.

.  .

.  .

.  .

.

Annette Bongiorno

Joann Crupi

Daniel Bonventre

George Perez

Jerome O’Hara

Guilty --- 5 more members of the Madoff criminal fraud

conspiracy

At root the Madoff ponzi was a cash transfer machine stealing

money from the little, often

indirect, Madoff investors and giving it to Madoff insiders

like the Picowers, Shapiros, and Wilpons

"(Jeffry) Picower was the only one that might have

known (of the fraud),"

“I mean how could he not?” Bernie Madoff as quoted by

NY Times reporter Diana B. Henriques

Madoff Securities: 'Phony documents are us' ---

Phony investment gains,

phony tax losses for favorite customers, phony SEC reports,

phony earnings for the whole Madoff family

created 12/08

updated 1/17/17

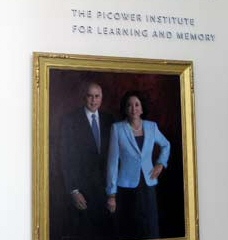

Picower

7.2

billion Picower settlement

Jeffry

Picower withdrawals

Review

of 501(c)(3) Picower Foundation 990 filings 2001 thru 2007

Picard

and Sheehan talk about Picower on CBS's 60 Min

Picower's

history --- Forbes 2002 article 'Unaccountable'

Madoff/MIT

connection

Reading

Picower's Will --- a new Picower Foundation -- (or Time to kiss April Freilich's

ass?)

Where

is the new Picower Foundation?

JPB

Foundation -- new Picower Foundation

Picower

Foundation 990 filings

Madoff family

Fake

Bernie lays out the circumstantial case against the Madoff family

Peter

Madoff to plead guilty (6/28/12)

My

take on the circumstantial case against the Madoff family

case

II -- Amazon review of Diana Henriques' Madoff book written after

Peter Madoff's arrest (7/12/12)

case

III -- Judge Swain's view parallels my view of Peter and the

'crooked' operation of the Madoff firm (12/20/12)

JP

Morgan bank -- Reading the Trustee's complaint (Feb 2011)

JP

Morgan 2.5 billion settlement with prosecutors (2 billion) and Trustee

(0.5 billion) (1/7/14)

Madoff insiders

J.

Ezra Merkin --- Bernie's NY bagman

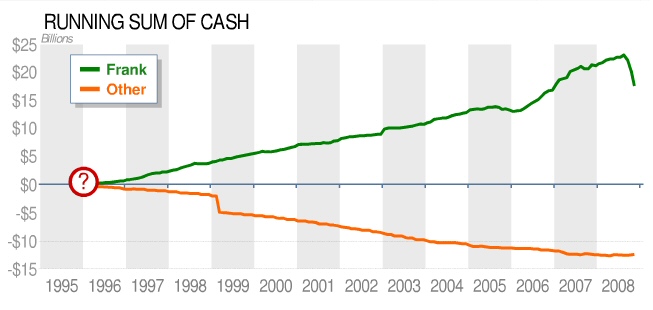

Ponzi cash transfer

data

Picower Foundation

table

Madoff links

Appendix

Mitt

Romney charitable foundation 990 filings

Madoff's 2nd son dies (9/3/14)

The headlines

today are that Bernie Madoff's younger son Andrew, age 48, just died of

cancer. Cancer runs in the Madoff family. Peter Madoff's son died of cancer

too. The articles about Andrew's death contain information about a July

2014 update to Picard's suit against the brothers. Picard a couple of years

ago on 60 Minutes said the purpose of his suit against the brothers was

not only to recover assets for the investors, but to bankrupt them. Mark

Madoff on Dec 11, 2010, exactly two years after his father was arrested,

perhaps not wanting to be poor (!), hanged himself.

New information about the brother's actions inside the firm, and their possible knowledge of criminal wrongdoing, has been made available to Picard from Frank DiPascali, who was Bernie's right hand man in the investment advisory business and the leading witness for the prosecution in the big trial last winter. The complaint against the brothers now details (see link below) how they conspired to conceal information from the SEC in a 2005 investigation by deleting masses of emails. The suit also describes how 'fake documents are us' Madoff ginned up a phony investment account statement for one of the brothers for him to verify his assets when he bought a NYC condo. Picard alleges they dipped into customer money to use as their own with phony loans for millions that they never intended to pay back. The brothers KNEW Madoff Securities was not run honestly.

Picard's July 2014 updated suit against the brothers lays out evidence of their criminality (10 pages):

http://www.madofftrustee.com/document/dockets/004921-andrew-madoffmemorandum09-01503docket185.pdf

This suit in footnotes also describes the 90 million dollar financial settlement with brother Peter Madoff (now in jail) and his family that kept his daughter Shana, a compliance officer at the firm, from being charged. Shana contributed to the 90 million settlement by selling her million dollar vacation home in the Hamptons.

I have long since argued that the brothers as senior professional traders had to have known that their father, who they could observe daily, was not trading in a manner consistent with their high yielding investment account statements. Bernie didn't have the resources (where was the staff, the traders?), didn't have the time (he spend weeks to months on vacation in France), didn't have the technical knowledge (it is reported by his secretary he could barely turn on a computer), or I dare say the trading skill. Furthermore as trading pros they would have known that no trading strategy in history has ever been devised that could yield the consistent, high yields that were reflected in their account statements. Thus they had to have known, for SURE, their father was running some sort of massive scam, and this would not surprise them. They knew their father was a scammer, always had been, the firm was run that way always skirting the law, he didn't pay proper taxes, lied to the SEC, and they participated too miraculously 'earning' millions on meager investments allowing them to live the live of the super rich. It was clear their own investment advisory account statements were clearly fraudulent, Madoff would change them on request, and they showed phony and backdated trades.

So if their father wasn't trading, where did they think the money was coming from? This is the key question about their guilt or innocence! Now upon learning it was a ponzi, of course they were shocked. They present this as 'evidence' of their innocence, but (if real) it is just as easily explained by their sudden realization that their investment accounts, which they thought were worth millions, were worthless. However, Bernie, ever the 'good' family man had an (idiot) plan, he was going to further screw all the little investors and pay off his family, key staff, and friends with the remaining cash, alas it never came to be, because the written checks went undelivered after his arrest.

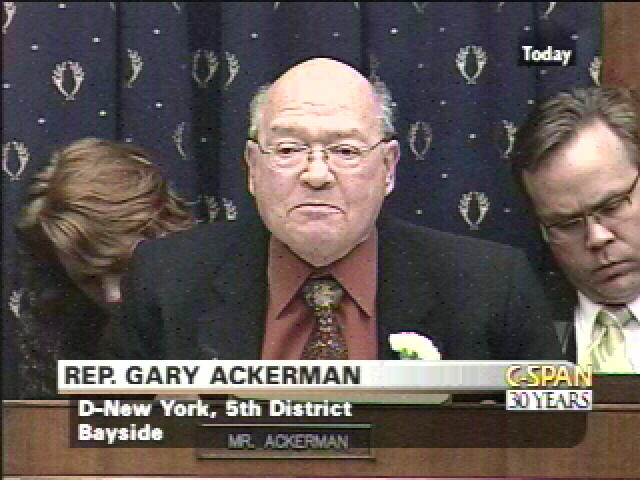

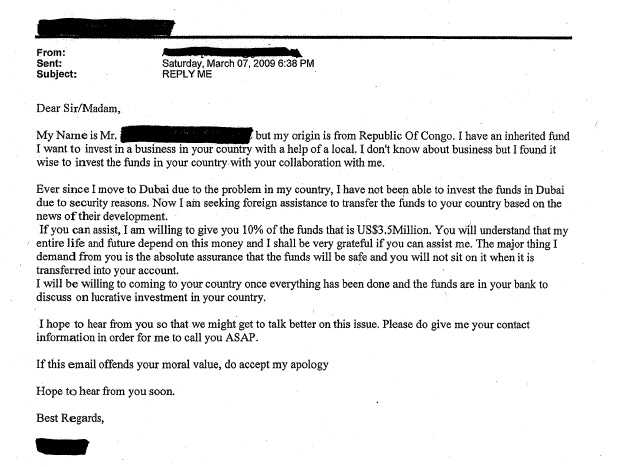

Madoff trial of five wraps up (3/24/14)

Many

of Bernie Madoff's associates, including his brother, have pled guilty

in the five years since he was arrested, but five who worked faking records,

cheating on taxes, lying to customers, backdating fictitious trades, keeping

a 2nd set of book, and were paid handsomely for it, claimed they were innocent,

no idea the investment advisory business was a fraud, they were just doing

as they were instructed. The jury didn't buy it. Today after one of the

longest white collar cases in Federal court history, they were found guilty

of all charges (31 counts).

The prosecutor, John T. Zach, an assistant United States attorney, in the closing weeks of a trial told the jury “There’s really no dispute here that there was a massive criminal conspiracy.” The only question, he said, was whether the (five) defendants knowingly committed fraud to help Mr. Madoff sustain that criminal enterprise. “So let me state it to you as clearly as I can,” he said: “The defendants knew that fraud was going on at Madoff Securities.” The jury agreed. Note the prosecution is not saying they knew specifically it was a ponzi, just that there was (massive) fraud going on, and Mr. Bharara (US attorney) said. “These defendants each played an important role in carrying out the charade, propping it up and concealing it from regulators, auditors, taxing authorities, lenders and investors.”

.

.  .

.  .

.  .

.

Annette Bongiorno

Joann Crupi

Daniel Bonventre

George Perez

Jerome O’Hara

Guilty --- 5 more members of the Madoff criminal fraud

conspiracy

Hi-lites of the trial

-- All five

tried together in one of the longest white collar criminal cases ever in

Federal court (Oct 2013 to March 2014)

-- Star prosecution

witness Frank DiPascali, Madoff's closest associate in the fake investment

advisory business who pled guilty in 2009, was on the stand for a

month (Dec). He detailed how all five were involved in the fraud.

-- Annette

Bongiorno and Dainel Beonventre took the stand (for a few days) in their

own defense.

-- “The trial

established that the Madoff fraud began at least as far back as the early

1970s,”said Preet Bharara, the United States attorney in Manhattan.

-- DiPascali

on the stand claimed that the defendants were well aware that Mr. Madoff’s

firm was routinely backdating the fictitious trades that showed

up on customer accounts — a practice that he said had been going on at

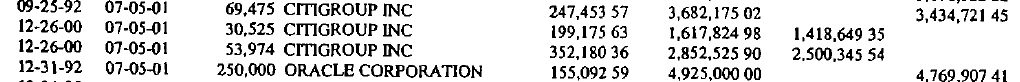

least since the late 1970s. (see Picower's charity investment records)

-- I was at

the trial (2 days in Nov)

"Annette Bongiorno's attorney, Roland Ripoelle, said his client "saw $50 million of what she thought was her own money to up in smoke." So they are Madoff victims too claim their lawyers! The jury didn't buy it. Annette claimed she was little more than a clerk at Madoff Securities, so how did she explain the 50 million in wealth she amassed? Did she claim to be just a good 'investor' like Picower, Shapiro and the other Madoff insiders.Arrest update (2/25/2010) (11/18/10) (6/28/12) (9/14/12) (11/15/13) (3/24/14) (12/9/14)

Bernie Madoff -- (pled guilty, in jail)Picower comes up at the trial (3/11/14)

Peter Madoff -- Bernie's brother pleads guilty and gets 10 years for filing false documents and

false income tax. (Only took 4 years to nail him!) The judge at sentencing says Peter's claim

that he didn't know anything was wrong with Bernie's investment advisory business (for which

he was faking records!) is "beneath the dignity of the former vice chairman of NASD"

and "frankly, not believable". The judge also said his plea taken at face value showed he "knew"

Bernie's IA business was a "little bit crooked". (So Peter like his brother pleads guilty, while at the

same time putting forward an absurd claim, here, 'I was shocked, shocked, I tell you. I thought

Bernie was this fantastic trader. Why he was so good that without the help of traders I saw him

make hundreds of millions almost every month for nearly 20 years. Now that's a trader, and you

know I never asked him how he did it.)

(36 page transcript of Peter's 12/20/12 sentencing hearing is here)

(details of Peter's 90 million settlement, which probably kept Shana from being indicted, is here, see footnotes)

Frank DiPascali -- Madoff's ponzi customer man (pled guilty, awaiting sentencing)

David G. Friehling -- Madoff's do nothing accountant and personal income tax preparer (pled guilty, awaiting sentencing)

Jerome O’Hara -- ponzi computer guy, who faked records, His trial starts Oct 2013. Convicted 3/24/14.

Sentened to 2.5 years in jail.

George Perez -- ponzi computer guy, who faked records, His trial starts Oct 2013. Convicted 3/24/14.

Sentened to 2.5 years in jail.

Daniel Bonventre -- financial guy who transferred funds back and forth between ponzi and

the trading business and faked SEC records. His trial starts Oct 2013.

He was convicted in 3/24/14 and on 12/8/14 sentenced to ten years in jail.

Annette Bongiorno -- Key manager on 17th floor under DiPascali arrested 11/18/10.

Her trial starts Oct 2013. She was convicted 3/24/14 and on 12/9/14

sentenced to six years in jail. At sentencing she claimed she was a 'victim' of Mr. Madoff

and even though she was regularly back dating and faking trades, she claimed she didn't

know what was going on. The judge said "She was a pampered, compliant and grossly overpaid

clerical worker" who had "willfully blinded herself" to illegal acts she was being told to

carry out, all in return for a luxurious lifestyle. She has to forfeit an estimated 14.6 million

she received in salary, bonuses and fake loans from Madoff Securities since 1992. At the close

she was managing hundreds of accounts with a balance of 8.5 billion.

Joann Crupi -- Another long time manager on 17th floor under DiPascali arrested on same day as Bongiorno.

Her trial starts Oct 2013. Convicted 3/24/14. Sentened to six years in jail on 12/16/14.

David L. Kugel -- A 40 year experienced Madoff trader, who for years also faked trading records.

He spans the two of the Madoff businesses (office on 18th floor?). Admits to faking

trading records as far back as early 70's, and his own account records are obviously fraudulent

back to 1977. (Strong proof Madoff has been a slimeball from day one.) His specialty was

“convertible arbitrage” trading both real and fake. Salary was 588k and he withdrew over 10

million from his accounts. He is a possible link to Peter Madoff. (pled guilty, awaiting

sentencing and is cooperating)

Craig Kugel -- David Kugel's son worked at Madoff Securities too as a human resources employee. He

sent fake forms to US Dept of Labor swearing the phony people on Madoff's payroll (like

DiPascali's boat captain, and probably all the wives who were making business charges)

worked at Madoff Securities. He was clearly an insider, because he charged 200k to the

company credit card for peronal items like family vacations, which of course he did not report

as income. (pled guilty to five criminal counts including income tax evasion, fined 2.3 million

awaiting sentening in Dec 2013, possible 19 years, but may be reduced since he is cooperating).

Finally someone at the firm is charged (and guilty) with income tax evasion! But at

200k he was a small fish. The whole Madoff family (very likely) did what Craig Kugel did

on a much bigger scale. Are they next?

Even more interesting the WSJ ties Craig Kugel to Peter Madoff. Peter is suspected to be

employee 'CC-1', who hired him, who approved of a plan to conceal corporate personal

spending from IRS, and Picard alleges that Peter Madoff's wife (for 12 years!) was one of the

phony employees collecting 1.57 million in salary.

Eric S. Lipkin -- Worked for Frank di Pascali for 16 years and was Madoff Securities payroll manager.

His father had been Madoff first employee, hired 1964. Picard alleges the father remained

on the payroll after retirement as a phony employee. (pled guilty, awaiting sentencing in Dec 2013)

Irwin Lipkin -- Now (9/12) comes news that Eric Lipkin's father has been rounded up and will plead guilty too.

This is Bernie's first employee, hired in 1964, and he is a crook, which tells you Madoff has probably

been a crook from day one! He is 74 and hadn't worked at the firm since 1999, but was still listed

as an employee and collected a salary. (It's things like this that tell you a lot of people at Madoff

Securities had to have known this was not a law respecting business.) He will plead guilty to making

'false statements in regulatory filings, conspiracy to commit securities fraud and other crimes' and faces

up to 10 years in prison.

Enrica Cotellessa-Pitz --- Bernie's long time (1978) controller is pleading guilty to criminal charges:

faking documents to deceive SEC, conspiring with the outside accoutant to provide false audit reports.

She was involved in moving 600 million from the ponzi to the trading side of the business. The

trustee wants a 3.75 million clawback (3.3 million salary and 500k withdrawals) from her and

her husband. She is a cooperating, and it turns out (according to the trustee) she was DiPascali's mistress.

Apparently she pled guilty, as she is to be sentenced in Dec 2013.

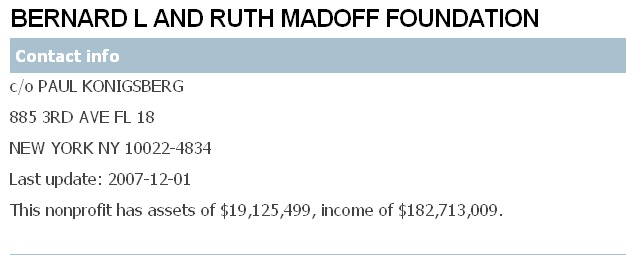

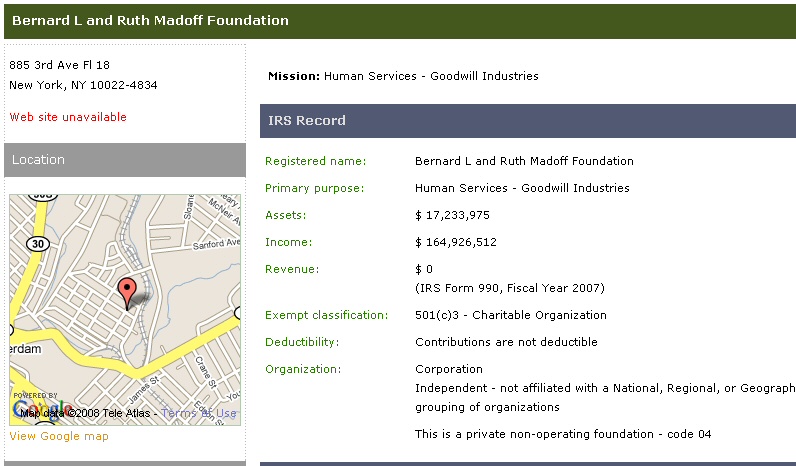

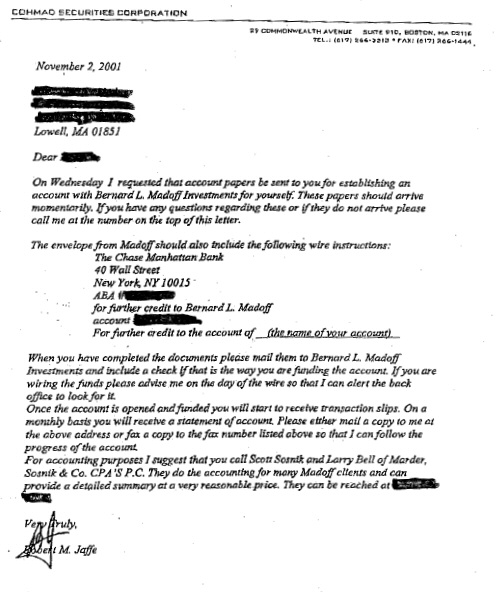

Paul Konigsberg --- Age 77, arrest Sept 2013 for conspiracy and falsifying records, released on $2 million bond.

He is a 'big time' outside accoutant who assisted Madoff in the ponzi by doctoring records including

phonying up his clients (so called) Madoff trading records to minimize their taxes (say the prosecutors).

One of his relatives was a no-show employee on Bernie's payroll. He was founding partner of mid-size

NYC accounting firm Konigsberg Wolf and Co and the goto accountant for some of Bernie's early and

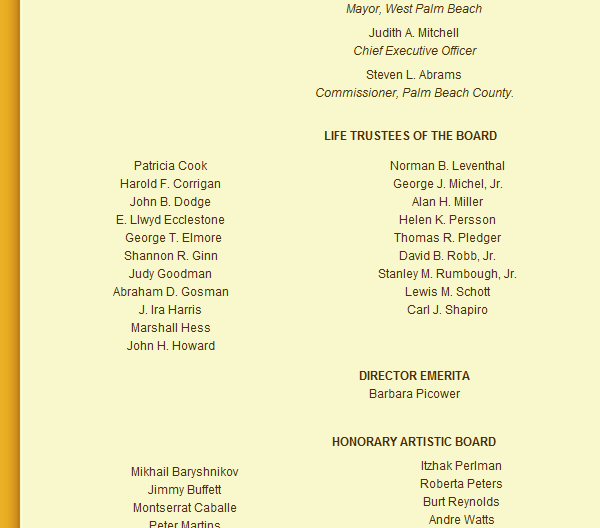

biggest clients including Carl Shapiro and later Jaffe (gee I wonder why?) including Madoff himself.

In June 2014 he pled guilty.

"Another client whose accounts were regularly brought in line was Jeffry Picower, whose staff often sent requests for specific backdated trades to Madoff, said Bongiorno, who managed the billionaire’s accounts for years. “They would make suggestions, and Bernie would say, ‘Yes, we will do it,’ or, ‘No, we won't,’” Bongiorno said. “But it was never a mystery that they were backdated. They knew it.” (from Bloomberg news 2/27/14)So here we have trial testimony from the person on the 17th floor who for years handled Picower's accounts, Annette Bongiorno, confirming what the forensic accounting found and the Madoff trustee suits alleged, that Picower was fully aware and participated in phonying up his account with fake dates, fake gains, and fake loses (for tax purposes).Picower, who began investing with Madoff in the late 1970s, died in 2009 at age 67. His estate in 2010 agreed to forfeit $7.2 billion to victims of the fraud and the U.S. A telephone call to his attorney wasn’t immediately returned.

I'm at the trial! (update 11/15/13)

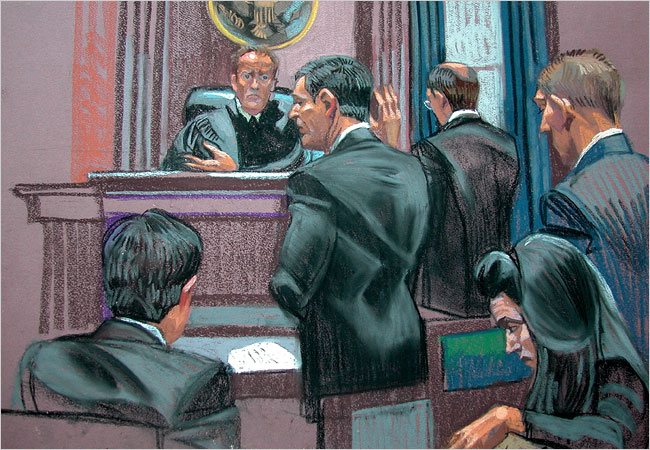

I found myself in NYC the week of 11/11/13 for a few days (mainly to see some shows) and with a lot of effort figured out how to observe at the Madoff trial. After five years this is the first (and maybe the only) criminal trial of Madoff people, all the others from Bernie on down in jail or going to jail (9) have pled guilty, so no trials. All five claiming innocence are being tried together. Went two days and spent a total of 4-5 hours observing. David G. Friehling was on the stand the whole time, he is a government witness. The first day I heard the last two hours of his direct testimony, and the next morning nearly three hours of his cross examination by two of the five defense lawyers.Trial wrap up -- In this long, long trial I observed the five defendants, all involved in carrying out the fraud in Madoff's office, were all convicted in March 2014. It took until Dec 2014 for the last of them to be sentenced. The length of sentence seems to have been set depending on how big a cheese they were. The judge (Judge Swain) thinks these people just got caught up in a bad situation, so sentenced quite litghtly, but other observers think the sentences far too short considering the huge extent of the fraud and harm done. [Daniel Bonventre -- 10 years, Annette Bongiorno -- 6 years, Joann Crupi -- 6 years, Jerome O’Hara -- 2.5 years, George Perez -- 2.5 years]The trial is in the biggest courtroom (ceremonial courtroom) in the new Daniel Patrick Moynihan courthouse at 500 Pearl St downtown. The trial observers were outnumbered by the lawyers! I counted 15 lawyers, 7 on the government side and 8 for the five defendants. At first I couldn't pick out the defendants with all the defense lawyers, but when the judge called for meeting in chambers, all 15 lawyers trooped out leaving the five defendants sitting alone on the defense side: Daniel Bonventre, Jerome O’Hara, George Perez in first row, and behind them Annette Bongiorno and Joann Crupi. The only spouse in evidence was Annette Bongiorno's husband parked by a window. 18 in the jury box (12 jurors and 6 alternates, could not tell which is which). Very few (if any) of the 18 potential jurors looked jewish.

Friehling said on the stand he had pled guilty to nine felonies, and he is a government witness hoping to lighten his pending sentence. He was always very precise and clear in his answers, it was clear he had been well prepared. It came out in cross that he had 15 meeting with prosecutors to prepare! Beside being the company's (do nothing) accountant for years he prepared the personal income taxes for Bernie and pretty much the whole Madoff family that worked at Madoff securities. A few of Bernie's 1040s were flashed on screen. I could see one year Bernie and Ruth reported 38 million in interest.

The main focus of the direct was that every year Friehling would work with Bonventre to produce phony company documents for the IRS to show that the company had nearly no profit. For the few years I saw presented the company earned 40-70 million profit each year (at least that what was Friehling was told, but he could not confirm). This should have been reported as income on Bernie's return since he owned 100% of the firm. Yet every year Bernie's 1040 would show the firm made barely any profit, just a small gain or loss (million or two) for nearly 20 years (my guess knowing Bernie is it probably averaged pretty close to zero over time) saving Bernie and Ruth tens of millions in taxes every year. (And Ruth is still walking around free!) So Friehling's testimony has Bonventre delivering phony company records for the IRS to support Bernie's cheating on his income taxes. The generation of phony records were of course a specialty of Madoff Securities!

Friehling's testimony also connected Annette Bongiorno with tax cheating, in this case Peter Madoff cheating on his personal income taxes. Bongiorno gives Friehling (so called) trading records showing a cool five million dollar gain Peter Madoff has (supposedly) made on a stock held less than a year. Friehling duly enters the five million as short term gain on Peter Madoff's 1040. Peter explodes when he sees how much tax liability this generates. When Friehling checks again with Bongiorno she hands him a new trading record that now (surprise, surprise) shows the stock had been held more than a year, thus converting a [short term capital gain => long term capital gain] saving Peter and Marion about a million in taxes. (This presentation to the jury led by lead prosecutor Randall Jackson I didn't think was very clear.)

The cross of Friehling I saw was pretty much a joke with blowhard defense lawyers making trivial arguments with questions like, 'You would agree that not all travel expenses are personal expenses?' Now and then the defense lawyers would troupe out the classic misleading defenses, 'Did you consider Bernie to be an investment guru?' (Ans: pretty much) and 'You never suspected that Bernie was running a ponzi? (Ans: no) They never ask about 'fraud', never a question about whether or not the returns looked like market returns, just did Friehling think it might be a ponzi. (Bloomberg's news story on Friehling's trial testimony is here.)

Footnote -- Observing the trial

The difficulty I found with observing the trial (even if you know the judge, case name and courthouse, which I did) is knowing when the trial is on. I could not find the 'court calendar', which gives the days and hours of the trials. There is no link to it on the District Court web site, it does not appear to be online. In fact there is zero support there for anyone wanting to observe any trial in the courthouse.While in NYC with a lot of searching (using google I think) I finally turned up a one page letter Judge Swain had issued to the press for this trial, and in that letter she gave the days and time: Mon thru Thur, 9:15am to 4:15pm, beginning in Oct 2013 expected to last for five months. (I had earlier emailed the Bloomberg reporter covering the trial, but got no reply.) Once through security at the courthouse entrance I found I had the run of the building and could just walk into any courtroom. It appears that each district judge has an assigned courtroom with his/her name posted outside. Curiously the courtroom where the case is being held (normally used I am told for things like the swearing in of judges) outside just says 'Courtroom', nothing else, no name, no number, and there is no one on the 9th floor outside the courtroom to ask.

JP Morgan settles for about 2.5 billion (Update

Jan 7, 2014)

You can find

my summary/commentary of this settlement here.

JP Morgan roughly 2.5 billion dollar settlement of several of its Madoff suits is headline news today. Biggest chunk is a fine of 1.7 billion fine to justice dept for violations of anti-money laundering laws, also an agreement by the bank on a long statement of facts. Another half billion or so goes to victims via Trustee and other suits. The Trustee settled for a lot less than he sued for.

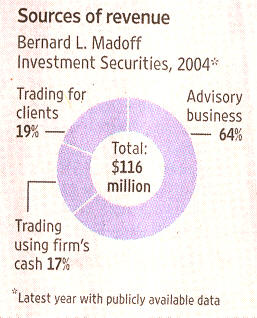

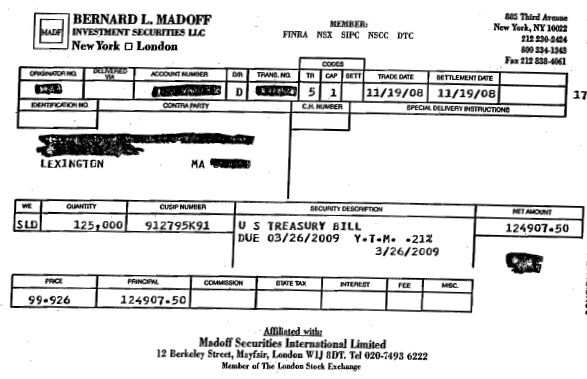

The infamous JP Morgan 'account 703' that Madoff used to run the ponzi had had over five billion in later summer 2008 only to have nearly all this drain away before the Dec 2008 arrest. Madoff used this account for 22 years (1986 to 2008) to run the ponzi, and when all the deposits and transfers are added up for the 22 years it comes to 150 billion. This gives some flavor of the circulation of the money as only about 20 billion in real money was even input to the ponzi, and it had a paper value at the end of 64 billion.

The report makes a claim I find impossible to swallow: The JP Morgan banker assigned to monitor Madoff and his 703 account, who visited Madoff's offices, who was Madoff's banker for something like fifteen years (until his retirement) claims he never knew much about Madoff business or the purpose of the 703 account, he thought it 'probably' contained just tens of millions and was used for routine support of a trader/broder firm like paying the rent and not for Madoff's investment business. Ten's of millions? Didn't he ever look at the account statement! In fact in 2005, long before the banker retired, the account had one billion in it.

Details of a long running check kiting scheme that Madoff did using Norman Levy's account at another bank is explained. Levy's account in mid 90's held a portfolio worth 2.3 billion, which was probably more cash that Madoff's 703 account had at the time, so it was probably useful for Madoff to have (or appear to have) some of Levy's money appear to be his. Tens of million went on a round trip loop through account 703 and two other accounts "virtually on a daily basis" for years, which had the effect, the report says, of making Madoff's balances look bigger than they really were. JP Morgan of course turned to a blind eye to these transaction which obviously had no business purpose.

In 1996 an outside bank used in this loop that had a Madoff account ('Madoff bank 2') investigated and smelling a rat it pulled out, terminating Madoff as a client, and importantly (in 1996!) filing with regulators an SAR (suspicious activity report) naming both Madoff and Levy! (Note this SAR is not filed by JP Morgan.) This struck me as pretty important, a filing of a suspicious banking report on Madoff in 1996, and in fact Bloomberg in their story high lights this quote from the report. (Bloomberg also high lights the unbelievable JP Morgan Madoff banker's claim that he thought account 703 had 100 times less money in it than it did and was used to pay the "rent".) When Madoff lost his outside bank, the round trips continued between his and Levy's account both at JP Morgan. Since this check kiting was now being done only between two JP Morgan accounts, it strains belief that the bank was not aware of this.

Does Bloomberg misread the report?

"The $1.7 billion that JPMC has agreed to forfeit to the United States pursuant to the Deferred Prosecution Agreement represents a portion of the funds leaving the Madoff Securities accounts at JPMC from October 29, 2008 (i.e., the date of JPMC's report to SOCA) until Madoff's arrest on December 11, 2008 ..." (This language is vague.) Bloomberg comments: "So at the time JP Morgan filed a report with the U.K.'s Serious Organized Crime Agency saying that it thought Madoff was a fraud, there were several billion dollars (about 3 billion, but most of this was withdrawn in short order by two feeder funds). That money vanished on JP Morgan's watch. And now JP Morgan is paying back "a portion" of it." (A little unfair I think. My reading of the report is that it is pretty clear that JP Morgan in the last weeks got out about 300 million (80% of the money they had at risk). They had other withdrawal requests pending, but they didn't clear before Bernie was arrested.The report says the 1.7 billion JP Morgan fine is a portion of the funds bled out of the ponzi in the last 6 weeks. Think about this. If JP Morgan near the end suspects Madoff is running a ponzi, and they are short Madoff, it is in their strong financial interest to try and run him into the ground to save their profit. And of course as his banker for 22 years they can watch the balance and trends in account 703, so if it is a ponzi, they can see it beginning to collapse and maybe they worked to help it collapse. It's clear in the report that the bank's withdrawals of it 300 million or so of its hedging investments with Madoff (via feeder funds) in late 2008 were part of the severe and rapid drain on Madoff cash, five billion paid out in just ten weeks or so, that lead to the ponzi collapse.Bloomberg points out that during this time they went 'short' on Madoff at the same time their clients were 'long'. This unwinding put the bank at risk if Bernie stayed afloat and prospered as they had sold 100 million or so of derivatives, which they were no longer hedging.

How Madoff treated his favorite investors: Levy's account increased 820% from couple of hundred million to close to 2 billion in 11-12 years (86 to 98), though he was borrowing from the bank to leverage his Madoff investment. The report says his returns were "consistently positive" including during 1987 when the market had a big crash.

In 2007 JP Morgan has been Bernie's banker for 21 years, but when the bank wanting to expand its Madoff derivative products asks to do due diligence on his funds Bernie says no. That killed the expansion in the Madoff derivative products. More and more it looks to me that a basic reason that a lot of banks and financial people didn't do business with Madoff wasn't because of his 'too good to be true' returns, but simply because he wouldn't let them in the door to do any real due diligence. He would tell a favored few a little about split strike, but that was the extent of his openness.

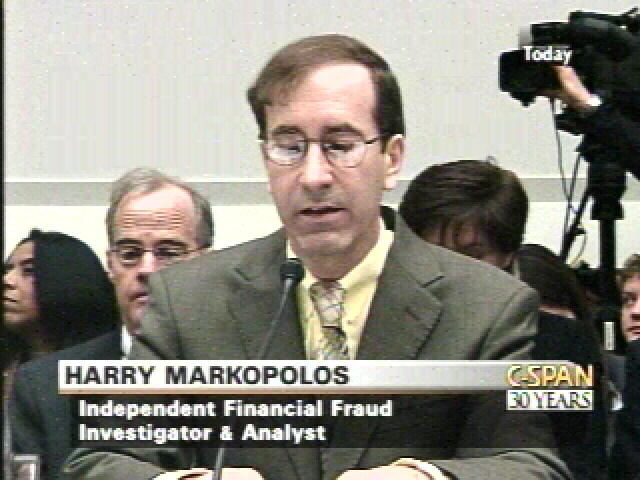

Near the end one senior JP Morgan executive is quoted as telling another JP Morgan executive that "Madoff has a very shady reputation in the market", which is exactly what Markopulus told the SEC. The Oct 16, 2008 internal JP Morgan memo, written in UK just weeks from the ponzi collapse, the basis of the SAR filing, details a host of the red flags Markopolus had figured out years earlier: total lack of transparency about his trading techniques and how implemented, feeders have no idea how he makes his money and are afraid of him, no confirmation the assets actually exist, no identification of the counterparties (for split strike), and coup de grace, performance so ahead of its peers and so consistent "as to appear too good to be true -- meaning that it probably is".

One poster to the Bloomberg story notes something interesting about JP Morgan in-house chief lawyer:

"Let’s talk about JPM’s chief in-house lawyer for a moment, one Stephen Cutler (He does in fact sign for JP Morgan). Steve was the SEC Director of Enforcement from ‘01 to ‘05 before going to JPM; in other words, at one time our nation’s top cop on the securities markets beat. At the SEC he made a couple hundred grand per year; at JPM he makes millions per year." (He's running SEC enforcement at the time Markopolus is filing complaints about Madoff's returns being phony.)------------------------------------------------

-- Madoff pays

off programers Jerome O'Hara and George Perez partly with diamonds to avoid

a paper trail.

-- In 1990s

when a possible ponzi wrap up 300 million payout to insiders was on the

table, 58 million of this was to go to Annette Bongiorno and she complained

she would have to pay taxes on it. Oh, yea!

-- Bonventre

kept three separate sets of books. He is paid over a million a year and

on top of that he write his own bunus checks. Most of his income doesn't

appear on his 1040s, because like most of the Madoff insiders he is a tax

cheat.

Oct 2013 trial pictures --- George Perez, Daniel

Bonventre and JoAnn Crupi

(Update 10/19/2013)

Headline today

is a 40 million case in London against several Madoff insiders, including

Sonja Kohn and Andrew Madoff, has been dismissed. The heart of this case

appears to be that British regulators (working with Picard) argued that

the Madoff sons and the board of the British arm of Madoff securities should

have recognized that some of the large money transfers between NY and London

were sham transactions.

Article: "Mr. Madoff’s sons, Andrew and Mark, won a significant victory on Friday when a judge in London dismissed a lawsuit brought against them and six others by the trustee seeking money for victims of the fraud." The UK judge, Andrew Popplewell, (sort of) appologized to Andrew Madoff for all he had been put through (with his cancer and all) ruling that neither of them “knew of, or suspected, the fraud” and stated that “their honesty and integrity has been vindicated.” (Really, his 'honesty' has been vindicated!) A separate US case by Picard seeking to recover 255 million from Andrew Madoff and the rest of the Madoff family is still pending. However, the 'vindication' includes this: Judge Popplewell ruled that the Madoff brothers and another director, Philip Toop, "were in breach of their duty to exercise reasonable skill and care" by failing to investigate whether the payments (30+ million to Sonja Kohn) were in the company's best interests." Peter Madoff testified in the trial by video link from prison, but invoked the 5th amendment more than 50 times.

I posted two comments below (two days apart) to the NYT Dealbook article announcing the decision:

Donald E. Fulton, Boston MA, Oct 19, 2013(Update 9/18/13)

Is this a question of semantics? Is Andrew Madoff's argument for his innocence like that of his uncle Peter? Peter in his plea to the court admitted he knew Madoff Securities was a 'little bit crooked'. The whole Madoff family routinely charged thousands of dollars in personal expenses to the firm every month. Everyone in the family, including Andrew, was benefiting from taxes not paid with phony loans for millions. Peter's 'defense' was that he didn't know specifically that Bernie's investment advisory business was a ponzi. Is this Andrew's claim?Let's look at the circumstantial case. Andrew had an account with his father. He saw the unreal (20%/yr for insiders) steady returns, almost never a down month. Even if the markets tanked or Bernie is off in Europe sailing, still his account shows a nice monthly gain. I would argue that to a trading pro like Andrew this would make no sense, the returns don't look like market returns.

Outside observers suspected for years that Bernie's IA business was a scam, but they usually assumed that his returns were coming from front running his trading clients. But the two Madoff sons run the trading business, they KNOW the IA returns are not coming from front running. It has to be trading, but where are the IA traders? How is it even remotely possible that in 20 years his sons can't figure out there are that there are NO traders or trades! They know their father is barely computer literate, so he can't be doing the trading.

-----------------------------------

Donald E. Fulton, Boston MA, Oct 21, 2013 (submitted late and not published)

Madoff Securites firm was run by scammer, legitimate taxes were not paid and SEC was fed phony documents. Everyone in the family knew this, and most participated and benefited.What I think is most consistent with the facts here is that the sons knew all along that Bernie's IA business was a scam, a huge scam, they just didn't know the NATURE of it, i.e. that it was a ponzi. I can believe they may very well have been shocked when they found out the principal of thousands of members of the jewish community that largely supported Bernie had been stolen.

The key I think is that Bernie had probably told the sons a cover story, for example, he had worked out a sweet deal laundering drug and mob money. This scenario explains a lot of otherwise inexplicable facts:

-- Why the sons don't ask their 70 year old father to show them what he does and maybe teach them

-- Why as professional traders the sons can't seem to figure out that Bernie's IA returns are not market returns

-- Why the sons never seem to notice that there are no traders or trades

-- How it can be that counter-parties so inept can exist that they can be on the losing side of option deals with Bernie month after month for decades

-- Why tens of million are paid to Sonja Kohn, who can access Russian mob money, for worthless stock 'research'http://dealbook.nytimes.com/2013/10/18/madoffs-sons-cleared-in-london-trial/?_r=0

Shana is Peter's daughter. She was a compliance officer at the firm, and the trustee says she signed off on regulatory documents that the firm had only 23 clients in its investment business when in fact it had nearly 5,000. (She must be one crack a jack lawyer!)

Andrew Madoff is Bernie's younger son. The article is unclear about how much Andrew is at risk saying only his "conduct has been examined". He now claims to have cancer and might die. Forgive me for being a little skeptical, but is this perhaps part of a little scheme his lawyer worked up to prevent him from being indicted?

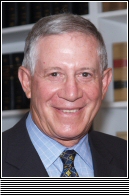

Konigsberg

Konigsberg is an

interesting case. He's a big time accountant, at the time head of his own

good sized NY accounting firm (founding partner of Konigsberg Wolf and

Co). If you look at the victim list his name appears (probably) hundreds

of times. Bernie sent a lot of business his way, small time clients were

instructed to hire him if they wanted to invest with Bernie. In effect

he was the outside customer man for a lot of Bernie's accounts (for a piece

of the action of course). The article labels him a Madoff insider, which

he was. He worked for major Madoff clients like Carl Shapiro and Norman

Levy, he even owned a (tiny) slice of Bernie's London trading business.

Here we have a (supposed) big time, reputable accountant with an inside

view of Madoff's operation. He has to know that Madoff's firm's accounting

was shall we say 'sub-par', but apparently that didn't bother him. I don't

see how they can put Bernie's small fry accountant, Friehling, in jail

and not file criminal charges this senior insider accountant who was racking

it in.

Phony tax lossesIn a couple of weeks (Oct 7, 13) criminal trials of five Madoff staff claiming to be innocent are to begin: Bonventre, Bongiorno, Crupi, O'Hara and Perez. With all the testimony in open court that this will produce, there should be a lot more Madoff news stories in the coming months. The WSJ article says court testimony is expected from Frank DiPascali and David Kugel, who have been cooperating with the prosecutors.

The criminal indictment of Konigsberg (Sept 2013) makes it clear that a lot of Bernie's biggest clients, like Shapiro, were 'invested' with Bernie because Bernie's firm would cooperate and generate phony account statements, so they could minimize their taxes. The prosecutors allege that central to the generation of these phony trading records (showing losses) was accountant Konigsberg, who likely worked out the details for his big time clients.

Konigsberg indictment (update 9/26/13)

More on Konigsberg

from a long press release by the US attorney and FBI. Konigsberg was the

senior tax partner at Konigsberg Wolf and Co. He is both a CPA and a licensed

attorney (degree in tax law).

http://www.justice.gov/usao/nys/pressreleases/September13/PaulKonigsbergArrestPR.php

http://www.justice.gov/usao/nys/pressreleases/September13/PaulKonigsbergArrestPR/Konigsberg,%20Paul%20S11%20Indictment.pdf

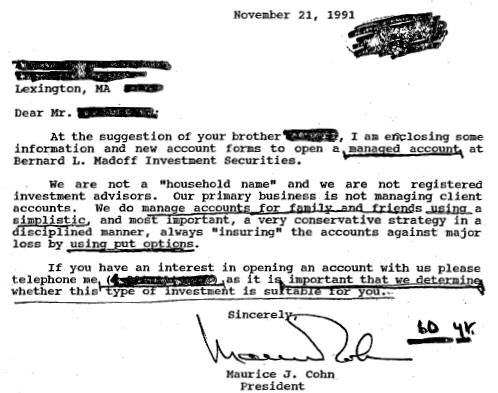

"After the death of one long-time Madoff client – who had recruited investors and had been promised by Madoff corresponding annual commission payments in the form of guaranteed returns – Madoff encouraged the client’s widow to use KONIGSBERG as her accountant. KONIGSBERG, Madoff, and Frank DiPascali, Jr. – who pled guilty for his role in the fraud and is cooperating with the Government – agreed on an investment “strategy” for the widow’s account. Under the “strategy,” the widow’s money would be “invested” in United States Treasury bonds and cash equivalents for the first 11 months of each year, and then in December, DiPascali would fabricate back-dated options trades in order to generate the promised returns. (Note, options were a favorite way Madoff customer accounts were 'tweaked up' to get the desired return or loss, because option trades are nearly impossible to trace.)On June 24, three month after the five Madoff office workers on trial were all found guilty, Konigsberg pled guilty to the charges against him. He is required to give up 4.4 million, he could face years in jail (he is now 78) plus additional penalties. When arrested in Sept 2013, he "claimed he was also a victim of Madoff’s scam" according to his lawyer, Reed Brodsky. Oh, yea. In 2009 Konigsberg and Wolf announced they were going to sue Lucinda Franks at the Daily Beast who had the goods on Konigsberg and reported it. (Gee, I wonder how that suit is going...) When long time Madoff big clients, like good old Carl Shapiro, needed their returns improved or wanted a tax loss, Konigsberg would resubmit all their returns for the year to DiPascali with instructions on how to fix them up. A true slimeball, and suprise he is not only a CPA but a lawyer too! Sentencing date is Sept 19, 2014.For instance, one of the widow’s accounts was invested in Treasuries and money market funds in January through November of 2003, resulting in net equity at the end of November 2003 of approximately $860,000. In January 2004, however, DiPascali back-dated fake options trades purportedly executed in December 2003 to generate an additional approximately $825,000, nearly doubling the value of the account. Each December, over the course of several years, KONIGSBERG spoke with DiPascali to ensure that DiPascali arranged for the back-dated trades necessary to ensure the widow’s promised returns.

Similarly, in May 2003, KONIGSBERG requested that another co-conspirator who worked at Madoff Securities (“CC-1”) (Is this Shapiro?) create back-dated trades in a second client’s account, retroactive to December 2002, in order to generate losses for tax purposes. ... In late 2002 or early 2003, KONIGSBERG sent back an entire year’s worth of statements for one client in favor of new ones. The new statements reflected millions of dollars in additional profitable trading activity for the client. Likewise, in 2008, KONIGSBERG sent back several months’ worth of statements for a different client, in favor of new ones reflecting millions of dollars in losses. ... (Konigsberg handled) one of Madoff’s oldest and largest (clients), deposited and withdrew tens of billions of dollars into Madoff Securities over the years, and Madoff executed glaringly fraudulent trades in his accounts, such as back-dating an entire year’s worth of statements into accounts that did not previously exist."

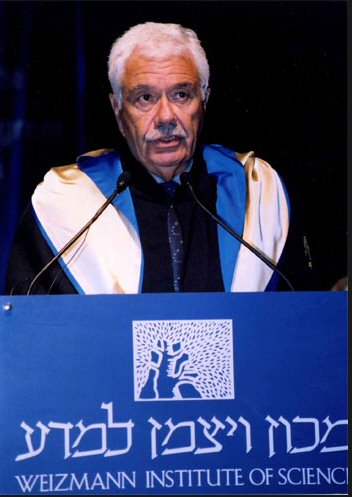

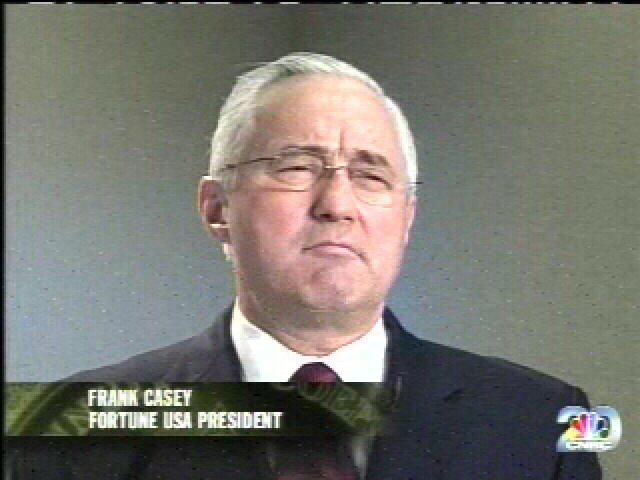

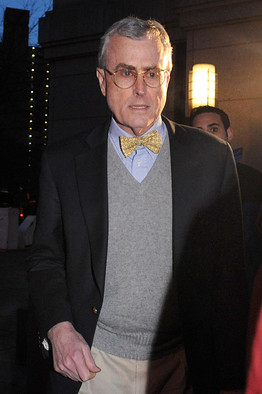

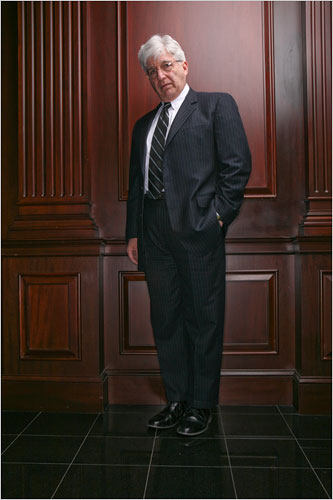

Paul Konigsberg (left) with lawyer Reed Brodsky outside

500 Pearl Stree courthouse

in June 2014 as he pleads guilty to conspiracy and

falsifying records.

Paul Konigsberg profile from Forbes (2011)New charges files against those who claim they are innocent (update 10/2/12)

Mr. Konigsberg has been one of our ( Gramercy Property Trust Inc) directors since August 2004. Mr. Konigsberg also serves as Chairman of our Audit Committee and as a member of our Nominating and Corporate Governance Committee. For the past 20 years, Mr. Konigsberg was a senior partner and President of Konigsberg Wolf and Co. PC, a New York-based accounting firm, which was reorganized in 2011 as KMR LLP and acquired in September 2011 by Citrin Cooperman, where Mr. Konigsberg now serves as a consultant. Previously, Mr. Konigsberg served on the Boards of Directors of two NYSE-listed companies, Savin Business Machines and Ipco Hospital Supplies. In addition, he served on the audit committees for Savin Business Machines and National Medical Health Card, also listed on the NYSE. Mr. Konigsberg is the former treasurer and board member of the UJA Federation of New York and a member of the Board of Overseers and on the finance committee of the Albert Einstein College of Medicine. He also serves as an officer and director for the Westlake Foundation, Inc. Mr. Konigsberg is a Certified Public Accountant, and a member of the New York State Society of CPAs and The American Institute of Certified Public Accountants. Mr. Konigsberg received a B.A. degree in Business Administration from New York University in 1958, a L.L.B. from Brooklyn Law School in 1961 and an L.L.M. in taxation from the New York University Law School in 1965.

-- "Bongiorno

also asked certain IA (investment advisory) clients to return previously

issued BLMIS account statements so that she could alter them and often

include additional backdated trades." This tells you a lot about Madoff's

(so-called) victims.

-- "From 1997

to 2008, more than $750 million of IA investor funds were used to support

BLMIS’s Market Making and Proprietary Trading operations." What, Bernie's

brother and sons, who run the trading operation, aren't the tinyest bit

curious as to where the nearly one billion that keeps their business

afloat comes from?

A further teaser

in advance of the trials has come from the prosecutors (Aug 8, 2013). They

say Madoff was in a 'Love Triangle' with one of the five! Assuming it is

not one of the wives of the three men, my money is on Crupi.

-------------------------------------------

Stanley ChaisMy take on the circumstantial case against the Madoff family

It has been confirmed by criminal investigators that they are looking into Stanley Chais (LA feeder) and into the Madoff family members for criminal tax evasion. In addition many civil suits have been filed against other insiders and feeders for recovery of funds by the court appointed Madoff Trustee (Picard) with suits also by SEC, NY AG, and MA AG. Unfortunately for the prosecutors Stanley Chais was a decade older than Madoff, and in 2010 he died at age 84.

Stanley Chais appearing to be honoredStanley Chais being honored? This is the guy who requested that the monthly statements of his LA clients never show a loss and for years Bernie honored this request!

Mark Madoff dead (update 12/11/10)

Mark Madoff, Bernie's oldest son age 46, killed himself (hung himself) today in his NYC apartment with his two year old in the next room and his wife in Florida. The Madoff Trustee is out to bankrupt him (he explicitly said this on 60 Min) and has filed several lawsuits against him seeking millions. What, Mark Madoff couldn't stand being poor?As I wrote here nearly two years ago, because so much of the Madoff firm's income came from Bernie's 17th floor operation and because Bernie was 70 years old, far beyond normal retirement age, I find it totally unbelievable the Bernie's brother and sons could be ignorant of the (so-called) investment advisory business run out of the 17th floor, unless they had good reason not to know what was going on.

When David Brook's blob discussing Mark Madoff's and David Holdbrook's deaths was published in the NYT (12/15/10), I posted the following comment to it: (comment #75)

Let's see...

The business is family owned and operated (father, brother, two sons, niece). A large fraction of the firm's income comes from the 'secret' business Bernie runs on the 17th floor. Bernie is 70 years old in 2008 far beyond normal retirement age. The sons run the trading operation, and records show many millions of dollars, sometimes 100 million, slosh back and forth between the trading business and the 'secret' business (the chief slosher has been arrested). All the family knows Bernie is not a legitimate business man/investment manger, because1) Most of them, including Mark, have special accounts in the 'secret' 17th floor investment advisory business and see the kind of unreal returns Bernie pays, and2) They all know Bernie and the firm are not paying proper taxes. Records show virtually the whole Madoff family (including wives) and favored employees charging tens of thousands in personal expenses monthly to the firm. And much larger sums (many millions) flow under the table to the family and favored employees to buy mansion homes.The odds are virtually zero that Mark and the rest of the family did not know a fraud (of some sort) was being run out of the 17th floor. Talk about George Bush being incurious! Don Fulton, 12/15/10Two days later there was another NYT article on Mark Madoff's death, so I posted below. 'Mark Madoff’s Name Became Too Big a Burden to Bear', By DIANA B. HENRIQUES and PETER LATTMAN (12/16/10) (ranked #2 out of 285 posts, posting #43)

Did Mark Madoff really tell his wife on [Nov 21,2008] Bernie is going to jail?I keep coming back to this ...

A large fraction of the revenue and profit of Madoff Securities came from the investment advisory business on the 17th floor. I believe it was reported that in recent years the profit from the investment advisory business was actually subsidizing losses on the trading side and keeping the firm afloat.Just suppose for a moment that Bernie's sons, who have worked for him for years, don't know anything about the investment advisory business dad is running on the 17th floor. Is it even conceivable that they haven't gone to their father and said, 'Hey, pop, you're getting older (Bernie is age 70 in 2008) and at some point you are going to retire. We depend on the firm and the firm can't afford to lose this business, and besides we want to know how you earn these great returns, just take some time to show us how you do it, train us so we can take it over. This is how companies work.If this didn't happen, why not? Was it because the family just 'understood' it was better 'not to know' what was happening on the 17th floor, even at the risk the firm might fail when Bernie retired.Another thing does not add up ...

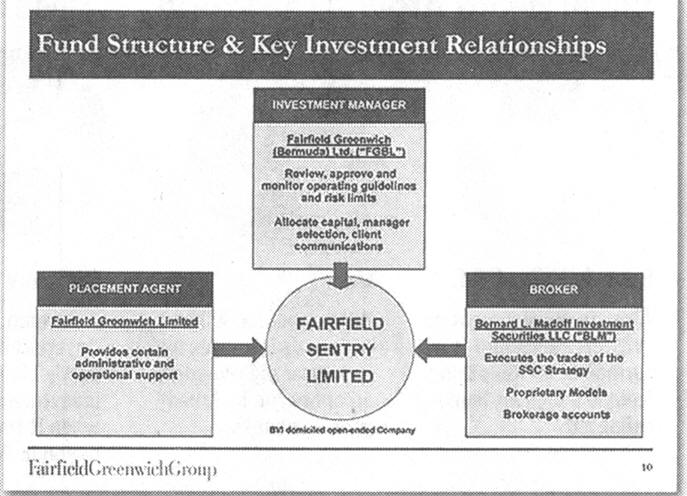

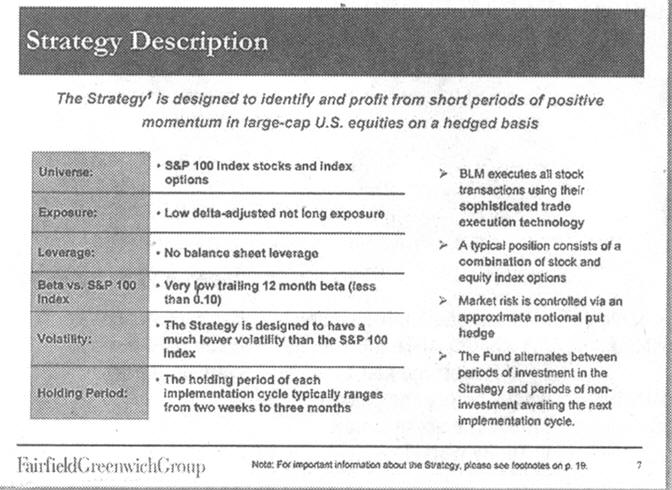

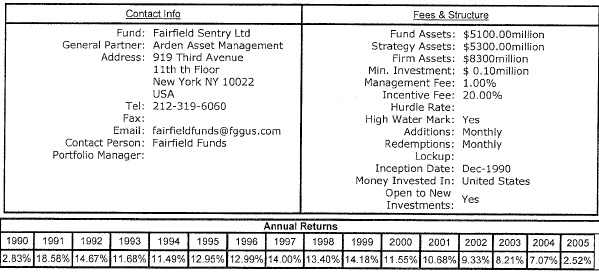

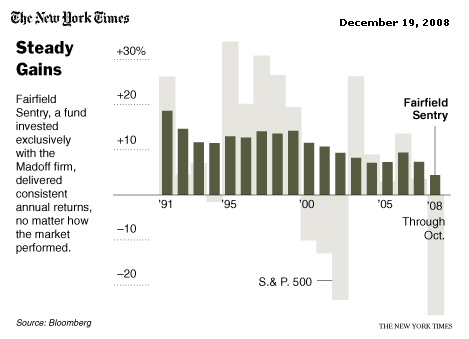

Bernie over the years made no secret that his 'special sauce' for investment was the exotic sounding split-strike trading strategy, in fact his biggest feeder, Fairfield Greenwich, described it on their web site while listing Madoff Securities as their executing broker. But here's the problem. It would have been obvious to his sons, who were top people in the trading side of the business, that not only were they not doing the trading the split strike required, but also there was no group of traders working on the 17th floor to execute it! No trading, no short term gains. So just how did they think their father was earning those great returns?

The Forbes article is discussing the new book by Mark Madoff's widow: 'The End of Normal: A Wife's Anguish, A Widow'…by Stephanie Madoff Mack.' This book is on Amazon and can be open, so I opened it and reading through the first chapter I found the Nov 21, 2008 reference. What the date refers to is this: It's her daughter's two year birthday and she takes Bernie's grandchild to the office on her birthday to meet up with Bernie and Ruth for lunch. She said earlier that Mark had told her that for weeks Bernie had lost interest in the business and was spending all his time just staring at the ceiling. He thought Bernie might be seriously ill. She say it was on Nov 21, 2008 that at the office she gets to see for herself Bernie's odd behavior. Mark does later tell her (on a Wed, presumably the day before the Thur Dec 11 Bernie is arrested): "It's my father. My father has done something very bad and is probably going to go to jail for the rest of his life". So Forbes in its article has conflated two events which happened weeks apart.

Peter Madoff

to plead guilty (6/28/12) (10/2/12)

Finally to

paraphase the mayor in the Music Man 'the sword of retribution has cut

down' Peter Madoff, Bernie's brother, the first member of the Madoff family

(other than Bernie) to be criminally nailed (only took 3.5 yrs!) with an

expected 10 year sentence. Charges are like those for Craig Kugel, filing

false documents and false income tax. My comment posting to the article

is below:

http://dealbook.nytimes.com/2012/06/27/peter-madoff-expected-to-plead-guilty/?ref=todayspaper

Donald Fulton, Stoneham MA (6/28/12)------------------------------------When a small fry at Madoff Securities (Craig Kugel) was recently nailed for not paying tax on 200k in charges to the company credit card, it was clear the government was finally taking income tax evasion seriously in the Madoff case. Court records show the whole Madoff family (including wives) did this too, but in much bigger amounts. Sure enough, one of the crimes which Peter Madoff will admit to is “filing false tax returns”.

I wonder if part of the plea deal is that Peter is protecting his daughter, Shana, also a compliance officer at the firm, and his wife, who reportedly has been a no show employee of the company for years.

This article says the two sides of the Madoff business operated separately, but Daniel Bonventre, the financial guy at the firm, is alleged in court papers to have moved hundreds of million of dollars from the ponzi to the trading side.

It may very well be, as Ms Henriques argues in her book, that Peter and the sons did not know Bernie was running a ponzi, but so what? With all that has come out in the last three years I believe the circumstantial case is very strong that the brother and sons had to know that Bernie's investment business was not as represented, was not 100% legitimate. Trustee Picard in his suits against insiders nearly always alleges: not that they knew it was a 'ponzi', but that it was a 'fraud'. So no surprise to me that we soon are to see Peter Madoff go into court and admit he is a criminal.

Below is my long Amazon review of the Diana Henrique's Madoff book 'The Wizard of Lies: Bernie Madoff and the Death of Trust'. This was written after Peter Madoff was arrest and pled guilty (with 10 years in jail pending). I agree with Ms. Henriques on her assessment of Picower and take a different view from her about the guilt (or innocence) of the rest of the Madoff family.

Title: Picower's role in ponzi nailed, but too much sympathy for the Madoff family----------------------------------------------------

By Donald E. Fulton, July 12, 2011 (incorrectly dated by Amazon, apparently the date of my earlier deleted review)I've read most of the Madoff books, and this is one of the better ones. Much about how the ponzi was operated remains murky, so in this review I want to focus on two of Ms. Henriques contributions: 1) Role of Madoff's biggest client (Jeffry Picower), and 2) Innocence or guilt of the rest of the Madoff family, did they know about the ponzi?

There's new information since the book was published. A second member of the Madoff family, Peter Madoff (Bernie's brother) has recently been arrested and will be going to jail for ten years for his role in the fraud.

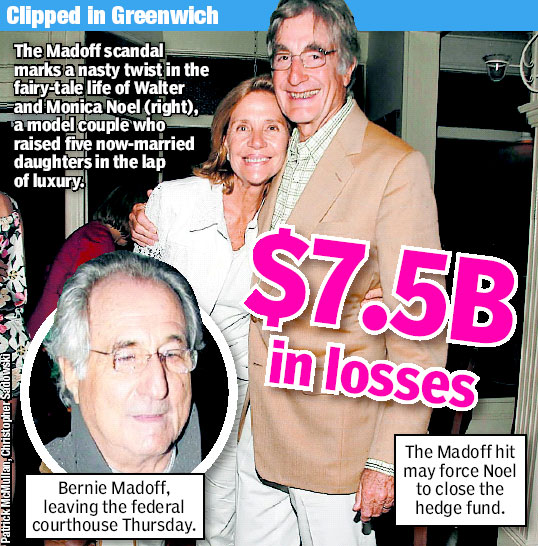

One of the important contributions of this book to the Madoff story is Ms. Henriques' examination of the role played by Madoff's biggest client, Jeffry Picower. Madoff told Henriques that he suspected that Picower early on had figured out what was going on, and for years he bled the ponzi of huge amounts of cash. Ms. Henriques concludes that Bernie's assessment is probably pretty close to the truth, that Picower had indeed probably guessed that Madoff was running a ponzi and used this leverage to end up with 1/3rd of all the ponzi cash. What is known for sure is that after Picower's sudden death, his widow was sitting on so much stolen Madoff cash that she was able to write a check for 7.2 billion dollars to the Madoff Trustee!

Where Ms. Henriques takes a stand different from other Madoff books is on the guilt (or innocence) of the rest of the Madoff family. She clearly has some sympathy for the Madoff family. She argues they were under Bernie's thumb, and there is no evidence that prosecutors could find that they knew about the ponzi. She has also been quite critical of those in the blogosphere who attack the family. However, as recent developments have shown, it is important to keep in mind that not knowing the details of the ponzi is not the same thing as being innocent.

On the family's guilt or innocence one can take an external or internal view. Ms. Henriques takes an external view. She has argued that an intensive multi-year search by investigators failed to turn up evidence that the family had knowledge of the ponzi. And in fact in Peter Madoff's recent plea deal Peter does not admit, nor do prosecutors allege, that he knew Bernie was running a ponzi. Peter in his plea, however, admits to various criminal acts masking the true nature of the business being run on the 17th floor and to personally enriching himself by illegal schemes to avoid paying taxes.

One can also take an internal view. To ask how prior to Bernie's arrest the ponzi looked to the Madoff family members who worked at the firm. Is it even conceivable that the family thought their father/brother/uncle was running a legitimate investment or hedge fund business on the 17th floor? I don't think so. Harry Markopolos early on had noticed and reported to the SEC a whole host of red flags about Madoff's returns, and he had far less visibility into what Madoff was doing than did Madoff's family at the firm. Markopolos and his boss at a Boston financial firm had analyzed Madoff's returns and concluded they were not 'market returns'.

Didn't the family every wonder how Bernie's stated investment strategy (blue chips with option collar known as the split-strike) could regularly report gains in a month when the market tanked? As professional traders they would know this was impossible. Even if they thought, contrary to all evidence, that Bernie was a trading genius, how could he be trading on the scale necessary? They ran the trading side of the business, and they weren't doing his trades. They knew Bernie personally was not doing the trading, so who and where in the firm were his traders? Bernie's reported returns were incredibly steady and almost never showed a monthly loss, so the market savvy and timing ability of his traders had to be near miraculous. Didn't the family ever wonder about this? Didn't they want to meet the world's greatest traders that Bernie seemed to be hiding somewhere?

There were other things to explain away too if they believed that Bernie was honestly investing. Quite a few people at Madoff Securities, a relatively small firm, were engaged in fabricating fake trading records. Two of them, the programmers, I think had their desks on the 18th floor and reported to Peter. How could the investment business be throwing off hundreds of millions in cash since Bernie allowed his bagmen (such as Jaffe of Boston, Noel of Greenwich, and Merkin of NY) to collect hedge fund like fees, while he only charged a small trading fee? To Markopolos this was the biggest red flag of all. Trading records were sloppily fabricated (often out of trading range, volumes too high). How could European counter-parties be found who were so totally incompetent that they would end up on the losing end of options trades month after month for years? To the Madoff family members who were top Wall St professional traders none of this would have made any sense.

Harry Markopolos and his colleagues at a Boston investment house told the SEC about dozens of top people on Wall St who suspected Madoff's returns were fraudulent (see Markopolos' excellent book, 'No One Would Listen: A True Financial Thriller'). Most outsiders suspected Bernie was illegally front running his clients. Markopolos told the SEC that multiple red flags pointed to Madoff's returns being fraudulent, and he figured Madoff was either front running or running a ponzi. But Bernie's brother and sons ran the trading side of the business, so they KNOW Bernie's steady investment returns (20% for favored clients) are NOT coming from front running! So just where does the family think the piles of cash Bernie needs for his investor returns (and in later years to keep the firm afloat) is coming from? To me the circumstantial case is overwhelming that the family had to have known that Bernie was running a scam (of some sort) on the 17th floor.

One of the charges Peter has pled guilty to is income tax evasion. Anyone who has looked at the various court filings knows the entire Madoff family was in on this. They benefited from phony business loans in the millions, thousands monthly in personal charges recorded as business expenses, and collected salaries for no work (Peter's wife Marion was a fake employee, as was the boat caption of Madoff's right hand man on the 17th floor Frank DiPascali). Ruth too, Bernie's wife, was no innocent here. The Trustee alleges that a million dollar tax avoidance scheme was being run out of her personal checking account.

Ms. Henriques may have been correct that the family did not know (the details) of the ponzi, but with time this is looking less and less important. Brother Peter Madoff has now been arrested and will be going to jail for ten years for (essentially) assisting Madoff while personally and illegally benefiting from millions in stolen cash. Peter's plea deal also appears to implicate his daughter, Shana (Bernie's niece) another compliance officer at the firm, with some press accounts saying she assisted him in preparing false documents for the SEC. Picard, the Madoff trustee, is seeking the return of 170 million from a trio of younger Madoff family members: niece Shana, son Andrew and estate of son Mark who killed himself, and of course Peter in addition to his jail term will be bankrupted. Yes indeed, quite a family

'If DiPascali has the goods on the other Madoff family members, then why haven't they been prosecuted?' Good question. Of course, one possibility is that Bernie revealed the ponzi at family gatherings with warnings this was never to be mentioned at work. While this might apply to Ruth and Peter, I am persuaded that, more likely than not, based mainly on how they have acted in the years since Bernie's arrest, that his sons did not know specifically it was a ponzi, meaning cash payouts were coming only from principal.

I think there can be little doubt that the whole family knew Bernie's investment advisory business was 'in some way' a scam. Bernie was not an honest man, he was a scammer and had been from day one. Even Bernie's first hire in 1964, Irwin Lipkin, is on the list of those arrested! The operation of the firm he 100% owed reflected his personality and was run with little regard for securities or tax law. Many outside observers on Wall Street and at banks with far less visibility than the family suspected strongly the IA business was a scam, but their guess was his returns were coming from front running his trading clients. For example, this was Markopolus' first guess. But, and this is an important but, his brother and sons, who run the trading side of the business, know this is not true, front running is not the source of his returns. So I think a key question is, 'If the returns are not being stolen from principal (aka, a ponzi), then where does the family think the returns are coming from?'

In public (see Peter's plea) his explanation is that Bernie was this trading genius. I discussed this in emails with a Madoff reporter for a well known newspaper. She thinks it was feasible that DiPascali with a few clicks could in his spare time trade 50 billion in equities and options in and out of the market every few months. I don't buy this at all. As Markopolus explained the only way to make money with this type of trading was exquisite timing (and research), and the brother and sons as trading professionals would understand this. The resources available to Bernie to expertly trade, to make money trading month after month, simply did not exist, and the family would have to know this.

So what's left for the family to believe? If the returns are not from being stolen from principal and not coming from trading, where is the money coming from? I can come up with only one guess.

Bernie's cover story

My guess is

that Bernie tells the sons (mayb Peter) in private some sort of plausible

cover story, probably involving the mob or drug types. He says can't tell

them details as to this sweet deal he as worked out, because if it gets

out it will collapse, and it is better that they don't know. His family

well understands when 'it is better not to know', so they don't ask. Hence

no evidence trail at work, and DiPascali can't point to anything. Both

Markopolus and NYT reporter Diana Henrique discuss how Madoff was involved

with South American and East European drug and mafia money, but the details

have never come out. He could have told the family he was helping the mob

launder cash, and his 'commission' is the source of his returns. In fact

I wonder if he didn't in fact do some of this at some point, it might even

be consistent with his explanation that the ponzi started later.

It explains a lot

of otherwise inexplicable facts:

-- Why as

professional traders they can't seem to figure out that Bernie's IA returns

are not market returns

-- Why they

can't seem to figure out that there aren't any traders or trades

-- Why they

don't ask their father to show them what he does and maybe teach them

-- How it

can be that counter-parties so inept can exist that they can be on the

losing side of option deals with Bernie month after month for decades

To continue with this rank speculation I note that Picower was a tax avoidance lawyer and expert, early investor and long time friend of Madoff's. Did he possibly work or consult with Bernie on money laundering for the mob in the early days? Maybe they had a falling out, which would explain a lot.

Ruth and Peter

I do think that

wife Ruth and brother Peter, being a generation older, probably knew a

lot more than the sons about what was going on in the investment advisory

business, and, more likely than not, they knew (or strongly suspected)

it was a ponzi.

----------------

Judge Swain's view (12/20/12)

I drafted the above

circumstantial case III on the family's guilt prior to today's Peter Madoff

court appearance, so I was pleased to see that the Judge's view about how

the Madoff firm was operated and what Peter knew parallel my views. Here's

the NYT today reporting the judges remarks to Peter in open court.

"Peter Madoff was not charged with knowing about the Ponzi scheme, and insists that he first learned about it only 36 hours before his brother’s arrest. During the sentencing in Federal District Court in Manhattan, Judge Laura Taylor Swain expressed skepticism about that assertion.----------------------------------------------------"Peter Madoff’s contention that he did not know that anything was wrong with the investment advisory business is beneath the dignity” of a sophisticated Wall Street executive, Judge Swain said.

“It is also, frankly, not believable,” she added.

In her view, Peter knew for decades that the Madoff business operation was “a little bit crooked and he was content to go along with that.” She then added, “We all know that a crooked operation is only rarely, if ever, just a little bit crooked.” (New York Times 12/20/12)

http://www.justice.gov/usao/nys/madoff/20120629transcriptpetermadoffpleaproceeding%20.pdf

In the court transcript Peter Madoff explains the details of how he again and again fakes documents that conceals his brother's (so-called) investment advisory business from the SEC, and how as compliance officer he has reviewed the investment business and it's on the up and up, customer accounts are protected. Somehow he never gets around to explaining why if he thought that Bernie was this world class trader that his investment advisory business couldn't stand the light of day. Also unstated is that he knows (for a fact!) that his brother is not honest, because he has schemed with Bernie for years to fake records to avoid he and his family from paying millions in taxes. A few excerpts:

Peter Madoff explaining to the court what he didAnalysis of Madoff's customer records

As the Court is aware, my brother is Bernard Madoff, who in December 2008 confessed and later pled guilty to operating a Ponzi scheme at Bernard L. Madoff Investment Securities, otherwise known as BLMIS. And while the conduct I am pleading guilty to relates to my own employment at BLMIS, it is important for your Honor to know that at no time before December 2008 was I ever aware that my brother Bernard Madoff, or anyone else at BLMIS, was engaged in a Ponzi scheme. I truly believed that my brother was a brilliant securities trader who successfully traded for his customers' accounts. In fact, I encouraged my own family to invest millions of dollars in accounts managed by my brother. My wife lost millions of dollars in an account managed by my brother, and my daughter and granddaughter, sister and other relatives similarly had, at my urging, invested money with my brother.My respect and admiration for my brother only grew over the decades, as he became one of the most successful and best regarded traders on Wall Street. He held important positions within the industry, including chairman of the NASDAQ. Among the most prominent members of the securities industry -- including high-ranking officials at the SEC -- my brother was widely viewed as one of the most honorable as well as the most successful traders of our time, and no one believed it more than I did. I revered him and trusted him implicitly.

On several occasions my brother and I engaged in money transfers in ways specifically designed to avoid payment of taxes. I knew that this conduct was wrong. In addition, at my request, my wife was placed on the BLMIS payroll and for many years received compensation for a no-show job.

In 2005, in order to avoid the payment of gift tax on a transfer from my brother to me, we treated the stock transaction as though it had occurred in my account rather than my brother's. In 2002, in order to avoid the payment of a gift tax on a transfer from my brother to me, we treated a similar stock transaction as though it had occurred in my account rather than my brother's. I now know that those transactions never occurred at all, but at the time I truly believed they were legitimate transactions, albeit not my own transactions.

On these and other occasions my brother provided me with gifts of substantial sums of money which I had no intention of repaying, and some of these transfers were documented as loans in order to avoid gift tax.

In addition, the next day, (after Bernie had told him about the ponzi) I had taken out $200,000 from the firm to make end-of-year charitable contributions, as I had planned to do before I was aware of the fraud. The following morning my brother was arrested and confessed, and shortly thereafter my assets were restrained, and I never made the planned charitable contributions.

Government summaries the case against Peter Madoff

For example, the evidence would show that Peter Madoff created documents that were filed with the SEC that stated that the investment advisory business had 23 client accounts, a statement that he knew was false. In reality, it had more than 4,000 client accounts. The evidence would show that in those filings, he vastly underreported the amounts of assets under management.With respect to the tax fraud, the evidence would show that Mr. Madoff engaged in an enormous tax fraud conspiracy in which tens of millions of dollars were transferred within the Madoff family so that Peter Madoff and OTHERS could avoid paying millions of dollars of taxes. Just from 1998 through 2008, the evidence would show that Peter Madoff received at least $40 million from Bernie L. Madoff and BLMIS out of accounts holding investor funds, and that Madoff conspired with others not to pay taxes on this money.

http://madoff.com/document/dockets/001036-kwdeclaration11-03605docket107.pdf

-------------------------------------------------------------------------------------

Chais dead (update 9/28/2010)

NYT had a short story today that Madoff's LA bag man Stanley Chais 84, who has not been in good health, just died. The article mentions the SEC suit against Chais charging him with defrauding his investors. On the criminal investigation, the article only says, "Last year, the Justice Department also started a criminal investigation into Mr. Chais and his funds." The article indicates that law suits again him are still pending, saying 'his surviving relative face legal action from his Madoff investors.'My memory is that one of his sons at one point was scheduled to replace him as fund manager as he got older and his health declined, but the article (on the word of family lawyers no doubt) says his wife and sons don't know nothing about how the fund were run...)

7.2 billion Picower settlement (Dec 2010)

Even though it had been reported in court papers in spring 2010 that the Picower suit would be settled for 2 billion, Barbara Picower ended up forking over 7.2 billion exactly the amount the Trustee had sued for. 7.2 billion was the amount the Trustee figured had been the Picower's net Madoff withdrawals for the last 13 years. Barbara said she settle for 7.2 billion because that's what Jeffry would have wanted. Oh, yea! I read the Picower's reply to court before Jeffry died, I guess I missed the part where he agreed to return 7.2 billion.

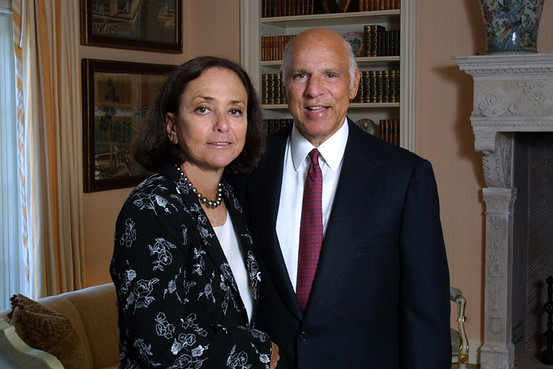

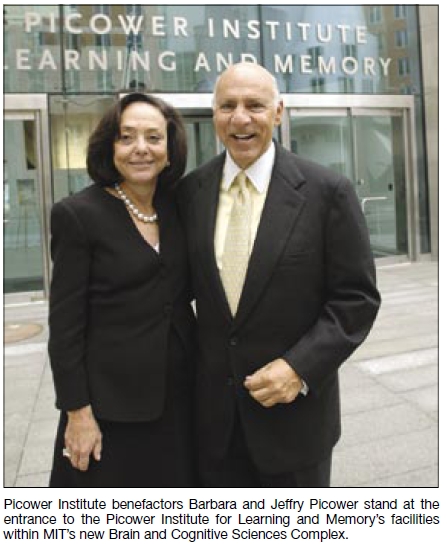

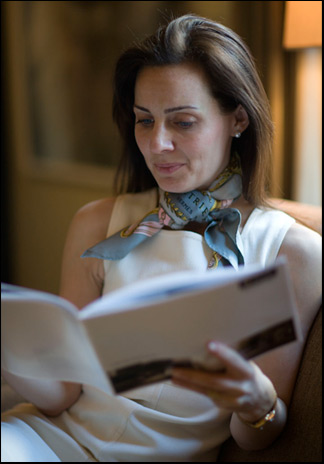

Barbara and Jeffry Picower2.2 billion of the Picower settlement is related to criminal activity (Dec 2010)

The 7.2 billion Picower settlement is actually two settlements announced at the same time. 5 billion is with the Madoff Trustee (Picard) and 2.2 billion is with the "U.S. Attorney for the Southern District of New York" which the WSJ article describes this way: "U.S. attorney’s office in Manhattan would obtain $2.2 billion through civil forfeiture, a procedure that allows prosecutors to recover the proceeds of criminal activity." (WSJ 12/17/2010)-- U.S. attorney's office in Manhattan would obtain $2.2 billion through civil forfeiture. (WSJ)

-- U.S. attorney, Preet Bharara, 4 page announcement of Picower settlement (link) (Dec 17, 2010

"largest single forfeiture in US hisory"

settlment is with US Dept of Justice, FBI, IRS and SIPA

settlement of 'civil forfeiture complaint'

"BLMIS was operated as a massive ponzi scheme from at least the early 1980's"

(in other words every single investment shown in the records of the Picower

Foundation beginning in 1989 was phony)

"The settlement contains no admission or finding of fault against Picower..."

-- US attorney 10 page forfeiture complaint (link) Dec 17, 2010 (cosigned by FBI)

7.2 billion the Justice Dept is seeking is on deposit at JP Morgan Chase bank

(Madoff ran all his ponzi money through a single account at the same bank)

"Any property, real or personal, which constitutes or is derived from proceeds tracable

to .... any offense constituting 'specified unlawful activity'... or a conspiracy to

commit such offense'." (this is the authorizing language, the '...' are included)-- US Dept of Justice report discussing asset forfeiture (link)

"Federal asset forfeiture laws and regulations are powerful law inforcement tools that

serve several important purposes. First, they deter criminal activity by taking the profit

out of crime, depriving criminals of their illegal proceeds and instrumentalities. Second,

they are used to restore funds to victims..."-- Civil forfeiture, a procedure that allows prosecutors to recover the proceeds of criminal activity.

-- (from a video of Preet Bharara speaking of the settlement. The 7.2 billion to be recovered he says,

"was always other's people's money".-- Federal prosecutors in Manhattan came to believe that the $7.2 billion represented the proceeds of “specified unlawful activity or a conspiracy to commit such an offense." The U.S. Attorney in Manhattan, Preet Bharara, filed a civil forfeiture complaint against the money in December at the same time that the government announced that Barbara Picower had agreed to turn over all of the money as part of the “largest single forfeiture recovery in U.S. history.” (Forbes 4/12/11)

-- Madoff is a liar and a thief, but he may have also provided Jeffry Picower with one of the largest zero-interest margin loans in history. (Forbes 4/12/11)

-- ** Asked about Picower’s role in Madoff’s scheme and whether the settlement cleared Picower’s name, U.S. Attorney Bharara said, “Mr. Picower passed away a year ago and so the question of whether he had a role—as a criminal matter—is now moot.” (Allan Dodds Frank writing in the Daily Beast 12/17/10)

-- ** The U.S. Attorney, like Picard, deflected questions about whether the (7.2 billion) settlement “cleared” Jeffry Picower’s name or reputation. What Bharara left to be said in court papers is this: The U.S. government can only force forfeiture in cases where they can tie the money to “specified unlawful activity or a conspiracy to commit such an offense.” (Allan Dodds Frank writing in the Daily Beast 12/17/10)

-- ** The aggressive use of forfeiture as a legal mechanism to seize and freeze criminal proceeds has long been a hallmark of Manhattan’s federal prosecutors. Securing forfeited assets is a priority of the office in part because many of the largest financial fraud cases are centered in New York. ( U.S. Attorney’s Office, Forfeiture From Crimes Pays, NYT Dealbook 1/1/13)

Trustee recovery and payout (update 5/5/11)