"We're living in a world in which oil prices keep setting records, in which the idea that global oil production will soon peak is rapidly moving from fringe belief to mainstream assumption." (economist Paul Krugman, NYT oped columnist, 5/19/08)I first read about the Hubbert Peak oil model in Scientific American many years ago. M. King Hubbert, a geophysicist at Shell in 1956 using his model predicted that US oil production would peak in about 15 years (from 1956) and he was right! His model applied to the earth predicts that we are now just about at the peak of world oil production. It's all downhill from here. The best source of information about Hubbert's model and the impending oil shortage is the two books by Princeton emeritus professor of geology, Kenneth Deffeyes.My comment --- It was only a (so called) fringe belief, because almost no one bothered to look at the facts about oil discovery and oil field depletion! It's amazing how the recent huge increases in oil prices has focused people's attention, isn't it?

Hubbert's Peak : The Impending World Oil Shortage by Kenneth S. Deffeyes (Paperback - Aug 11, 2003)

Beyond Oil : The View from Hubbert's Peak by Kenneth S. Deffeyes (Hardcover - Mar 15, 2005)

Hubbert's Peak Oil Model

Hubbert's

model assumes that if you plot cumulative, total, oil production, from

0%, when oil is first pumped, to 100% when all the oil that ever will be

recovered is recovered, the result is sort of a symmetrical 'S'

curve. In the beginning oil production year to year increases slowly because

no one knows very well how to find it, pump it, refine it, ship it, or

what to do with it. Near the end oil production year to year is assumed

to slowly dwindle because output from existing oil fields dwindles more

than the replacement oil from new fields coming on line since new oil fields

keep get smaller and smaller.

A key feature of this model is that (annual) oil production, which is the slope of the cumulative curve, peaks when 50% of all the oil that will ever be recovered has been pumped. Note the slope is maximum in the middle because the cumulative production curve has been assumed to be symmetrical.

Ok, so how do we know if this model applies? And even it does apply what good is knowing production peaks at 50% of total cumulative production when we don't know what this number is. Here is where the Hubbert model shines. There is a simple way to check the model against existing oil production data and from the data to find the projected 100% of oil that will ever be recovered.

Model Formula

Look at this

formula y = x (1 - x/x0), where x0 is a constant. It may not be obvious

that y vs x plots as a symmetrical humped curve, but it does as

you can see from below:

| x/x0 | y = x(1-x/x0) |

| 0 | 0 |

| .1 | .1 x0 (1-.1) = .09 x0 |

| .2 | .2 x0 (1-.2) = .16 x0 |

| .3 | .3 x0 (1-.3) = .21 x0 |

| .4 | .4 x0 (1-.4) = .24 x0 |

| .5 | .5 x0 (1-.5) = .25 x0 |

| .6 | .6 x0 (1-.6) = .24 x0 |

| .7 | .7 x0 (1-.7) = .21 x0 |

| .8 | .8 x0 (1-.8) = .16 x0 |

| .9 | .9 x0 (1-.9) = .09 x0 |

| 1.0 | 0 |

The Hubbert

peak model uses the above formula for annual (not cumulative) production.

where

y = annual production

x = cumulative production (sum

of earlier years production)

x0 = all oil that will ever cumulatively be produced

Rewrite the equation, dividing both sides by x

y = x (1 - x/x0)

y/x = (1 - x/x0)

Notice you can rearrange above into the standard formula

for a straight line (y = ax + b), where a is the slope and b the intercept

of the y axis.

y/x = -(1/x0) x + 1

Does the Model Formula Fit with Oil Production Data?

Here comes

the 1st neat part. To check the model against reality all that need be

done is to plot y/x vs x, meaning plot

(annual production/cumulative production) vs cumulative production

Do you get a straight line? If yes, then the data fits the model and the model is useful. Annual oil production numbers have always been well documented, so the data needed to do this plot is readily available and is clean data. Note this plot does not depend on reserves (estimates of oil in the ground), which are very squishy numbers, it uses only hard production data.

Here is the 2nd neat part. From the resulting (best fit) straight line to the data you can find the key parameter x0 (all oil that will ever cumulatively be produced) because it is just the 1/slope of the line. x0 is also where the straight line intersects the x axis. To see this set vertical parameter (x/y) to zero, and solve for x.

0 = -(1/x0) x + 1

(1/x0) x = 1

x = x0

When x (cumulative production to date) reaches x0/2 (50% of all oil that will ever cumulatively be produced), the model predicts that annual oil production is at or near its peak. That in a nutshell is the Hubbert Peak Oil model.

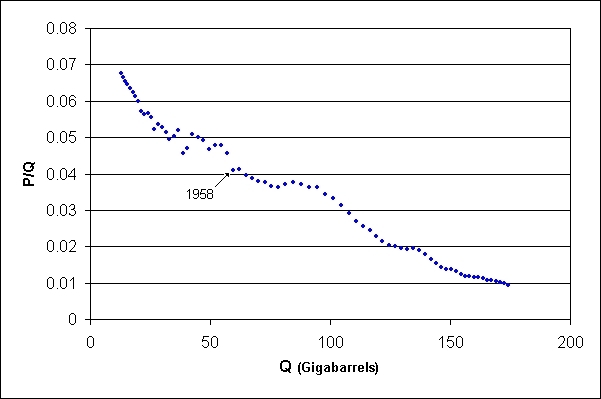

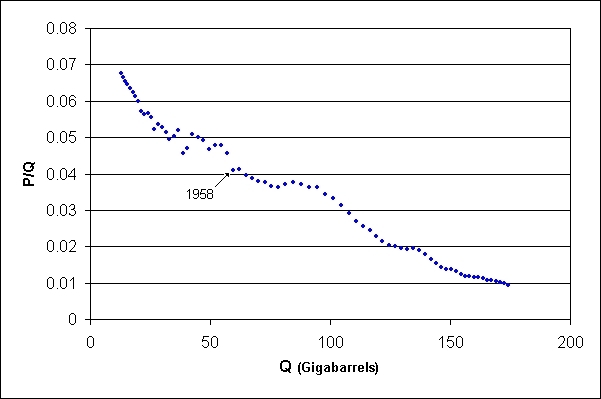

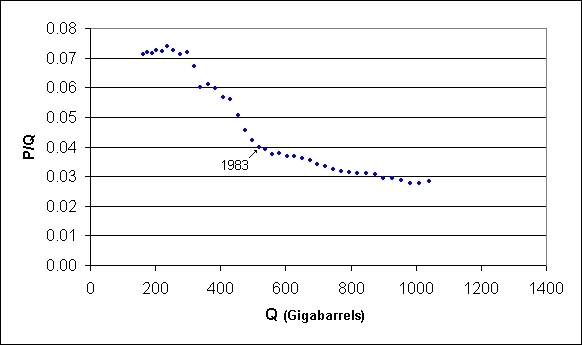

Three plots below are for US oil production

(US annual production/cumulative production) vs cumulative production

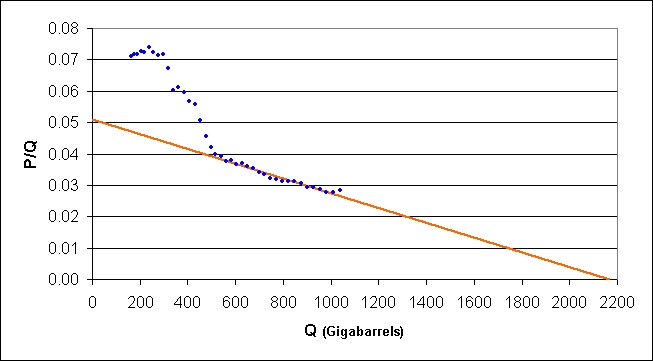

Fitting a straight line to the US data

US annual production and model annual curve

Clearly the peak oil model fits US oil production data quite well. Note the model tells us (predicts) that the US has already pumped out (about) 7/8th of all the oil that it is ever going to pump out, and this includes Alaska's North Slope and the waters of the Gulf of Mexico!

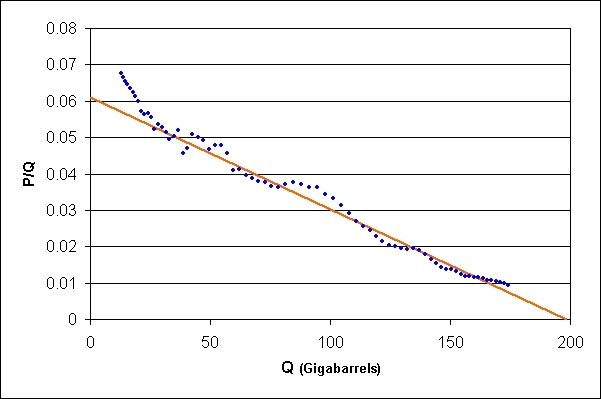

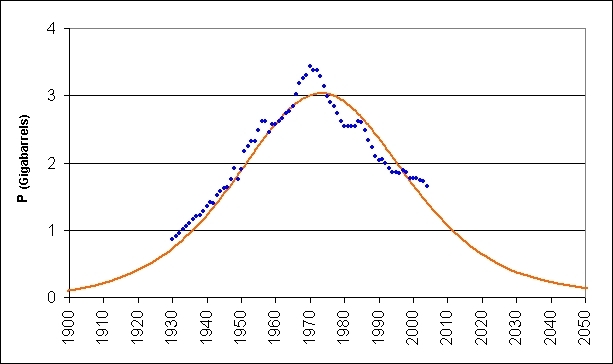

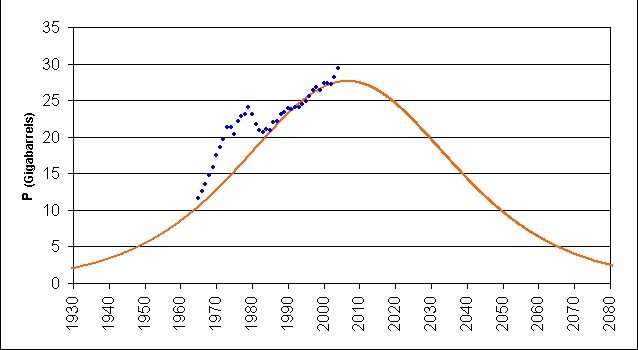

Three plots below are for world oil production

(World annual production/cumulative production) vs cumulative production

Fitting a straight line to the world data

World annual production and model annual curve

Aside --- Comparing the model's straight line extrapolations (above) for US and world total cumulative production you can see that about 9% (200 billion/2,200 billion) of all the world's recoverable oil was originally held by the US. The US is now heavily dependent on foreign oil imports not only because we use about 25% of annual production, but because the US pumped its oil early and hard, being the world's leading oil producer for nearly a century ending in the early 1950's.Coal

Source of Data: Durham Mining Museum, Coal Authority

(U.K.)

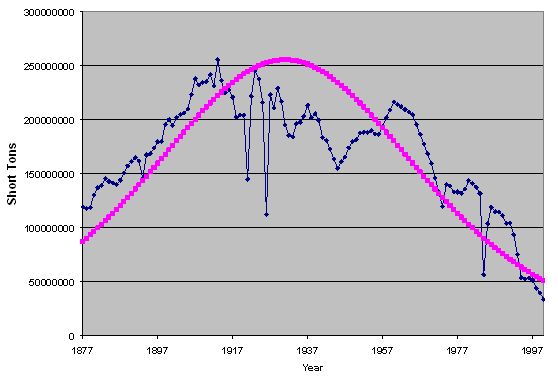

Another coal curve, this one for anthracite (high quality coal) of Pennsylvania, which has been mined for 200 years. Since anthracite production in Pennsylvania has now fallen to only a few per cent of its peak, it provides a good check for the superimposed Hubbert production curve. The dip in the 1930's is due to the depression followed by a peak during World War II. The brief dips are coal strikes.

Anthracite coal mined in Pennsylvania Referenced

in Wikipedia.(data sources: USEIA, USBoC)

Production Formula

The symmetry of

the peak oil production formula is better seen if we recenter x to the

center of the peak. In the original peak oil formula below x varies from

0 to x0 with the peak occurring at x0/2.

original peak

oil formula

y = x (1 - x/x0)

define

new x centered at x0/2

x = x0/2 + delta x

combine

y = {x0/2 + delta x}(1 - {x0/2 + delta x}/x0)

y = {x0/2 + delta x}(1 - 1/2 - delta x/x0)

y = {x0/2 + delta x}(1/2 - delta x/x0)

y = x0/4 + delta x/2 - delta x/2 - (delta x)(delta x)/x0

y = x0/4 - (delta x)(delta x)/x0

rewriting

y = .25 x0 - (delta x)^2/x0

where delta x varies from -x0/2 to +x0/2

Now the symmetry in the production formula is much more clear. y peaks at .25x0 when delta x =0, and since delta x appears in the formula squared preceded by a minus sign, y falls off symmetrically toward zero as delta x either increases or decreases.

Geology of oil and gas

Gas, oil,

heavy oil, tar, waxes all have a similar molecular structure. They're made

of a hydrogen/carbon chain whose length varies, with gas being the shortest

and tars and waxes being the longest. When organic material from plants,

animals, and microbes gets sequested underground, the material gets

cooked and broken down over time. At the molecular level the higher the

temperature and pressure the shorter the final hydrogen/carbon chain, so

material buried deep, where temperature and pressure are high, becomes

gas. No oil is found below 15,000 ft; in this range only gas is found.

Almost all oil is created only in the range of 7,500 ft (82C) to 15,000

ft (145C) called the 'oil window'.

All oil comes from oil saturated rocks (not underground lakes or caverns). For a recoverable oil deposit to form two different types are rock are needed: a porous rock to hold the oil and a much denser rock above prevent the oil from migrating to the surface and dispersing. The rock holding the oil, called the reservoir rock, must have porosity (open pores) to hold the oil and enough permeability (connections between pores) to allow the oil to flow (really ooze) under pressure so we can get the oil out. Most reservoir rocks are sandstones (compressed sand) or carbonates -- calcium carbonate (limestone) or calcium magnesium carbonate (dolomite). Above the permeable rock must be a layer of rock that the oil can't penetrate in the form of a fold or dome that traps the oil. This rock cap must be very tight. Leakage of just a barrel a day from a reservoir in 100 million years is a loss of 33 billion barrels, which would drain all but the biggest reservoirs. The best rock caps are anhydrite and salt, both formed from evaporation of sea water, and these cap the oil fields in the middle east and north sea.

Often the gas formed deep rises up and collects under the rock cap putting pressure on the oil. It is the pressure of the gas that causes wells drilled in new fields to sometimes gush. After a field is pumped for a while, the gas pressure is not sufficient to push up the oil. From then on to get the oil up it must be pumped or water or CO2 injected down injection wells to raise the pressure. Pumping of a field usually takes decades because the oil only slowly oozes from the rocks to the wells where it can be collected. If a field is pumped too fast, it can damage the field, lowering the percentage of oil in the field that can be recovered.

Amazingly, it's not that well understood how most of the earth's stores of oil and gas were created. Virtually all animals, plants and microbes get eaten by something when they die, so their carbon and hydrogen get recycled in the form of water and CO2. The question is, how do large local concentrations of this stuff avoid getting eaten and get sequested underground. Deffeyes, professor emeritus of geology at Princeton, says only in the late 1990's did he find what he thinks is the best explanation for the formation of most oil reservoirs. He calls it a nutrient trap. This is shallow basin on the edge of the ocean where sometimes the water flow is in the right direction (nutrient rich deep water comes in and surface water flows out). This results in a lack of oxygen at the bottom, so dead microbes and fecal pellets drifting to the bottom don't get oxidized and can get buried. In the past this happened on and off at the eastern end of the Mediterranean ocean.

Deffeyes was able to analyze reservoir rocks from the world's largest oil field (Ghawar field in Saudi Arabia). He found most of it to be fecal-pellet limestone. As he says in his first book, "I had to go home that evening and explain to my family that the reservoir rock in the world's biggest oil field was made of shit." (Hubbert's Peak, the Impending World Oil Shortage, p58)

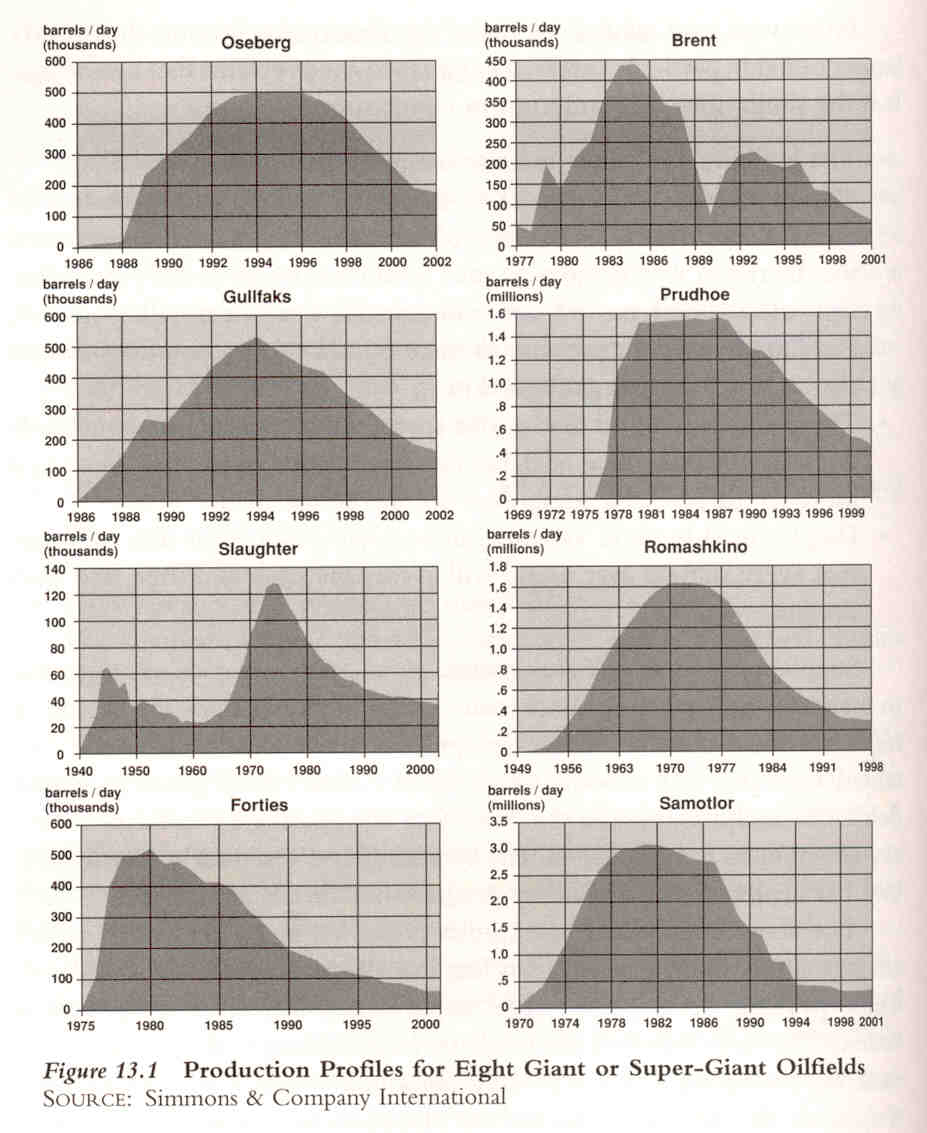

Giant Oil Field Production Curves

You think

we're not running out of oil? Take a look at these production curves

of eight large oil fields. While all are still producing, the daily production

in them is only 10% to 30% of what it was at their peak. The message is

all fields peak, and then production rapidly rolls off.

At present about 11% of world oil production comes from only four oil fields: Ghawar in Saudi Arbia (4.5 mbar/day), Cantarell in Mexico (2 mbar/day), Burgan in Kuwait (1.7 mbar/day) and Da Qing in China (1 mbar/day). These are all old fields. Ghawar, the world's largest oil field, has been pumped since the early 1950's. By some estimates this field once held 14% of the world's oil. Saudi Arabia keeps it's state a secret. Cantarell, Burgan, and Da Qing are all now just starting into decline.

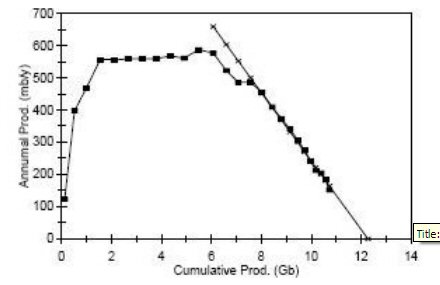

Plotting annual production vs cumulative production (update

12/10)

There is another

way to apply Hubbert's formula, while perhaps not so elegant, is simpler

and more intuitive. Hubbert plotted annual production scaled by cumulative

production (y/x), which is hard to get your head around, vs cumulative

production (x). The simpler way is to plot just annual production (x) vs

cumulative production (y). What does this look like?

I was prompted to plot up Hubbert's equation as [y vs x] when in Dec 2010 I came across (see below) a plot of Alaska's Prudhoe Bay oil field annual production (y) vs cumulative production (x). Prudhoe Bay is a good test case because this oil field peaked many years ago, and its current production is now only a small fraction of what it once was. The author fitted a straight line to the later years production (an impressive fit!), projected it to x axis, and claimed this gives a prediction for the total oil the field will yield (12 to 13 billion barrels).

Is this approach consistent with Hubbert's theory I wondered? It is!

Plot of annual production versus cumulative

production for the Prudhoe Bay field

and best-fit line to x-axis (Data from the Alaska

Department of Revenue)

Cumulative production as of 2007: 11.4

billion barrels

Wikipedia quotes BP in 2006 estimating that the field

will yield 13 billion barrels.

(source -- http://www.aspo-usa.com/archives/index.php?option=com_content&task=view&id=311&Itemid=93)

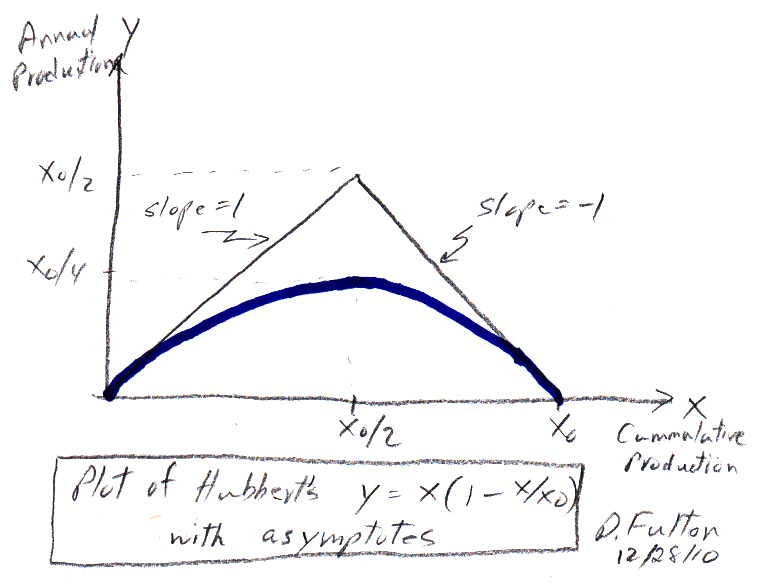

Math

A good engineering

approach to examining a formula like Hubbert's [y = x (1 - x/x0)] is to

start plotting its asymptotes. Examine it near the beginning of production

(x<< x0/2), at Hubbert's production peak (x=x0/2), and near the end

of production (x => x0).

Definitions

y = annual production

x = cumulative production (sum

of earlier years production)

x0 = all oil that will ever cumulatively be produced

Hubbert's equation

y = x (1 - x/x0)

slope (dy/dx)

dy/dx = 1 - 2x/x0

At (x<< x0/2)

y = x

dy/dx = 1

At (x = x0/2) midpoint

y = (x0/2)(1 - (x0/2)/x0) = x0/4

dy/dx = (1 - 2 (x0/2)/x0) = 0

At (x = (x0 - delta x) and delta x << x0/2)

y = (x0 - delta x) {1 - (x0 - delta x)/x0}

= (x0){delta x)/x0} = delta x

dy/dx = 1 - 2(x0 - delta x)/x0 = -1

Looking at above we see that the (straight line) asymptote of production (y) vs cumulative production (x) starts off (from origin) with a slope of 1. A straight line with a slope of 1 projects to (y = x0/2) @ (x = x0/2) midpoint, but the equation for y shows us that we get only half this value (y = x0/4) @ x=x0/2 with a slope of 0, so clearly the curve rolls off the (slope =1) asymptote as it rises and bends over at the midpoint (x=x0/2). The shape of the curve near production end (x => x0) is a mirror image of the curve near x =0, coming into the x axis @ x=x0 with a slope of -1. I plotted it up (see below).

Bottom line is that Hubbert's formula plotted as annual production (y) vs cumulative production (x) does in fact show the curve gradually approach a straight line asymptote near the end of production. So fitting a straight line to the right side of a (y vs x) plot, while perhaps not as clean (at least in theory) as curve fitting to a classic Hubbert (y/x vs x) plot, it is simpler, more intuitive, and it may very well give a pretty good estimate of total production.

Saudi's put 15 bb/day production capacity on 'indefinite'

hold (4/20/08 Financial Times)

Interesting

development in the oil business today --- Saudi Arabia has said for

several years that their plan over the next few years was to increase production

capacity to 15 bb/day. Skeptics have argued -- it's not going to happen.

Guess what? Today Saudi Oil minister said the plan to increase production

capacity to 15 bb/day is on 'indefinite' hold. The planned increase in

capacity will halt at 12.5 bb/day in 2009.

With the rapid increase in the price of oil there is a (perverse?) incentive for producing countries to cut production. If oil goes up in price a modest 20% a year, a producing country can cut production 10%/yr and still increase their country's oil revenue 10%/yr. So whether driven by geology or the incentive to cut production, it really doesn't matter it's still consistent with peak oil theory.

Oh yeah, and King Abdullah commented, 'I told them leave it in the ground, our children will need it.'

Peak Oil In News

Update (11/7/12)

Roscoe Bartlett, 86, lost his bid for reelection yesterday. As I discuss

below he has been trying to educate congress on peak oil (co-founder of

Peak Oil Caucus) has been a supporter of renewal energy, while curiously

at the same time he is a conservative Tea Party Republican

(a member of the Tea Party Caucus). This is a very strange combination

given that the Tea-party hold many strong anti-scientific views (like global

warming is a fraud, etc). Rachael Maddow of MSNBC tonight grouped Bartlett

with nine other defeated republicans all of whom had made during the campaign

what Maddow labeled as 'creepy' pro-life comments on abortion and/or rape.

His website bio describes him as a Seventh-day Adventist, and he and his

wife had ten children.

-----------------------

On CSpan I have

seen Roscoe Bartlett, congressman from Maryland, give three excellent hour

long talks on peak oil to an empty house chamber. Barlett says he has given

12 such talks in congress. I guess congressman can't be bothered

to listen to somebody who actually knows something about oil. Barlett is

one of the few technically trained people in congress, a skilled aerospace

doctor with 20 patented inventions.

http://www.bartlett.house.gov/

Barlett made an interesting point I have not seen elsewhere. One of his peak oil charts has a bulge at the top showing an extra decade or two of high or even slightly rising production. This might in fact be achievable if huge investments were now made to drill and pump like crazy. Does this solve the problem? No, it just uses up the oil faster and then the oil decline will be even more rapid.

.

.

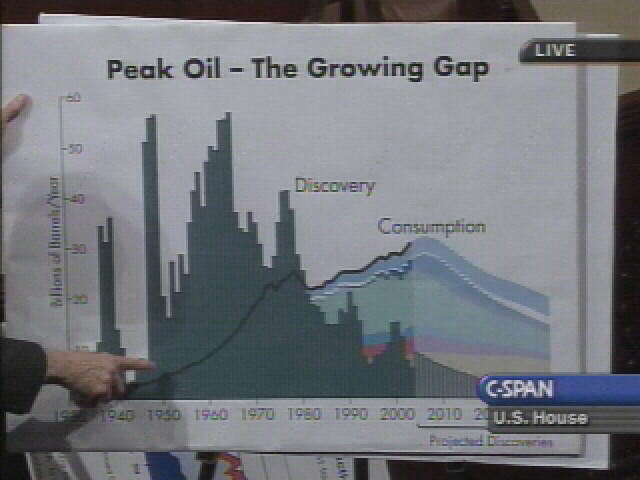

Oil

consumption must fall since discovery has fallen - Bartlett in speech to

House Jan 2007

Clinton is a convert -- I heard former president Bill Clinton in an hour long interview with James Fallows on PBS radio July 2006. He said he is convinced we are at or near the peak in world old production, then added "but you gotta read the geology books" to (really) understand this.

Congressman Lugar and former Fed chairman Greenspan have also recently (spring 2006) given long speeches or testimony before congress on oil. Both well understand the shortage of oil supply, but their explanation for the shortage, such as it is, is given in classic economic terms (not enough investment, etc) without consideration of the underlying geological driver that is provided by peak oil model.

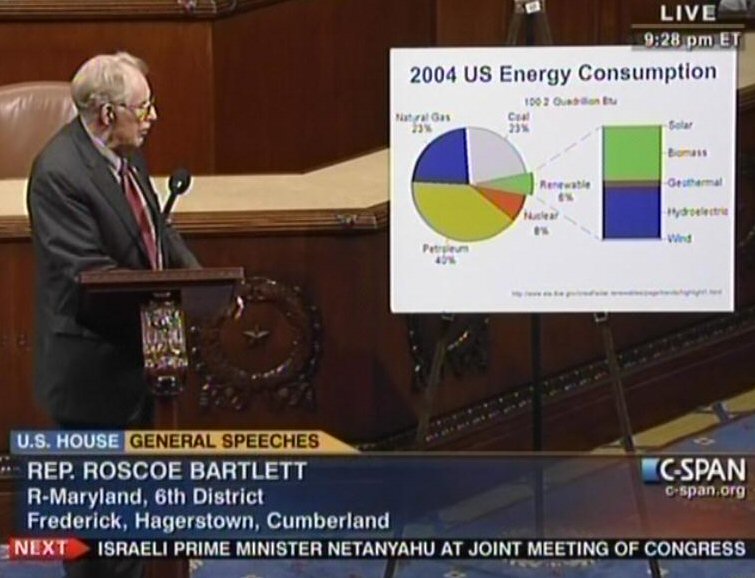

(update May 24, 2011)

Four years

later good old Roscoe Bartlett, now age 84, is still trying to educate

congress about peak oil, giving another excellent balanced speech (see

screen captures below). Too bad there is no indication congress is paying

any attention. The Democratic bill to put a price on CO2 emissions was

not even put to a vote.

Why do Republicans oppose conservation?

I notice he is a Republican, and it is very curious indeed that he barely mentions the almost total rejection by the Republican party of the case he has been trying to educate them on for years. His only mention in his speech today of their energy related stupidity was this: When talking about the value of conservation, his said his wife didn't understand the Republicans' objection to conservation!

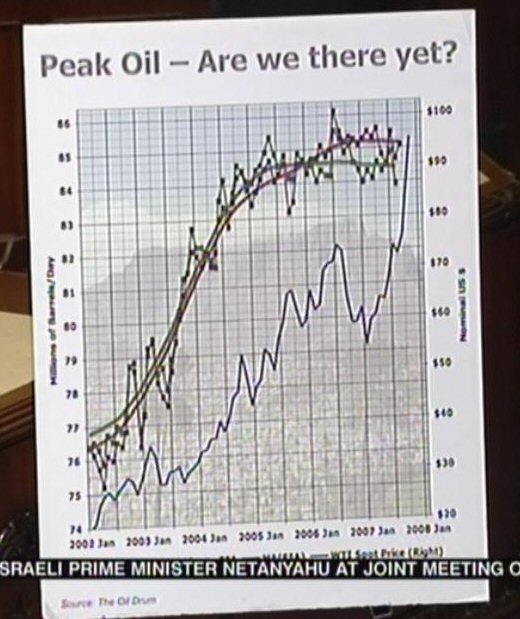

His lower graph shows oil production (from two reputable sources) has been flat for the last few years at 84-85 million barrels a day. This may the peak of oil production. We will see when the world economy recovers.

Proponents

David Goodstein,

who can occasionally be seen on PBS at 2:00 am in the 80's, The Mechanical

Universe and Beyond, lecturing to students at CalTech is now the vice

provost of CalTech. He is very concerned about running out of oil and is

pretty sure Hubbert got it right. In 2004 he wrote his own little book

on the subject.

Out of Gas: The End of the Age Of Oil by David Goodstein, 2004

Tertzakian provides a useful, historical, and wide ranging look at all the world's energy sources. He starts with the stories of how 'rock oil' replaced whale oil for lighting and why Churchill converted the British navy from coal to oil even though Britian had lots of coal and no oil. In a graph of US oil consumption plotted against real GDP he shows the dramatic and permanent impact the 70's oil price increases had. After a chapter on the search for oil and the implications of dwindling new finds of oil, he speculates on how the world's energy mix will need to adjust to the upcoming peaking of 'light sweet crude' by the development of "alternate energy supply chains" like liquefied natural gas and the Canadian oil sands.

A Thousand Barrels a Second by Peter Tertzakian, 2006

Deffeyes

Deffeyes makes

an interesting point that our grandchildren may curse us for burning up

all the oil, since oil is needed as a basic raw material for the petrochemical

industry (plastics, etc.)

Deffeyes provides some fascinating history about how the Texas Railroad Commission, which in years prior to the OPEC cartel, effectively regulated oil prices in the US and the world. Deffeyes says that when he saw a little item in the newspaper in 1971 that the Texas Railroad Commission had set the 'allowable' to 100% for the next month he knew that old Hubbert had been right.

Texas

RailRoad Commission Oil Price Regulation

History

of the East Texas oil field --- 5.2 billion barrels to date

(size: 45 miles x 5 miles)

(Prudhoe Bay in Alaska is 11-12 billion barrels)

-----------------------------------------------------------------------------------------

Peak Oil Forecasters Win Converts on Wall Street to

$200 Crude

By Deepak

Gopinath

(article from Bloomberg

news Aug 31, 2006)

On a sweltering Tuesday in mid-July, in the fields outside Pisa, Italy, Willem Kadijk scribbles notes as a ragtag troupe of doomsayers predict the end of the Oil Age. With his shaved head, jeans and sandals, Kadijk, 48, blends into a crowd gathered under a white tent to hear of the coming calamity. The death of cheap, abundant crude, the forecasters warn, might unleash war and plunge the world into a second Great Depression. That's not the prophecy of some apocalyptic cult. Kadijk, a hedge fund adviser, had flown from Amsterdam to attend a conference on a geologic theory known as peak oil.

Proponents of this controversial idea say global oil production is now at or near its zenith. Once the flow crests and starts to decline -- and some geologists say it already has -- oil will no longer be able to slake the world's growing thirst for energy. The result will be the oil shock to end all oil shocks. The price of a barrel of crude will spiral to $200 -- and keep rising. To the peaksters, today's energy crunch is nothing next to the pain that will follow. ``Peak oil is a reality,'' says Kadijk, a senior equity salesman at Kepler Equities, an Amsterdam-based brokerage. He plans to start a fund to capitalize on what he sees as a looming crisis for the world's fossil fuel-based economy and the ultimate bull market in oil.

As energy prices soar and violence convulses the Middle East, the peak-oil movement -- an unlikely alliance of geologists, physicists, oil industry consultants and environmental activists -- is winning converts. Peak-oil ideas are bubbling up from scientific journals and offbeat Web sites, much the way warnings of global warming did a decade ago. For the first time, the peaksters have begun to grab the attention of Washington and Wall Street.

Congressional Caucus

U.S. Energy

Secretary Samuel Bodman, former boss of Boston- based Cabot Corp., an oil

and chemicals company, has asked the National Petroleum Council, which

advises him, to investigate whether oil supplies can keep pace with demand.

The U.S. Government Accountability Office, the nonpartisan congressional

watchdog, is due to release a study on peak oil this November. Rep. Roscoe

Bartlett, a Maryland Republican, has formed the Congressional Peak Oil

Caucus to sound the alarm. ``The world has never faced a problem like this,''

Bartlett says.

Everyone agrees we'll run out of crude eventually. Oil, after all, is a finite resource: The Earth holds only so much of it. The controversial issue is when a global peak will occur -- and what will happen then. Colin Campbell, a British geologist who popularized the peak- oil theory in his book ``The Coming Oil Crisis'' (Multi-Science Publishing Co. and Petroconsultants SA, 1997, 210 pages) says world production of conventional oil, the kind that comes from gushing wells, is reaching its apex.

End of Oil Age

Society isn't

prepared for the consequences, Campbell, 75, says. It's too late to develop

alternative sources of power, such as solar cells, nuclear reactors and

windmills, to fill the oil gap before energy prices soar, says Campbell,

who has a doctorate in geology from the University of Oxford and more than

40 years of experience in the oil industry. ``We have come to the end of

the first half of the Oil Age,'' Campbell says.

Nonsense, says Russ Roberts, a spokesman for Exxon Mobil Corp., the world's largest oil company. Exxon Mobil, which has reaped record profits as the price of oil has surged, has taken out ads dismissing peak oil in U.S. newspapers such as the New York Times. The Irving, Texas-based oil giant says the peaksters are being alarmist. In all, the world probably has 4 trillion barrels of oil left, four times the amount we have used so far, the ad says.

Time to Think

``The world

is nowhere near running out of oil,'' Roberts says. Exxon Mobil geologists

believe global oil production will keep rising through 2030, he says. Cambridge

Energy Research Associates, whose chairman, Daniel Yergin, is a leading

peak-oil critic, says production will reach an ``undulating plateau'' sometime

in the future. ``Our outlook goes to 2020, and we see no evidence of a

peak,'' CERA geologist Peter Jackson says. ``Eventually, we will start

to see a decline. There is still time to think about alternatives.''

Predictions of an imminent oil famine are as old as the industry itself. When production at the first U.S. wells, located in western Pennsylvania, began to decline in the late 19th century, some people predicted the country would soon run out of oil. Then crude was discovered in east Texas, whose oil fields yielded so much black gold that the Texas Railroad Commission capped production to support prices.

Peak Moment

In the past,

Campbell or his disciples have forecast the oil peak down to the year or

even the day only to push back the fateful moment. In 1997, Campbell said

it would occur in 2001. Now, he says total production, which includes oil

from deep-water wells and fuel derived from natural gases, will reach its

height sometime after 2010. Kenneth Deffeyes, a geologist and professor

emeritus at Princeton University, first pinpointed Nov. 24, 2005, as the

peak- oil date and then revised it to Dec 16, 2005. Campbell says the exact

day or year isn't important. What matters is that peak oil is coming, and

soon. Almost a century and a half after the first U.S. wells were drilled

in Titusville, Pennsylvania, production has begun to decline in more than

a dozen countries, including the U.S., according to the BP Statistical

Review of World Energy. Production at the giant Cantarell oil field in

Mexico is likely to decline 8 percent this year, according to Mexican state

oil monopoly Petroleos Mexicanos.

U.S. Addiction

At a time

when U.S. President George W. Bush has urged the country to break its addiction

to foreign oil, the fact is, the U.S. is becoming ever more dependent on

overseas crude. U.S. oil production peaked 36 years ago, in 1970, at 11.3

million barrels a day. Since then, output has fallen 39 percent, to 6.8

million barrels a day, or 8 percent of the world total, in 2005, according

to BP.

Investors have started to listen to the peaksters. Billionaire Boone Pickens says he's a peak believer. So does Peter Thiel, who co-founded PayPal Inc. and now runs Clarium Capital Management LLC, a $2.1 billion hedge fund firm. Pickens, Thiel and other investors are positioning themselves to profit from what they say will be the biggest oil squeeze of all time. Even some oil companies and industry veterans sound nervous. Chevron Corp. has run a series of full-page ads in U.S. newspapers that highlight surging oil consumption and declare, ``The era of easy oil is over.''

Chicken Littles

Thierry Desmarest,

chief executive officer of Paris-based Total SA, told the World Gas Conference

in Amsterdam in June that global oil production would peak in 2020. Matthew

Simmons, whose Houston-based investment bank, Simmons & Co., trades

oil and gas stocks, says Saudi Arabia's production may decline soon.

Alex Cranberg, chairman of Denver-based independent oil company Aspect

Energy LLC, calls the peaksters Chicken Littles -- misguided souls who

think the sky is falling. In fact, Cranberg hired two people to dress

in chicken costumes and hand out fliers dismissing peak oil at the conference

Kadijk attended in July. Like many oil-industry vets, Cranberg, 51, says

market forces and technological advances will ultimately cure our energy

ills. As oil prices rise, companies will be more willing to hunt for crude

and extract it. They'll invest in expensive deep-water wells and new technologies

to wring more oil from existing fields. Consumers will start conserving

energy. Even now, stock market investors and Silicon Valley venture capitalists

are pouring billions of dollars into companies developing ethanol, solar

power and other alternative sources of energy.

$3-a-Gallon Gas

More and more,

however, the peaksters are drowning out everyone else, Cranberg says. ``You

can't turn around without seeing or hearing these ideas,'' he says. ``I

think they are gaining.'' You don't have to be a geologist to understand

why. The price of crude has tripled since 2000. In the U.S., $3-a-gallon

gasoline has sapped consumers' confidence. Nearly half of Americans believe

the economy is doing poorly, according to a July 28-Aug. 1 Bloomberg/Los

Angeles Times poll. Fifty-nine percent of Americans expressed a negative

view of Bush's handling of the economy. ``If oil was still at $20, no one

would be talking about peak oil,'' says Manouchehr Takin, senior petroleum

upstream analyst at the Centre for Global Energy Studies, a London-based

consulting firm. High oil prices are only part of the story, however. The

world is straining to feed its energy habit. Today, we consume 85 million

barrels of oil a day, according to the U.S. Energy Information Administration

(EIA). By 2030, the world will devour 118 million barrels a day, as China

and India emerge as economic superpowers.

Big Question Mark

No one knows

for sure how much oil the world has. That's a big question mark because

the peaksters say production will max out once half of the oil has been

pumped. So far, we've extracted about 1 trillion barrels in all. In 2000,

the U.S. Geological Survey estimated global resources at 3 trillion barrels,

enough to push peak production out to 2037, according to the EIA. Campbell

puts the total lower, at 2.5 trillion barrels. Oil is certainly getting

harder -- and more expensive -- to find and extract. Oil discoveries plummeted

to 5 billion barrels in 2005 from 90 billion barrels in 1964, according

to Campbell.``Discovery is in long-term decline, and spending more money

won't increase it,'' says Chris Skrebowski, editor of the London- based

Petroleum Review, an industry journal.

OPEC's Stash

Oil companies

have to find enough crude to offset dwindling production at existing fields,

which can decline by more than 8 percent a year, and to keep pace with

rising demand. Most of that increase will have to come from members of

the Organization of Petroleum Exporting Countries, which are often cauldrons

of discontent, war and terror. The cartel's members -- Algeria, Indonesia,

Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, United Arab Emirates

and Venezuela -- together sit atop 75 percent of the world's reserves and

account for about 42 percent of total production, according to BP. OPEC

countries are hardly paragons of economic and political stability. Most

of the terrorists who attacked the U.S. on Sept. 11, 2001, came from Saudi

Arabia. The war in Iraq has hurt that country's ability to pump oil. Bush

says Iran is trying to develop nuclear weapons. In Venezuela, President

Hugo Chavez has said he wants to diversify oil exports away from the U.S.

In its 2005 Energy Outlook, Exxon Mobil says the combined production of non-OPEC countries will peak sometime from 2010 to 2020. OPEC will be able to fill the gap, the report says. OPEC produced about 30 million barrels a day in 2005; by 2030, OPEC would have to churn out 47 million barrels a day -- almost 57 percent more than it did last year -- to satisfy the world's needs, the report says.

Meeting the Call

``We believe

the resource base will support this increase, assuming that investments

in development are made in a timely fashion,'' the report says. OPEC

countries will invest a combined $100 billion in the five years through

2010 so they can increase output, OPEC spokesman Omar Ibrahim says. ``We

are set to meet the extra call on OPEC to 2030,'' Ibrahim says. Yet even

now, OPEC nations are struggling to keep up. Since 2000, OPEC has gradually

lost the spare pumping capacity its members can use as an emergency reserve

to moderate prices. The cushion has dwindled to about 1.5 million barrels

a day from 6 million barrels a day, Takin says.

What's more, neither the peaksters nor oil industry executives know for sure how much oil OPEC has and how much it can actually produce. OPEC countries haven't been transparent about their reserves or production capacity, says Mike Rodgers, a partner at PFC Energy, a Washington-based oil industry consulting firm. ``OPEC is the big unknown,'' he says.

Overstated Reserves

Many energy

analysts believe OPEC nations began overstating their resources in the

1980s, when the cartel linked members' production quotas to the size of

their reserves, says Mamdouh Salameh, an independent oil economist. In

the late '80s, cartel members raised their reserve estimates by a combined

300 billion barrels even though none of them had actually found much more

oil. In his 2005 book ``Twilight in the Desert: The Coming Saudi Oil Shock

and the World Economy'' (John Wiley & Sons, 448 pages, $24.95), Simmons

says the Saudis have pumped so much oil so fast that the country's biggest

oilfields face declining output. ``Saudi Arabia is keeping everything in

the dark,'' Simmons, 63, says. Saudi officials have dismissed peak-oil

theorists and suggestions that their country is running on empty.

Saudi Assurances

``We currently

manage approximately 260 billion barrels of oil,'' Abdallah Jum'ah, CEO

of Saudi Aramco, the government-owned oil giant, said at an oil and gas

conference in June. ``We continue to expand our reserve base, and conservatively

estimate our additional potential of recoverable oil to be in the range

of 200 billion barrels. At Saudi Aramco's present production levels, that

means we will have well over a century's worth of oil to produce.''

Herman Franssen, former chief economist at the Paris-based International Energy Agency, says some OPEC members, such as Iran, Iraq, Kuwait and Venezuela, may be reluctant or unable to produce more oil even as prices soar, largely for political reasons. ``We may never see the volumes of conventional oil production that we see in official forecasts,'' says Franssen, who's now an oil industry consultant in Chevy Chase, Maryland.

Sadad al-Husseini, who spent 35 years working for Saudi Aramco, says Saudi Arabia's reserves are sound but that Kuwait, which says it has reserves of 101.5 billion barrels, probably has half that much. Iran, with official reserves of 132.5 billion barrels, has likewise overstated its reserves, says Husseini, who was an executive vice president at Saudi Aramco before retiring in 2004.

Assume the Worst

``Even with

high prices, it will be very difficult for world production of conventional

oil to exceed 90 million barrels per day within the next 10 years,'' he

says. That's millions of barrels a day short of what the EIA says the world

will need in 2015. Political leaders, business executives and investors

should assume OPEC won't be able to satisfy future demand, Rodgers says.

``From an energy-security point of view, if you believe in a non- OPEC

peak and OPEC is not being transparent, we have to assume they don't have

it,'' he says. The precarious balance of supply and demand in the oil markets

became even clearer in early August when London-based BP Plc announced

it would temporarily shut down its Prudhoe Bay oil field on the North Slope

of Alaska because of pipeline corrosion. The news drove already-high oil

prices up more than $2 to almost $77.

Alaskan Decline

Prudhoe Bay,

the largest oil field in the U.S., is part of the peak-oil story. The field

was discovered in 1968 and came onstream in 1977. Since then, it has yielded

more than 11 billion barrels of oil. Yet even before the August mishap,

this vast field had begun to die. Its output has fallen 73 percent to 400,000

barrels a day from a height of 1.5 million barrels a day in 1989. Prudhoe

Bay is following the life cycle of oil fields across the U.S. and around

the world, a phenomenon known as the Hubbert Curve, which takes its name

from M. King Hubbert.

Fifty years ago, Hubbert, then a geologist at Shell Oil Co.'s research lab in Houston, postulated that U.S. oil production would follow a bell-shaped curve. At the 1956 meeting of the American Petroleum Institute in San Antonio, Hubbert predicted that total annual U.S. output would climb steadily, level off sometime between 1965 and '70 and then decline after about half of the country's reserves had been depleted.

Hubbert's Peak

The U.S. reached

what geologists now refer to as Hubbert's Peak in 1970. Hubbert died in

1989 at the age of 86. It wasn't until the late 1990s when Hubbert's ideas,

which had percolated for decades in academia and oil circles, began to

reach a wide audience via Campbell, the British geologist.

Now in his eighth decade, Campbell is a grandfatherly man with a shock of gray hair. He hardly comes across as a doom- monger. He works out of a two-story house in Ballydehob, a village on the western edge of Ireland. Campbell spent 40 years exploring for oil for Amoco Corp. and other companies. He helped Amoco search for oil in Ecuador and then, during the 1980s, led its exploration in Norway. He later joined PetroFina SA, the oil exploration company now owned by Total. After retiring from PetroFina in 1990, Campbell joined forces with Jean Laherrere, a retired French geophysicist who had spent 25 years working at Total, to analyze production profiles for the world's countries. Campbell says he and Laherrere, now 75, looked at their data and concluded global oil production was approaching its zenith. In 1998, they co-wrote an article for Scientific American magazine titled ``The End of Cheap Oil'' that helped popularize their cause.

Coming Crunch

``The world

is not running out of oil -- at least not yet,'' Campbell and Laherrere

wrote. ``What our society does face, and soon, is the end of the abundant

and cheap oil on which all industrial nations depend.'' In 2000, Campbell

founded the Association for the Study of Peak Oil and Gas, an informal

organization for fellow travelers. Now known as ASPO International, the

group has sponsored five annual conferences, including the one in Pisa

in July, which drew more than 230 people. It's now run by Kjell Aleklett,

a physics professor at Uppsala University in Sweden. Twenty independent

national ASPO groups have sprung up around the world, from Australia to

France, to the U.S. Many peaksters are driven by a moral imperative to

spread the word. Campbell says he's a scientist, not a social or environmental

crusader. Even so, he says he's worried that oil has harmed human society

and the planet. Since the Oil Age dawned, nearly 150 years ago, the Earth's

population has soared six-fold, he says.

Man Alone

``Man is the

only animal that uses external energy,'' Campbell says. Asked why he has

championed the peak-oil theory, Laherrere quotes Antoine de Saint-Exupery,

author of ``The Little Prince'': ``We don't inherit the Earth from our

ancestors; we borrow it from our children.'' Activists have jumped on the

peak-oil bandwagon and added their own, often strident, voices to the debate

over the future of oil. Jim Kunstler, a writer-activist who lives in Saratoga

Springs, New York, says peak oil will ultimately destroy suburbia and plunge

the U.S. into a violent dark age of feudalism. ``The question is, Can we

run our shit the way we are running our shit?'' Kunstler, 57, says. In

2005, Kunstler wrote ``The Long Emergency: Surviving the Converging Catastrophes

of the Twenty-First Century'' (Atlantic Monthly Press, 320 pages, $23),

which warns of the havoc to come.

Dieoff.com

Lifeaftertheoilcrash.net,

a Web site run by lawyer and peak- oil entrepreneur Matt Savinar, warns,

``Civilization as we know it is coming to an end soon.'' The site sells

peak-inspired books and products, including an investor's guide to peak

oil. Another site, dieoff.com, says

wars over oil and other natural resources will eventually erupt and millions

of people will be wiped out.

Stephen Andrews, a Denver-based energy consultant who founded ASPO-USA in June 2005, says the alarmists have hurt the peak-oil movement. ``The peak-oil tent has different voices -- some shrill, some more sober -- reaching different conclusions from the same facts,'' Andrews, 59, says. Andrews has attracted more-sober voices to the movement. Last November, Denver Mayor John Hickenlooper helped co-sponsor a two- day peak-oil conference organized by Andrews. ``I think the people most exuberant about peak oil underestimate how much unconventional sources of oil will help flatten the peak, but to say that there is no peak is shortsighted,'' Hickenlooper says.

Crash Program

The world

would have to embark on a crash mitigation program 20 years in advance

to prevent peak oil from hobbling the global economy, says Robert Hirsch,

a senior energy program adviser at San Diego-based research and engineering

firm Science Applications International Corp. ``And I consider myself an

optimist,'' says Hirsch, 71, who included his findings in a 2005 study

on peak oil for the U.S. Department of Energy and estimates such a program

would cost the world $1 trillion a year.

Some investors and analysts see lots of opportunities in a post-peak world. Charles Maxwell, senior energy analyst at Weeden & Co., an independent research firm based in Greenwich, Connecticut, says high oil prices will spur companies to invest in unconventional sources. Few people, however, realize how much such projects will cost or how long they will take to come onstream, he says.

Take the Canadian oil sands. This region in Alberta holds 175 billion barrels of oil, according to the Canadian Association of Petroleum Producers (CAPP), the world's second-largest reserves.``It's big. It's really big,'' Neil Camarta, senior vice president for oil sands at Calgary-based Petro-Canada, says of the region. ``It can keep America going for 25 years.'' The oil sands hold vast stores of bitumen, a tarlike substance that is mined, rather than pumped, and then processed into oil that can be refined. The process is expensive -- and getting more so. Rising operating and capital costs have driven the price of mining and upgrading bitumen to as much as $40 a barrel, Camarta says.

By 2020, Canada's oil sands will yield 4 million barrels a day, almost four times what they do now, according to CAPP. That sounds like a lot until you realize that 4 million barrels is just over a third of what Saudi Arabia produced per day in 2005. Pickens, who built Mesa Petroleum Co. into one of the world's largest independent oil and gas producers, says he sees trouble -- and opportunity -- in peak oil. Pickens, who collected a degree in geology from Oklahoma State University in 1951, has called for the construction of more nuclear power plants and the promotion of alternative energy. He says he's invested in the Canadian oil sands.

Pickens's Picks

``I'm a disciple of Hubbert,'' Pickens, 77, says. ``I

think we've peaked and we are going to see an undersupply of oil.'' Clarium

Capital's Thiel says he began thinking about peak oil in 1999. As the Internet

bubble grew that year, Thiel, 38, says he started to wonder about other

risks that investors might be ignoring and seized on the uncertain future

of oil. ``Energy will be systematically undervalued until peak oil is priced

in,'' Thiel says. He's bought shares of Calgary-based EnCana Corp., which

has invested in exploration and new production, and of oil services companies

like New York-based Schlumberger Ltd. and Houston-based Weatherford International

Ltd., which stand to profit as explorers hunt for oil and drill wells.

Thiel says he's leery of U.S. oil majors, such as Exxon Mobil, because

they may become targets of new taxes once the government wakes up to peak

oil. Thiel himself says the peak will come by 2008 -- if it hasn't already.

``Geology will trump technology,'' he says.

Coal, Uranium

Eric Sprott,

CEO of Toronto-based Sprott Asset Management Inc., says he became a peak-oil

convert after hearing Campbell speak in 2004. Sprott, who helps manage

3.6 billion Canadian dollars (US$3.2 billion), says the bull market in

energy has only just begun. He's invested 36 percent of his firm's assets

in a variety of areas that could benefit from peak oil. His flagship hedge

fund returned 41 percent in 12 months ended July 31, he says. Sprott's

investments include St. Louis-based Arch Coal Inc. and Brisbane, Australia-based

Macarthur Coal Ltd. His oil and gas picks include Halifax, Nova Scotia-based

Corridor Resources Inc.; Denver- based Delta Petroleum Corp.; and Houston-based

Ultra Petroleum Corp. He has also invested in Australian uranium companies

Energy Resources of Australia Ltd. and Paladin Resources Ltd.

Midnight Ride

Meanwhile,

the peaksters aren't about to let up. They'll convene in Boston on Oct.

25-27 to sound their alarm at a conference called ``Time for Action: A

Midnight Ride for Peak Oil.'' The title is a reference to the American

patriot Paul Revere, whose horse ride in 1775 warned Massachusetts colonists

that British soldiers were advancing. The battle that followed, at Lexington

and Concord, marked the beginning of the American Revolution. It was just

84 years after Revere took his ride, on Aug. 27, 1859, that Edwin Drake

struck oil in Titusville, ushering in the Oil Age. Exxon Mobil says the

era of oil isn't about to end. In one of its ads, the company says, ``Oil

is a finite resource, but because it is so incredibly large, a peak will

not occur this year, next year or for decades to come.'' The ad depicts

a man looking through binoculars at a snowcapped mountain whose summit

is hidden by clouds. Campbell says the illustration actually drives home

the point Exxon Mobil is trying to avoid. ``Even though it is obscured

by clouds, we know there is a peak,'' Campbell says. His investor followers

are betting he's right.

---------------------------------------------------------

(a good perspective and plan from Samuelson)

Geopolitics At $100 A Barrel

By Robert J. Samuelson

November 14, 2007

Oil is flirting with $100 a barrel. Do not think this just another price spike. It suggests a new geopolitical era when energy increasingly serves as a political weapon. Producers (or some of them) will use it to advance national agendas; consumers (or some of them) will seek preferential treatment. We already see this in Hugo Ch¿vez's discounting of Venezuelan oil to favored allies, China's frantic efforts to secure guaranteed supplies, and Russia's veiled threats to use natural gas -- it supplies much of Europe -- to intimidate its neighbors and customers.

Since World War II, the United States has sought to keep energy -- mainly oil -- widely available on commercial terms. America's foreign policy has been, in effect, to prevent other nations from using oil to advance their foreign policies. On the whole, this has minimized conflicts over natural resources and favored global economic growth. Producing countries focused on maximizing their wealth; consuming nations relied on the market to get their oil. But shifts in supply and demand now threaten this system.

Just last week, the International Energy Agency in Paris projected that world oil demand would grow to 116 million barrels a day by 2030, up from 86 million in 2007. About two-fifths of the increase would come from China and India; other developing countries would account for much of the rest. The number of cars and trucks worldwide would more than double, to 2.1 billion. There's only one catch: Oil supply probably won't satisfy projected demand.

The bottleneck is not scarcity of oil in the ground. Someday that will happen; it hasn't yet. Proven oil reserves -- discovered oil, deemed recoverable -- total about 1.2 trillion barrels, says the National Petroleum Council, a U.S. government advisory group of industry and academic experts. That's 38 years of supply at present consumption rates. Next is undiscovered oil; the NPC reckons another trillion barrels. Finally, there's about 1.5 trillion barrels of "unconventional" reserves of heavy oil, tar sands and oil shale recoverable at higher prices.

Producing this oil is another matter. Low prices in the past (1985-2002 average: $21 a barrel) discouraged exploration. Companies consolidated; Exxon merged with Mobil, Chevron with Texaco. Cutbacks have left shortages of drilling rigs, pipes, engineers, geologists and drilling crews. In the late 1990s, a deep-water rig could be leased for less than $200,000 a day, says Peter Robertson, Chevron's vice chairman; now the cost can run $600,000.

With time, these shortages should ease. A bigger obstacle is access to reserves. Government-owned national oil companies control perhaps three-quarters of proven oil reserves. But they often need private companies (the world's Exxons and BPs) to explore and develop. Perversely, high prices make negotiations longer, harder. Governments already have more oil money than expected. In 2007, OPEC nations are projected to have revenue of $658 billion, up from about $195 billion in 2002. Governments can afford to be tough and patient.

Indeed, higher prices have caused them to raise royalty rates and taxes on private oil firms. Some companies have pulled out rather than accept tougher terms. In the past year, Exxon Mobil and ConocoPhillips left Venezuela, reports analyst Simon Wardell of Global Insight. All these problems suggest that world oil output will advance slowly. For various reasons, Venezuela, Iran and Iraq are all producing below previous peaks and below potential.

At some point, higher prices will dampen demand; changes in the weather and business cycle could also lead to lower prices. Still, a major turning point has been reached. Until now, oil's main geopolitical threat lay in the concentration of reserves in the unstable Persian Gulf. Supply disruptions (1973, 1979-80, 1990) coincided with wars and revolutions. Otherwise, surplus capacity cushioned losses from accidents and weather. Now, most of that surplus has vanished. The pivotal year was 2004, when global demand, propelled by China, rose about triple the expected rate, says Larry Goldstein of the Energy Policy Research Foundation.

So the tightened gap between supply and demand has shifted power to producers. "Will competition for scarce resources lead to political or even military clashes among major powers?" asks a report by the National Petroleum Council. "Will bilateral arrangements among nations become common as governments attempt to 'secure' energy supplies outside of traditional market mechanisms?"

Here is what we might do

Raise fuel

economy standards for new cars and trucks; gradually increase the gas tax

(possibly offset with tax cuts) to induce people to buy those vehicles;

expand oil and natural gas production in Alaska, the Gulf of Mexico, and

off the Atlantic and Pacific coasts. These steps would, with time, temper

the power of oil producers while also checking greenhouse gases. But many

liberals, conservatives and environmentalists oppose parts of a sensible

compromise. The stalemate hurts mainly us.

Hess Corp supports peak oil (3/2011)

Is this an

oil company supporting peak oil or is he just pushing for more drilling?

Hess CEO is saying in the next ten years we will not have the production

capacity to meet demand.

"Many top corporate and political figures gathered in Houston on Tuesday for the annual CeraWeek conference on the outlook for energy, and they got an earful from John B. Hess, chairman and chief executive of the Hess Corporation. “An energy crisis is coming, likely to be triggered by oil,” he predicted.

“Demand is expected to grow on an annual basis by at least one million barrels per day, driven by the developing economies of the world and by a growth in transportation as we go from one billion cars today to two billion cars in 2050.” (This would be 85 million barrels/day in 2011 to 124 million barrels/day in 2050.) The problem, he said, is not that the world is running out of oil. He estimated that while the world has produced one trillion barrels of oil, two trillion more remain in the ground. (3 T total vs 2.2 T in figure above) Meanwhile surplus oil production capacity (in 2011 during recession) is three billion to four million barrels a day.

** But watch out for the future. “As demand grows in the next decade, we will not have the oil production capacity we will need to meet demand,” Mr. Hess said. “Supply will then have to ration demand, and prices will skyrocket – with the likely outcome of bringing the world’s economy to its knees.” So where are oil prices going? “The $140-per-barrel oil price of three years ago was not an aberration,” he said. “It was a warning.”

(update 2/12)

Wtih some

economic recovery (but still weak especially in Europe) Oil price has climbed

to $109/barrel and at the pump gasoline is close to $4/gal.

Canadian Oil Sands production (11/11/2011)

A huge amount

of heavy to non-flowing bitumen exists in the oil sands of Alberta Canada

and Venezuela. The oil sands of Alberta contain more potential oil (1,700

billions of barrels) than the Middle East. With current technology about

10% of the potential oil can be recovered (roughly comparable to Saudi

Arabia) and is profitable if oil remains above $50 barrel, which looks

like a good bet for the future. Oil is now about $75/barrel. In a book

by the retired Princeton oil geology professor (Deffeyes) he explained

oil sands expansion plans were canceled not too many years ago, because

of uncertainty about the availability (and cost) of natural gas. He explained

that bitumen oil is very heavy oil because it has a high carbon to hydrogen

ratio. Hydrogen must be added to make it into oil, to make it shippable

and refinable, and the cheapest source of hydrogen is natural gas (methane,

CH4).

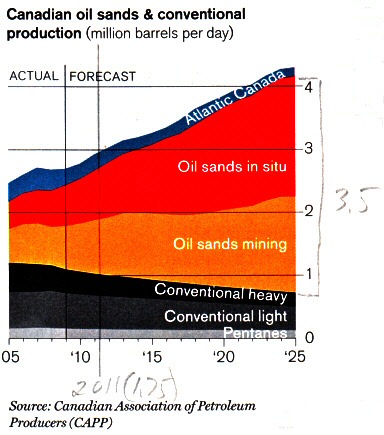

Long article about Alberta oil sands production in the Tech describes an oil sands industry that in 2011 is booming with plans to double capacity in about 13 years.. Current oil sands production is about 1.75 million barrels/day, which is about 2.0% of world 85 million barrels day production, projected to double to 3.5 million barrels/day by 2025. Another way to look at this is, if Saudia Arabian production is (ballpark) 10 million barrel/day, then Alberta tar sands production now of 1.75 million barrel/day is 17% of Saudi Arbian production expected to rise to 35% of Saudi Ariabian production by 2025. About half oil sands production now comes from strip mining the oil sands and half from in-situ production and is projected to remain this way.

.

.

scan from Technology Review, Nov/Dec 2011

Oil sands mining truck, 4 stories high, made by Catapillar

Natural gas burning steam generators for in-situ oil

sands production

(scan from Technology Review, Nov/Dec 2011)

In situ production (SAGD -- steam assisted gravity drainage) a pair of large dia pipes, one above the other about 16 feet apart, run done about 1,200 feet and then horizontal about half mile through the oil sand layer. Huge amounts of steam is pumped into top pipe and melted bitumen + water are pumped from the lower (producing) pipe. Water is separated and recycled. Wikipedia says they are done in sequence with steam pumped for a week or so allowing oil production for a few months. About 90% of the water in in-situ production is recyled, but strip mining also takes huge amounts of water (come from a big river in Alberta) and most of it ends up in tailing ponds which now cover 19 square miles. Luckily the oil fields are in central Alberta, deep in the forests and far from most people.

The steam is generated by nine 100 foot tall steam generators that burn natural gas. At Lake Christina site, where the most dense bitumen is located, it requires two barrels of water be steamed for each barrel of oil. In future lower grade, less dense, seams will require three or more barrels of water to be steamed. Article says the oil is mixed with a "hydrocarbon dilutent" for shipment by pipeline to refineries. Currently approval is being sought for a 36 inch pipeline from the Alberta fields to Texas refineries.

At about 1,200 ft below ground the bitumen is somewhat warmer than the surface, but a check of Wikipedia shows the earth's geothermal gradient is about +30C/km, so at a depth of 1/3rd km it is only about 10C warmer than the surface, which of course being far north in Canada is cold....Some key points not explained by the article. Where does the methane come from to make the steam? Is it possible this is methane recovered from the site? What is the "hydrocarbon dilutent"? (update -- Bloomberg magazine calls the material added to dilute the oil for the pipeline a natural gas concentrate, saying it contains benezene)

Pipeline non-decision (update 11/15/11)CO2 emission

Obama's job was to decide (y/n) by end of Dec 2011 about building the pipeline. If he decided yes, he would offend the greens, 1,000 of whom have been arrested including James Hansen, leading climate scientist. If he decided no, he would offend the energy industry and reduce local oil supplies for the country. So what did he do? He refused to decide, refused to do his job! In Nov 2011 using as an excuse that pipeline route needed to be restudied the White House announced there will be no decsion for two years (until after the election as the NYT headline put it).

gasoline burn in car

212 gram CO2/km

oil production

conventional

+53 gram CO2/km

in-situ oil sands

+123 gram CO2/km

In other words obtaining oil from (in-situ) heated oil sands increases car driving CO2 output about 25% (70/(212 + 53). Short term a moderate increase, but of course long term much more CO2 entering the atmosphere.

Oil Sands companies

http://www.syncrude.ca

http://www.suncor.com/

Light oil from shale deposits (12/14)

In 2008 due to the

financial crisis the price of a barrel of oil was all over the place, starting

the year at 90, hitting 147 by July and ending the year at 35. In 2014

another big price swing as the price of oil has declined from 115 to 60

within the last six months of the year.

The root cause of the recent oil price drop has been recent improvements in oil drilling (fracturing rock and horizontal drilling) that has allowed the light oil and gas trapped in shale deposits to be tapped leading to a substantial rise in US oil production. In six years US oil production has increased from 5 mil barrel/day to 9 mil barrel/day. This is not 'shale oil' of years earlier where the plan was to mine and crush shale rock to get the oil out. Now the shale rock in the ground is fractured by chemicals pumped down wells allowing the (light) oil and gas trapped in the shale to be collected and rise in the wells to the surface. Shale oil is light oil, unlike the heavy oil of the Canadian tar sands or the medium oil of Saudi Arabia.

A root cause of the oil price instability, of course, is the inflexibility of oil demand. This inherently leads to high price sensitivity to mismatches between demand and production. Historically Saudia Arabia with its high volume, low cost production has been a swing producer. By changing its production it worked to stabilize the price of oil in 2008, but in 2014 where it has chosen not to lower its production as prices have dropped.