fees

Be

prepared with overdraft coverage with Sovereign Account Protector

My

comments

Sovereign

will not give up pushing OverDraft protection

Sovereign

still pushing OverDraft protection

Overdraft

associated with shift from Visa to Mastercard?

Sovereign monthly

statement

ATM charges

How is

a foreign ATM fee justified?

Big guys can avoid

the fee

I thought I knew how my bank's Bill Pay system (formerly Sovereign bank, now Santander bank): some bills were paid electronically and some by a mailed paper check. Funds sent electronically could not have a note attached. I could control which payment method was to be used by how I set up a biller. When I set up a new biller, the bank always asked me if it should search for an electronic link, so if I wanted to attach a note I could decline and a paper check would be sent. The paper checks the bank sent out were like the checks I wrote: showing up in my account statement only when cashed and with a link to the image of the check.

Yes, I understood online banking bill pay, or so I thought, but my recent experience with writing a bunch of charity checks showed me I didn't understand all the options the bank has to make a payment. The bank actually has three ways it can pay a bill: electronic transfer and two types of mailed paper checks: draft check, with which I was familiar, and cashiers check. The bank reserves the right to pay via any of these three methods at its discretion, and in my experience the bank willy-nilly changes back and forth between draft and cashiers checks.

The cashiers check for online bill pay is a lot less customer friendly than the draft check, because you cannot tell from your account statement that the check has been received and cashed. It's deducted from your account on the pay date, the date the check is expected to arrive in the mail. If it gets lost in the mail or for some reason is not cashed, you won't know for months, if ever. Cashiers checks are the underside of online bill pay, one of its dirty little secrets.

Using

BillPay for charity giving

At the end

of last year I decided to add my list of charities to Bill Pay. Why write

and mail checks when the bank will do it for me for free? It took a while

to enter all the addresses and tel#, but I figured it would make

charity giving a lot easier in future years. I wanted a paper check sent

to the charities because it was important to indicate on the checks that

the purpose of this money was 'contribution', and I knew that so-called

Memo text could not be included with electronic transfers. So when I added

the charities to Bill Pay, I declined when the bank asked if it should

search for an electronic link. I thought this would ensure that a paper

check was cut.

When I looked at my account a week or so later, I found that a lot of my charities, but not all, were listed in my account as paid Dec 31 via "Online PMT" (online payment). Since this is exactly how electronic payments to my utilities were always labelled, it wasn't much of a leap to assume that electronic transfer had been used in these cases, which if true meant that my important note on the checks [Memo: 'contribution'] had been thrown away. I was pissed and regretting I had tried using online bill pay for charity donations. I later found out that none of the charities had been paid via electronic transfer. All had received paper checks (cashiers or draft) and that my memo text was always on the check.

Draft

checks appear to be long gone (update Jan 2011, Mar 2011)

Over

the last year or so BillPay seemed to be using draft check less and less.

At the end of 2010 I used BillPay to send paper check donations to 21 charities

(all entries entered at one session). On the scheduled pay day I find online

payment deductions in my account for all 21. Clearly this year the bank's

BillPay system made 21 of 21 payments via bank mailed paper cashiers checks.

And the 21 deductions are ordered with largest first and smallest last. This is, of course, is the slimy practice the bank uses to try and maximize the number of overdrafts fees they can tack on.

But two months later (3/11) a confirmation email from the bank (below) shows my scheduled monthly rent check has gone out as a draft check.

Date Debited From Your Account: *Draft* Cashiers check

Date Sent to Biller: 03/24/2011

Estimated Date Posted by Biller: 03/25/2011

(your biller) has not supplied posting information for this payment. The posted date above is an estimate based on our past experience with (this biller).*Note: If the word Draft appears as the date the payment was debited from your account, we could not send your biller an electronic payment and sent a paper check instead. Your account will be debited after the biller deposits the check and it is paid by your financial institution.

Benefits

of handwritten checks

When you write

and mail a check you control four elements: dollar amount, purpose of money

(optional 'Memo' text), mailing address, mailing date, and a handwritten

check provides two additional benefits: tracking and security. You have

visibility that a check has been received and deposited, because only when

it is deposited is it deducted from your account, and you can verify the

name, amount, and memo text with a link to the check image. There is no

significant risk from a check lost in the mail, or for some reason not

cashed, because your account is only debited when a check is deposited.

Only one of the three BillPay payment methods preserves all of the benefits

of a handwritten (draft) check: BillPay paper draft check.

Three methods

of payment

My bank I eventually

discovered has three ways of paying people: electronic transfer (no Memo

text) and two types of mailed paper checks, draft checks and cashiers checks

(both with Memo text).

1) Electronic transfer

2) Draft mailed paper check

3) Cashiers mailed paper check

BillPay draft checks are pretty much like handwritten checks. They show up in you account statement and are deducted from your account only when the check had been received and deposited, and like handwritten checks they are listed by check number (bank assigned). When online if you want to see to whom a check is written or its memo text, you click the check number to bring up the check image. In mailed statements images of the checks are provided.

BillPay cashiers check by contrast are entered and deducted from your account on the scheduled payment date, and no online link is provided to show an image of a cashiers checks. On the account statement they are listed very confusingly as 'Online PMT', which is exactly how electronic transfers are listed. Since the bank has three means of paying you would think they would have three different account labels, but not my bank they have only two! I much later found out that you can see the cashiers check Memo text online either in Bill History or by clicking on the payee and clicking on the amount recently paid. This page also gives the "Status" of the cashiers check, which for all my charity checks was marked "Paid". I at first thought this meant that the bank had cashed the cashiers check, but this is not what it means. 'Paid' only means the bank has mailed out the check. I checked my monthly bank statement to see if possibly it contained any additional information on the billpay cashiers checks. I didn't expect that it would, and it didn't. The statement had images of all my charity checks that went out as draft checks and no images of the charity checks sent out as cashiers checks.

Sovereign Online Banking Agreement* With cashiers check no way to verify online that the check was cashed

I looked through the ten page 'Sovereign Online Banking Agreement' (link below). Curiously I found it had nothing to say (that I could find) on the important topic of how BillPay payment methods affected the ability to include 'Memo text' and how payment methods are labelled in your account statement. Or maybe it's not so curious, maybe it's deliberate. The bank, clearly eager to push for electronic transfer, just somehow 'forgets' to discuss in its Banking Agreement one of the most serious drawback of electronic transfer, the lack of memo text.http://www.sovereignbank.com/personal/docs/online_banking_agreement.pdf

'Lost' BillPay cashiers check (July 2016 update)* Void time is bank policy

I recently had this proof problem of a cashiers check with billing from my dentist. They billed me after two months saying I owed $400.50 for work done. I always pay immediately using Sovereign (now Santander bank) BillPay, and sure enough my online BillPay records and checking account records show I ordered the bank to pay the bill on the day the work was done. I know the bank issued a cashiers check (on 5/5/16) because on the same date they show the check 'Delivered' and the amount of the check was deducted from my account.This rebilling by my dentist implies that either they never received the check, or never posted it correctly, so the check is 'lost'. The best recourse is to first inquire of the bank whether the cashiers check as been cashed (see below). And inquire if it remains uncashed, when the check will become 'Void' and the funds will be redeposited back in my checking account. Based on my past experience with this bank (when it was Sovereign, now Santander) the check became Void in 90 days and the money was returned.

I did in fact message the bank on a fri asking if the check had been cashed (forgot my own advice to ask about the Void time) and received a message mon that it had been cashed on 5/11/16, six days after the date on my account statement verifying that it was a cashiers check. But in the meantime my call to the dentist advising them I had paid the bill and when caused them to recheck their records and they found it. The message from the bank said if provided a fax number for the biller, they will fax them a copy of the cashed check as proof.

http://classroom.synonym.com/happens-cashiers-check-uncashed-24025.html

**

Does the bank know when BillPay cashiers checks are cashed?

Does

the

bank know when BillPay cashiers checks are cashed? Yes, it does. And can

it link a particular cashiers check to a particular BillPay transaction?

Yes, it can. How do I know? Because in an online message to me from

a BillPay specialist the bank was able to tell me about a cashiers check

I sent to a family member, telling me not only the date the amount was

withdrawn from my account, but also the date the family member cashed the

check.

Since the bank obviously knows (or can find out) when BillPay cashiers checks are cashed, why is this not routinely reported back to the customer? I would think it would be a simple matter to expand the payment Detail box to include this information. This would remove one of the major disadvantages of cashiers checks from the customer's perspective.

**

How to check on whether a cashiers check has been cashed

(Jan 2015

update)

One huge frustration

with BillPay is this: A biller contacts you by mail or phone saying they

never received payment for a particular bill. You remember paying them

via BillPay. You check the bank's bill history and find the disputed payment,

and the bank shows it as 'Paid'. You check your account and find that the

disputed payment has been deducted from your account on the paydate. So

the money is gone from your account, the bank is saying they mailed a check

to the biller, and the biller is saying they never received it (or at least

didn't post it correctly). Where do you go from here?

A serious illness in the last few months generated a swarm of medical bills. As the bills dribbled in, I made it a point to quickly pay each and every bill. And here my bank's BillPay (attached to my checking account) was a great convenience, so I used it to pay all my medical bills. My bank is now called Santander, but it's the old Sovereign Bank acquired and renamed, and its BillPay system works as it always has. About half a dozen of these dozens of medical bills ended up in dispute, so I've had a chance to work this problem recently.

What has happened in the case I described above is that the bank has paid the biller using a cashiers check. You can tell this because the amount was deducted from your account exactly on the paydate, and also in your account statement the deduction is described only as an 'Online Payment' to the biller. Unlike with a draft check there is no check image to view online even though the bank has (very likely) mailed a paper check to the biller.

If the bank's BillPay had paid via a draft check, and about half my medical bills were paid this way, then you can see an image of the check, and most important in a dispute with a biller you can see if the check has been cashed. The date it is cashed by the biller is in the check's bill history and will typically be a few days after the paydate. With a bank record in hand showing that the biller has cashed the check, you are in a much stronger position in a dispute. It means the problem is at the biller. Most likely it's a posting problem, the biller can't figure out what bill to credit the payment against.The problem with the bank's BillPay paying via a cashiers check is your online bank records provide no information as to whether the biller cashed the check or not. That leaves you in a weak position when a biller tells you they never received payment. All you can say is that the bank is telling you they mailed the check. If a cashiers check is not cashed in 90 days, it will expire and the deducted amount will show back up in your checking account, but that does you little good when in dispute with a biller.

***

Use BillPay message service to inquire

If you think about

it, the bank must know if, and when, a cashiers check is cashed,

because cashing the check initiates the money transfer from bank to biller.

The huge weakness in BillPay is that the bank does not routinely make this

information about the cashing of cashiers checks available to its customers.

But I have found that this information can be obtained by making an inquiry

to the bank. I did it via the online messaging of my Billpay. Each disputed

bill must be identified in the Bill History, and from there a message window

can be opened allowing you to ask if the check has been cashed. It's cludgy

and time consuming and a separate message must be left for each disputed

check, but I did receive back useful information. The bank will answer

in a day or two. Here's part of a reply message I recently received from

the bank:

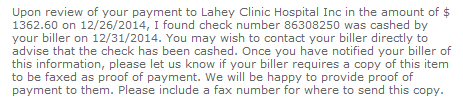

BillPay reply message to me in response to an inquiry

about whether or not a cashier's check had been cashed

The reply message (above) has two pieces of information useful in a dispute. One, you have the bank telling you the date when the cashier's check was cashed, and two, the bank here is offering to provide "proof of payment" by faxing this information to the biller. (Whether there is a charge for this or not is unstated, and I have not used it, so I don't know.)

Call the biller

I also found

it useful to call the biller before leaving messages at the bank. My hospital

was double billing me for six payments that it said it had not received.

In three of six cases a phone call to the hospital billing department resolved

the dispute. The hospital admitted (in effect) they had initially

misposted my payments but the problem had now been resolved. So when I

called them, they told me to the balance was zero, even though just days

before they had demanded payment with a 2nd bill sent via the mail. After

my phone call, they followed up with new mailed statements showing zero

balance, so that settled three of the disputed bills. That phone call to

the biller whittled down the number of BillPay messages I needed to leave

at the bank from six to three.

How will

the bank pay the bill?

The banking

Agreement makes it very clear that bank gets to decide for every online

check you write which of the three methods of payment will be used. Are

there patterns? Can you predict or tell after the fact which method the

bank used? For my dozen plus charity checks there was a clear pattern.

All checks 300 dollars and higher had been paid via cashiers check, while

those at 150 dollars and lower had been paid via draft check. So a week

or so later, being the engineer that I am, I ran a test. I sent two checks

to myself, one for 300 and one for 150. After they were written, the BillPay

screen shows both to be paid via cashiers checks. I looked at the history

of my monthly rent payments. This payment is automatically sent by the

bank every month for the same dollar amount. My online account shows BillPay

for the last two months sent draft checks, but a month earlier had sent

a cashiers check. So much for a pattern. Other than to say there's an increased

likelihood that larger checks will be paid via cashiers check, there appears

to be no way to be sure which type of paper check a bank will send.

You can, at least to some degree, predict and control whether or not the bank pays via electronic transfer. As I mentioned earlier, the bank does ask when you set up a biller whether they should search for an electronic link to that biller and you can decline. However, since they reserve the right to pick the method of payment, I don't see anything to prevent them from adding an electronic link 'behind your back' (as programmers like to say). Clearly banks prefers to send funds electronically because it is cheaper.

If you snoop around, you can pick up some hints as how the bank is likely to send a new payment. Click on the payee. Those to whom payment will be sent via electronic link say "Address on file", whereas those to whom paper checks (draft or cashier) will be sent are shown with the address you entered when the biller was set up. In the Sovereign customer agreement it says you can predict if it is to be an electronic payment by looking at the 'Pay Date', saying, it will be four days out for a paper check and two days out for an electronic transfer. I found this is true, but I doubt many people pick up on this hint, and it is poorly implemented. Let me list the problems. There is a little calendar next to each payee with a red dot on it to indicate the closest Pay Date. The red dot should be closer to the current date for payee with electronic links, but it's not! It's four days out on all the payees. Only when you type in an amount does the pay date pop up in text and only then are electronic transfer pay dates seen to be two days out. But unless you read (and remember!) the customer legal agreement, this does not clearly indicate an electronic payment. Only by putting in payment amounts and then cancelling them for a few payees can you see that some are closer in than others. After the fact, i.e. after the check is authorized, clicking on the amount will bring up a popup window that will tell you which of the three payment methods the bank has selected for this check.

The fact that the bank may substitute an electronic payment for a paper check is reinforced by warning text in red under the Memo text box that says 'No memo text will be included with electronic payment', Why are they telling you this here, if there is not some possibility they will send it via electronic transfer? This warning is very unsettling when you want to be sure the purpose of the payment is made clear to the payee, say an account number (or in the case of cash to family: gift or loan).

An

experiment --- sending myself two checks

As a test,

I sent myself two checks one for 300 dollars and one for 150 dollars, both

entered in the same login. I picked these amounts because I was looking

for a pattern. Less than two weeks earlier 300 dollar charity checks had

been sent as cashiers checks and 150 dollar charity checks as draft checks.

I entered the payments on Wed and the Pay Date was given as the following

Mon. Come Mon I find the envelope below (containing both checks) in my

mailbox.

Envelope for 'Sovereign' BillPay cashiers checks

(name & address blanked)

Cashiers check

envelope

First thing

I notice is that the bank's name does not appear on the envelope. It comes

from some vaguely generic 'Payment Processing Center' in Ohio sloppily

printed in the upper left corner. Frankly it looks like a piece of junk

mail. It looks for all the world like the bogus 'Award checks' that arrive

in my mailbox about once a week. It would be oh so easy to throw

this away without opening it. I begin to smell a rat. Maybe the bank doesn't

care or even prefers if a percentage of mailed out cashiers checks go missing.

It means the bank has free use of customer money for a 1/4 year. After

90 days it will return the amount deducted to the customer, but of course

it keeps all the interest.

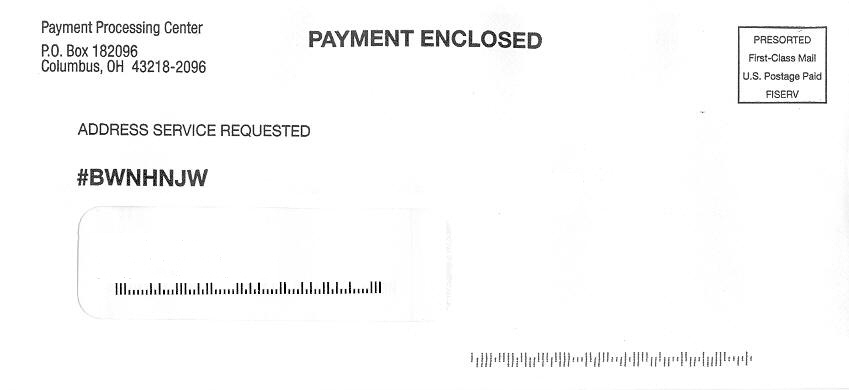

'Sovereign' (really Northern Trust) Billpay cashiers

check (name & address blanked)

Notice above signature it says, 'Remitance void if

not cashed within 90 days'

Cashiers check

details

Above

is a scan one of the paper checks 'Sovereign' BillPay mailed to me. This

is a cashiers check. I have not cashed it yet, but my online banking statement

shows it already deducted from my account. No image of this check is available

online, and I'll be surprised if an image of it shows up in the mailed

monthly statement.

Notice anything interesting? The bank marked on the check (upper center) is 'Northern Trust', not Sovereign! That's right, when you pay a bill from your Sovereign bank checking account the payee may get a check from Northern Trust bank! Also whose "Authorized Signature" is that, some dude at Northern Trust? It sure isn't mine (and it's not legible either)! The check does contain the Memo text I entered along with my name and address in upper left (here blanked). The bank assigned check number is the number in upper right immediately above date (00655...).

Above the signature is the important security measure --- 'Void after 90 days'. Before I found out about the cashiers check time limit, I was very concerned that a cashiers check lost in the mail was essentially a gift from me to the bank! The marked void time is consistent with the BillPay Customer agreement that says cashiers check funds will be automatically redeposited in a customer's account if cashiers checks are not cashed within 90 days.

Less than two weeks earlier when I had used BillPay for checks of 150 dollars they went out as draft checks. Now (as shown above) at the same 150 dollar level Sovereign has switched to a cashiers check. Weird.

Sovereign Billpay draft check

(name & address blanked)

Draft check details

Above is a

screen capture of Sovereign BillPay draft check from my account. This image

is linked to the upper right corner bank assigned check number (000095...)

in my online account statement and (I think) will be included with my mailed

monthly statement. Notice here the bank (upper center) is identified as

"Sovereign Bank", whereas in the same location on the cashiers check the

bank is identified as "Northern Trust". The other differences are no signature

here, and it voids after 180 days rather than 90 days for the cashiers

check. Both checks refer the payee to 'Online bill Payment Processing Center'

for questions, but tel #'s are different and draft check has no address

for the Center. The same blank check stock is used for both checks, so

Memo text and payer's name & address are included and in the same locations.

Uncashed cashiers check funds are returned in 90 days (Aug 10 updated)---------------------------------------------------------------------------------------------------------------------------------------------------------------------

Within months of writing this essay my concerns have been vindicated. Today I was surprised to see a large deposit show up in my online bank account statement marked: PMT (name of person to whom check was written). When I checked Sovereign's BillPay, I found I had written a check to this person for the deposit amount almost exactly three months earlier, and the bank had sent it as a cashiers check. Clearly this cashiers check had never been cashed, and maybe never received. My going on is this essay about lack of visibility when the bank sends payment via cashiers checks now doesn't look so crazy. In fact in the last eight months I have had two 'lost' (uncashed) checks.The good news is that the bank did indeed automatically return the money that it withdrew for the cashiers check back into my account (sans interest, which it kept!) 90 days later when the check became invalid. The bad news is that until today I had not known that this money was never received! This is why I hate BillPay cashiers checks.

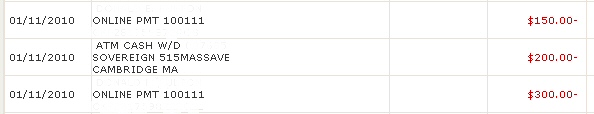

I made a dozen or so charity payments and paid a few bills on 12/31/09. In reviewing my account statements online I noticed all the 'online payments' deducted from my account on 12/31/09 were deducted in the order of the dollar amount, the largest first. This sure looked like the bank had reordered them, but I couldn't be sure since I didn't remember the order the I entered them. But now I am sure the bank is reordering. Below shows the 1/11/2010 (Mon) posting in my checking account for the two BillPay checks I sent myself. Both had been sent in a single login on 1/6/2010, yet here I find inserted between them a 200 dollar ATM withdrawal (from Sat 1/9/2010).

my checking account statement

(name & transaction #'s blanked)

This ordered pattern repeats over and over again in my checking account. Of eight days with multiple withdrawals in the last two months in all cases the withdrawals for the day are ordered by dollar amount, largest first smallest last.

Why do banks do this? Probably to maximize late fees. According to the Wall St Journal bank customer fees, like overdraft fees, are a major component of bank income, and the banks go to great effort to maximize this income. In a shocking NYT article on bank overdraft fees (1/22/10) one expert is quoted as saying the "average" customer pay 12 overdraft fees per year (at 25 to 30 dollars a pop!) and that many banks build their business plans around overdraft fees. [After July 2010, banks will need to get permission from customers to include so-called overdraft protection] Deducting the larger amounts first increases the likelihood that each smaller check will trigger another overdraft fee, which at $39 per overdraft (at least at some banks) can run into big bucks.

'Overdraft protection' combined with reordering generate $200 in late feesAre overdraft fees why the bank sometimes switches from draft to cashiers checks?

When banks last year were forced to testify before Congress about reordering of debit card charges, it generated a lot of news stories headlined: '39 dollar cup of coffee'. I got caught up in this debit card reordering/overdraft scam myself at another bank a couple of years ago. And it is a scam! This other bank reordered my debit card charges while traveling (even though incurred on different days!) deducting my last big charge (hotel bill) first, so that multiple earlier small charges each triggered an overdraft fee causing total overdraft fees to exceed 200 dollars. (Goodbye to that bank...) Clearly reordering is in the banks' interest as it makes triggering of multiple overdraft charges more likely.Banks lose class action reordering suit (update Oct 2011)

As they say in 'Music Man' the sword of retribution has cut down (at least one) bank. Bloomberg magazine says in 2010 Well Fargo bank lost a class action suit in federal court and was ordered to pay 200 million (!) to their customers for the outrageous reordering of debit postings to maximize overdraft fees. The bank used the usual absurd defense with the judge, 'Customers want the big charges deducted first', but the judge didn't buy it. So caught with their hand in the cookie jar, has the bank paid up? Nope, they have appealed. What, you expected a slimy bank to act responsibly?

Summing up

What I have

learned from my little adventure in Online BillPay with Sovereign bank

is this. The bank has three ways of making an online BillPay payment and

reserves the right to do it anyway it wants. While it has three methods

of payment, for some strange reason in your account statement it describes

them with only two labels with the result that electronic transfers and

cashiers checks are confusingly both labelled 'online PMT'.

The bank will not tell you in advance which way a bill is to be paid (you can find out afterward), but if you study up, you can pretty much figure out in advance whether or not it will be paid via electronic transfer or paper check. This is important because if money is sent via electronic transfer, then no Memo text will be sent. I was told by a bank's BillPay expert that if a Memo box pops up when payment is entered that the memo text will be included, but if this is always true why is there a warning in red under the Memo box saying it will not be included in an electronic transfer?

If the bank is paying via paper check, I can see no way to figure in advance if the bank will pay via draft check or cashiers check. The customer is disadvantaged in several ways when payment is via cashiers check. For one thing the money is deducted from your account sooner, but more importantly your ability to track if the check has been received and cashed is lost. If a cashiers check is lost in the mail, you might discover it three months later when the check voids and the funds reappear in your account. Also you can't see an image of a cashiers check online, though pushing into a transaction will show the Memo text on the check and the address of the payee.

Sovereign appears to go out of its way to muddy the waters with cashiers checks, never (in writing) calling them cashier checks, instead referring to them as:

online PMT

account statement

checks deducted from your account on Pay Date

Bill Pay detail page

checks drawn on bank's account

Customer Agreement

electronic checks

BillPay FAQ

guaranteed funds checks

message from BillPay specialist

Only on the phone with a Sovereign BillPay expert did I hear the bank call them cashiers checks. (Other banks are not so obscuring and call them in writing cashiers checks.)

In a BillPay experiment I ran paper cashiers checks were mailed to me. They arrived in an envelop that had no bank name outside and looked for all the world like a piece of junk mail (like a phony award center 'check'). Inside I found the name of the bank on the cashiers checks to be not Sovereign Bank, but Northern Trust! Yet the name on BillPay draft checks is Sovereign Bank. How's that for confusion.

BillPay withdrawals (combined with other checking account withdrawals) show clear signs of being routinely reordered by the bank (intraday + weekends) with the largest dollar amount deducted first and smallest last. My suspicion (unconfirmed) is that the bank's choice of draft or cashiers check may be associated with maximizing the likelihood of overdraft fees. Probably cashiers checks are more likely to be sent when there are multiple BillPays entered on the same day (perhaps above some dollar threshold). Not only are cashiers checks deducted sooner from your account, but multiple cashiers check withdrawals in a single day allow the bank to play its reordering game in the hope of triggering multiple overdraft charges.

The biggest disadvantage of BillPay cashiers checks is that you can't see when they are cashed by the payee. In the case of a dispute with the biller you can't prove he received the payment. My bank has shown me it knows when my BillPay cashiers checks are cashed. So the bank knows, but doesn't (routinely) tell customers when they are cashed. Why? If the bank would simply include the date when BillPay cashiers checks are cashed by the payee, it would be a huge improvement in BillPay. As it is now, cashiers checks are one of the dirty little secret of online Bill Pay.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------

(update 1/10)

Attempting

to pin down the bank

When I finished

this essay, I was 99% sure a customer could not tell from his account statement

when a BillPay cashiers check is cashed. I could not find this information

in my Bill History for any of my recent BillPay cashiers checks, which

went to a major insurance company, large arts organizations and individuals.

In my visits and calls to the bank this had been confirmed by a bank BillPay

specialist. However, I got an online message (below) from a different bank

BillPay specialist that appeared to say the opposite.

The funds for guaranteed funds checks, however, are deducted from your account on the pay date you specify to guarantee the funds for your biller. You may review payment information regarding guaranteed funds checks in BillPay by clicking on Bill History and choosing View Detail to the right of the payment in question, including if the check has been cashed to date. (BillPay message to me 1/11/10)To try and get to the bottom of this I went back to the bank. At the bank I got the same answer as before, you can't tell from your account statement when a cashiers check is cashed. Using the banks online message feature I forwarded the first message and asked for clarification. The same billpay specialist answered:

The BillPay service offers several pieces of information in your Bill History regarding your payments. If your biller offers the option to view the date in which in your biller has cashed your payment check, you are able to view this information by clicking on Bill History, followed by the link View Detail next to the payment in question. We regret to say not all billers offer this option, and you may find you are not able to view this information for some of your billers (BillPay message to me 1/19/09)What?

(update 5/25/10)

I get a 'Draft'

email

I get an email

from my bank saying a regularly scheduled BillPay (paper) check has been

mailed with the payment date a few days in the future. The email clearly

says payment is via paper "Draft" and tells me "Your account will be debited

after the biller deposits the check and it is paid by your financial institution."

(I guess 'your financial institution' is the bank's cute way of referring

to itself.)

I immediately checked to see if I could tell from info online whether or not this was a draft check. I log on to my bank account, but the detail box on this payment does not say if it's draft or cashiers. Since the payment date is still a few days in the future, I cannot tell from my account statement either.

This is totally weird. The bank tells me via email that they have mailed a 'draft' check, but 'draft' or 'cashiers' info on the paper check is nowhere to be found in my online statement. I sent the bank a message about this. Unfortunately if I direct BillPay to mail a paper check the bank sends no such email, so I have no way of telling for several days whether or not a draft check has been sent. (Bank's message reply was just a boilerplate, 'Thanks for your suggestion')

(update 6/24/10)

I get

a 'Cashiers Check' email

I get an email

from my bank saying a regularly scheduled BillPay (paper) check has been

mailed with the payment date a few days in the future. The email specifies

in advance the date the payment will be deducted from my account, so I

know the bank sent a (paper) cashiers check, but as always the bank avoids

calling it a cashiers check. Why? Here I notice they have begun calling

the check debit date the "estimated date posted by biller".

The following payment has been sent:

Biller: xxxxxxx

Payment Amount:

xxxxxx

Date Debited

From Your Account: 06/29/2010

Date Sent

to Biller: 06/24/2010

Estimated

Date Posted by Biller: 06/29/2010

*Note: If the word Draft appears as the date the payment was debited from your account, we could not send your biller an electronic payment and sent a paper check instead. Your account will be debited after the biller deposits the check and it is paid by your financial institution.(update Aug 25, 2010)

I sent this message to the bank:

What happened here? Was this check ever mailed or was it mailed and not cashed? I thought uncashed cashiers checks expired in 180 days (got this wrong, 180 days is for draft checks). Today I see this ..... deposit in my account, 90 days after this cashier check was sent.Bank replies:

This check was sent (I later confirmed from the family member that the check had been received) as a guaranteed funds check, also known as a corporate check (a new name for cashiers check!). This type of check is good for 90 days. Since your payment was not negotiated within this timeframe (bank speak for 'not cashed') the check was stopped and credited to your designated checking account.The good news is that the bank did what it was obligated to do, after 90 days it returned the money to my account when a cashiers BillPay check remained uncashed. The bad news is that this unplanned event vindicated by concerns about how the bank operates BillPay, the concern about no visibility for checks sent as cashiers checks, the concern that prompted me to write this essay!

==============================================================================================================

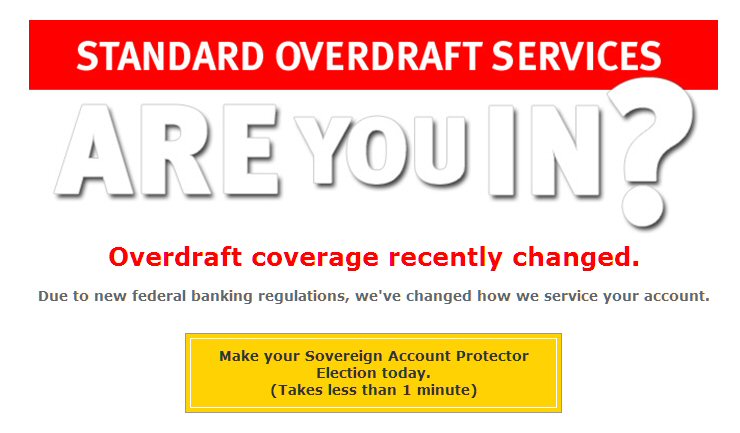

Summer of 2010 federal legislation kicked in to limit the wide spread abuses of so-called Overdraft protection, abuse which I have experienced and documented in this essay. No longer can the bank tack on Overdraft protection (with its huge fees) automatically, the customer now needs to OK it. My bank, Sovereign bank, responded to the new law with a huge, shamelessly misleading, advertising campaign.

Sovereign employs a new, slimy trick to get customers

to grant overdraft approval (9/5/2014 update)

Here it is

four years since the law change and Sovereign still hasn't given up on

coming up with new tricks to get customers to approve overdraft protection

(with its high fees). I stumbled onto a new trick today, a really slimy,

underhanded trick that the bank has just come up with.

I have used the same ATM at a Sovereign branch bank regularly for years since I run a cash economy. Using the same ATM all the time I could probably push the button sequence in my sleep, and it's a little game to see how fast I can go. The 'withdrawal' button has always been in the upper right corner. But today as I was reaching for the upper right corner I noticed the button had been changed, it had a lot of abbreviated text and hitting it looked like it was going to grant approval for overdraft protection. Yikes!

This is really, really low, suddenly switching their ATM's 'withdrawal' button to 'overdraft approval', hoping to snare a bunch of regular ATM users into hitting it once by mistake. One hit I am sure is all it would take, and the bank would claim they have the customer's approval to re-instate overdraft protection. What the hell is such a request even doing on an ATM screen anyway? More proof that Sovereign bank is run by a bunch of real slime balls.

Federal

protection from Overdraft fees (6/23/10 update)

Today when

I logged onto my Sovereign account I find a big red notice (see below,

which leads to the message text below). After Aug 15, 2010 federal law

prevents them from automatically including overdraft 'protection' (on some

transactions). After this date, you need to sign up to get ATM and debit

card overdraft 'loans' (along with the $35 fee for each short term loan!),

which of course the bank is encouraging its customers to do.

"Important message about federal regulations impacting your account"Be prepared with overdraft coverage with Sovereign Account Protector

How it works now --- As part of the standard overdraft practices that come with your account, Sovereign may currently authorize and pay overdrafts for:

* Checks and

other transactions made using your checking account number

* ATM withdrawals

and transfers

* Automatic

bill payments

* One-time

debit card transactions

* Online Banking

payments and transfers

* Recurring

debit card transactions

Changes effective August 15, 2010 --- Unless you authorize us to pay these overdrafts and charge a fee, as of August 15, 2010, Sovereign will no longer authorize and pay overdrafts on:

* ATM withdrawals

and transfers

* One-time

debit card transactions

(Aug 10 update) The bank's massive campaign to get people to sign up for its wildly expansive (stupid) overdraft protection continues. Last week there were large (8x10) sheets about it taped next to every Sovereign cash machine.

My comments

First, notice

what is the bank's explanation for "why" they have been automatically paying

overdrafts. The explanation they give above is, plain and simple, a big

fat lie. It is not a service for customers, it is exploitation

of customers. These short term loans that are astoundingly profitable for

the bank and astoundingly costly for the customers.

Second, notice the huge loop hole the banks have carved out of the (so-called) federal protection. Only two of the six cases they list where they now provide overdraft protection have been blocked by the law. It looks like their ruinous automatic overdraft fees still apply to checks, online payments to vendor where you give your credit/debit card number, and online Bill Pay payments!

Federal protection

is only for ATM withdrawals and where you present your debit card (in person

apparently).

========================================================================

Sovereign

will not give up pushing OverDraft protection

(update 12/14/10)

It is five

months after the change in overdraft law, and Sovereign is still beating

this horse. When I open my account online today, I find below filling the

screen. Now it's 'Standard' Overdraft Services. This must be a huge money

maker for them, and it shows you what banks are really all about. This

deceptive baloney is what passes for customer service at Sovereign Bank!

screen capture of opening screen when trying to view

my Sovereign account online (12/14/10)

Overdraft

associated with shift from Visa to Mastercard?

I haven't

figured out yet what the bank is really doing, but I suspect Overdraft,

or some other new hidden fees, are connected with the bank shifting from

Visa to Mastercard. My old Sovereign Visa debit card was about due to expire

(June 2011), and the bank instead of sending me a new Visa card sent me

a Mastercard. Later they called me asking I wanted it activated then, said

yes. I understood the (low level) Sovereign person on this call to say

that the bank was replacing all its Visa cards with Mastercard,

because if offered "additional protections". I smell a rat. An increase

in bank costs is always presented as a (vague) positive to the customer,

you get more 'protection'! From what?

Yup, with a little googling I found this FAQ from Sovereign

All Sovereign Bank debit cards are currently changing over from Visa to MasterCard®. Your current card will be discontinued and switching now will ensure uninterrupted service. Purchases will continue to be deducted from your primary checking account, just like before, and your replacement card will continue to work with the same PIN number.So the advertised reason for the switch is "extended warranties, purchase protection, and satisfaction guarantees". The next phrase, apparently referring to 'purchase protection' sells this to customers as Mastercard offering a better 'charge back' procedure than VISA. Is this true? But what's the deal with 'extended warranties and satisfaction guarantees'? Is this the same as purchase protection or something else? I read that charge back and customer protection is one of the few things that does differ from card to card, so jury is still out on this one.Now that Sovereign is part of Santander, we're able to provide you with more benefits than ever, including extended warranties, purchase protection, and satisfaction guarantees, which help protect you if something you buy is broken, lost, stolen, or simply something you're not happy with.

If its not

overdraft or other fees, then my skeptical mind thinks maybe the shift

from VISA to Mastercard could be because it brings a new contract into

play with higher interest? Or, more benignly, it might just be that Mastercard

is the preferred card of Sovereign's new Spanish owner, so it's just a

corporate standardization thing.

===============================================================================================

Sovereign

monthly statement (2/13)

My latest

(mailed) monthly statement from Sovereign is little more than a bank ad

with my account details on the back. Unfolding the 8.5 x 11 piece of paper

shows my name and address in the upper 20% of the page and the rest of

the page is a B&W newspaper type ad for the bank (hawking a limited

time special on housing equity loans). Only when I flip over the ad do

I find my account transactions! Other companies, like the telephone company,

have long slipped small ads into the envelope with the bill, but Sovereign

has taken that a step further. The account statement itself is now essentially

an ad! Sovereign bank is really a piece of work.

------------------------------------

ATM charges (2/13)

I run my life

with cash not credit cards and use a Sovereign ATM weekly for my cash needs.

But recently with a record 2 ft of snow coming the next day I stocked up

on cash using a non-Sovereign ATM in my local supermarket. A couple of

weeks later scanning my monthly Sovereign bank statement I noticed two

charges connected to the pre-snow storm withdrawal. The cash withdrawal

was 263.50, which implies a 3.50 ATM charge. OK, I had approved a 3.50

charge to use the ATM. I remember when ATM fees were 0.50 or a dollar,

but every year they get higher and higher. However the next line was a

3.00 deduction marked "cash withdrawal fee" (with the same bank name, code

and location). The fact that this might be a foreign ATM fee imposed by

Sovereign never occurred to me. (Maybe because Sovereign doesn't label

it as such!)

I looked to me like the bank in the supermarket owing the ATM must have double billed my checking account, so off I go to the supermarket bank, but they won't talk to me and just send me to Sovereign. The Sovereign bank manager tells me they have added a new fee weeks earlier, Sovereign bank now charges a 3.00 fee for using a non-Sovereign ATM! (And to compound that pain she tells me that Sovereign used to belong to an ATM network, but they have left it.) Now the only way to avoid this 3.00 fee is to use a Sovereign bank ATM. So there was no error, an ATM withdrawal at my supermarket now costs me 6.50 in fees, 3.50 to the bank that owes the ATM and Sovereign now piles on charging a 3.00 foreign ATM fee, which they 'conveniently' forget to label as such!

How

is a foreign ATM fee justified?

When I think

about this, What possible justification is there for the existence of a

foreign ATM fee, aside from the bank's parochial business interests? None

that I can think of. The bank that owns the ATM can in principle impose

a fee because they are providing a service. What service has Sovereign

bank provided? The ATM withdrawal from my checking account is no different

from the dozens of withdrawals and deposits that occur every month in the

account. It should be included in the checking account charges. There's

no justification for a special fee for this particular type of withdrawal,

none!

Big guys can

avoid the fee

The local

bank manager looking over my account suggested a way to avoid the foreign

ATM fee. She looked at my deposits and asked if the total deposits in my

account made automatically (for example, SS, pension) exceeded 2,500.

I said yes, so she changed my account type. The new type of account does

not imposed a foreign ATM fee, but worse has a 15 monthly charge, but the

trick is the 15 monthly fee is waived if automatic deposits in your account

exceed the 2,500 threshold.

So what we

have here is the core business model of Sovereign and a huge number of

banks in action. Abuse the little guy, the guy least able to pay with fee

after fee, bleed him dry. Got a few bucks, no problem, the fees get waived.

Note the bank waives the monthly fee NOT if you keep a minimum amount of

money in your checking account, only that you have 2,500 of automatic deposits

into it.