Investing Basics

-------------------------

created 8/06

Go to homepage

Your objective

as an investor is to capture as much of the available market return as

possible. If you are not knowledgeable, much of what should be your return

will end up in the pocket of the professional investment people you deal

with, such as mutual funds, stock brokers, and investment advisors. Here

is Bill Bernstein's memorably line from his book the Four Pillars of

Investing, "The stockbroker services his clients in the same way that

Bonnie and Clyde serviced banks."

Mutual fund costs are very important

Consider

two mutual funds, an actively managed fund with 2% per year cost and a

passively managed index fund with 0.2% per year cost. Note, these per cent

fees are not levied on your annual gain, they are levied on your total

account value. The fund sucks 2% (or 0.2%) out of your account every year

regardless of the investment gain or loss of the fund for that year. Let's

assume to keep thing simple their underlying investment returns for the

two funds are the same, and you invest for 30 years.

A revealing

way to understand the impact of fund costs is to figure what fraction of

the account values of an ideal zero cost fund you get to keep. At the end

of every year what you keep is 99.8% of the ideal zero cost fund value

for the passive fund and 98.0% for the active fund. Here is what you end

up with after 30 years for these two cases. (To calculated this on a scientific

calculator use the y^x button.).

You Keep Fund Gets

passive fund

(0.998)^30th = .942 94.2%

5.8%

active fund

(0.980)^30th = .545 54.5%

45.5%

With passive

investing you have retained 94.2% of the underlying (zero cost) account

value vs only 54.5% for the active fund. This is a huge difference. The

2% annual cost of an actively managed mutual fund will result in 30 years

in almost half of the underlying investment value being eaten up by fund

costs. They get 45%, you get 55%! The passive account value after 30 years

will be 173% = 100% x (.942/.545) larger than the active account

value.

If you have

an investment advisor who charges a fee that is 1% of your account value

and he puts you in active mutual funds with 2% costs, then after 30 years

you end up with only 0.97^30th = 40.1% of the underlying account values.

If he charges 2% and your total fees are 4%, you end up with only 0.96^30=29.4%.

Yikes!

Market returns

in the future are unknowable, but costs are predictable, and costs can

be kept low if you are knowledgeable. Keeping costs low is essential

for smart investing.

Taxes are costs too

Your gains

in the market (capital gains and dividends) are taxed. Taxes should be

viewed as a cost, and taxes are a big cost. It is important to structure

your portfolio to minimize them, or at least put off paying them until

tomorrow. One of the big advantage of tax shielded accounts, like 401(k)'s,

403(b)'s, and IRA's, is that if you leave your money there until retirement,

as you should (don't take it out when you change jobs!!), you are

not taxed on the gains and dividends until you take the money out. For

every 10 years that you can postpone paying taxes you are effectively cutting

your tax rate (about) in half.

Where to put assets

If in addition to

tax shielded accounts (like 401(k)'s) you also have non-tax shielded investments,

then equity is best held in your taxable accounts. The reason is that at

the present time capital gains and stock dividends are taxed at a maximum

rate of only 15%, whereas bond interest is taxed at your (marginal) earned

income rate, which for most people is much higher. Bonds are best held

in tax shielded accounts, and very high yielding (7% to 10%), high risk

investments, like high yield bonds, emerging market bonds and commodity

funds, should only be held in shielded accounts.

Minimizing capital gains

There is no easy

way to minimize dividends in taxable accounts, but you can substantially

reduce capital gains. When money is invested in equity mutual funds, even

if you don't sell you still have to pay taxes on capital gains the fund

reports each year. So in your taxable accounts you want mutual funds that

report the minimum of capital gains. The best choice is ETF's (Exchange

Traded Funds), which due to a quirk in the law generally report zero

capital

gains. Most ETF's that passively invest have low cost, so they can be a

good alternative to index mutal funds. Most index funds have low turn-over,

so they don't report a lot of capital gains. Even better is an index fund

with 'Tax Managed' in the title. They try to do their selling to minimize

the capital gains they report.

Shielded accounts have a downside

There is one

negative

to tax shielded accounts (like 401k's) to be aware of. When you (eventually)

pay taxes on the accumulated capital gains in your account, you pay them

not at capital gains rates (15%), but at earned income tax rates, which

are more likely to be 25% to 33%! Yup, there is no special tax treatment

for capital gains incurred within tax shielded accounts. One way to think

about this is since {1/(1.06^12) = 0.50} it takes about 10 to 12 years

of tax shielding to roughly compensate for the rough doubling of tax on

capital gains within shielded accounts (15% to 30% or so). There's not

much you can do about this if all you have is tax shielded investments.

Avoid dumb risks

It's

a fundamental principle of investing that, above a threshold known as the

'risk free rate of return', which can be thought of as the interest rate

paid by money market funds, the higher the potential return the higher

the risk. But, in practice, this rule of investing is a little tricky.

The market will only compensate you for taking risks that cannot be

avoided. For example, here are some common mistakes:

Reason for poor return vs risk

Owning

just a few stocks

risk can be diversified away

Long term bonds, or

long term bond funds

favored by insurance companies

Owning just

a few stocks is really dumb (statistically). Compare what happens when

a company has its only plant burn down (this happens!). Let's assume the

stock drops 75%. If it's one of only three stocks you own, then you have

taken a 25% loss. If your funds are spread into 50 stocks, then the loss

is more like 1.5% and for 500 stocks it's more like 0.15%.

Money professionals

(mutual funds, insurance companies, etc) spread their money around. They

diversify

away

the risk of individual investments. Since this is a risk which can be avoided,

the market does not (on average) provide any return for taking this risk,

so this is a dumb risk to take. Yet when I was younger I did it, and I

suspect it is one of the most common mistakes of the inexperienced investor,

but pros don't do it and neither should you.

Cautionary tale --- Billionaires

Key Lay of Enron and James Cayne of Bear Sterns each took a risk by investing

big in their own companies and paid the price when their companies tanked;

Lay virtually wiped out and Cayne losing 94% of his billion dollar investment.

Bonds (and bond

mutual funds) are generally classified as short, medium, or long term.

The longer the duration of the bond (or bond fund) the more interest

rate sensitive it is which makes its price volatile. Generally medium term

bonds have higher yield than short term bonds to compensate for the higher

interest rate risk. So, of course, for the same reason long term bonds

should have higher yield than medium term bonds, right? Well, just barely.

As Bernstein points out, long term bonds are a special case. They are preferred

by insurance companies because their long term matches the company's long

term liabilities. The result is excess demand for the long bond, which

lowers the yield. Don't buy them, too little return for the risk.

Don't try to predict market movements or time the market

All financial

'experts' you read and hear on TV and radio are no more able to forecast

future market movements or interest rate movements than the man in the

moon, and you can't do it either. The fact is markets go up, and markets

go down. You just need to live with this, and play the odds that growth

in the economy will, over the long term, take average stock prices

higher.

As Boogle points

out in his latest book, data shows that people who jump from fund to fund

(chasing the hot funds) do on the average very badly, much worse than the

annual numbers posted by the funds. Put your money in some low cost index

funds and just leave it there for the long term.

Is it just gambling?

Well yes,

sort of. Investing is a statistical game, playing the odds, but historically

investing (broadly) in the market has been a good, low risk bet. Investing

in the stock market is betting on the continuing growth of the US (&

world) economy. The price of stocks tend to increase over time because

the earnings of companies (historically) tend to (slowly) increase over

time (see plot below). The average price to earnings ratio (P/E) of companies

of the S&P 500 index is generally in (or near) the range of 10 to 20,

meaning the 'rule of thumb' for the price of a stock in the S&P

500 index is 10 to 20 times its annual earnings.

Anyway, risk

is hard to avoid. You may think you're taking no risk if you put all your

money in long term government bonds, but you would be wrong. You are taking

an inflation risk. Your risk is minimum if you invest in short term high

quality investments, like MM funds, short term bond funds, and bank CD's,

but your return is minimum too. Historically their real (after inflation)

return is just barely positive (+1% or so). The way to think about it is

a little risk is a good thing, because it is necessary if you are to earn

a modest real return over the long term.

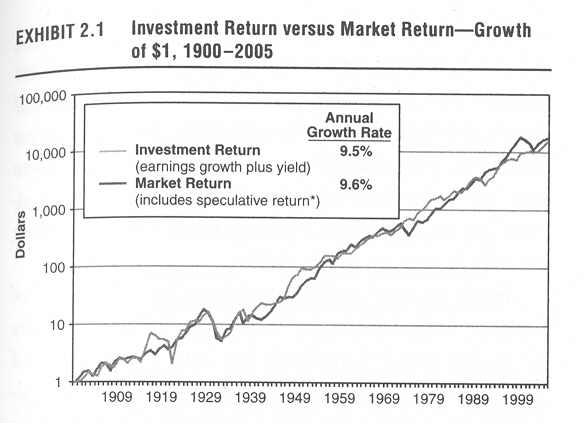

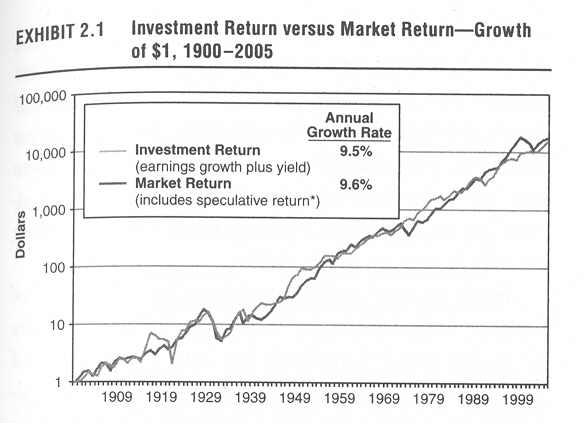

Here's a plot

from Boogle's latest book (2007). The lighter trace shows growth of earnings

plus dividends of US companies since 1900. The darker trace is the growth

of an investment in the (whole) US stock market (starting with $1 in 1900).

Clearly the market (with some wiggles) tracks the performance of companies,

those wiggles are due to variations in the P/E ratio.

Note, this is a logarithmic curve, so close up and

in the short term (few years) P/E wiggles can be big. For example, the

wiggle near 1999 shows the market rose to about $20,000 while the (underlying)

investment return was about $10,000. This was followed by a sharp correction

in early 2000's.

In gambling

terms you want to be like the house, not the man at the table. That's

the reason you should diversify broadly and be patient. As Nobel

prize winning economist Samulson once said, "Investing should be about

as exciting as watching the grass grow."

Eat your lunch

Even though

a core principle in finance is that there's no free lunch, there

are (effectively) two free lunches available to the small investor, and

they should be eaten. The first is diversification and the second

is value over growth. Diversification reduces risk (volatility)

without reducing returns. The only downside is the small extra effort it

takes to set up and monitor more and a wider variety of funds. The easiest

way to do this is to buy all your funds through one or two big houses like

Vanguard or Fidelity.

Diversifying not (1/8/13)

The opening

show in the 3rd season of the well written PBS drama 'Downton Abbey' has

the lord of the manner, Robert Crawley, Earl of Grantham, losing most of

his family wealth. How? By not diversifying! Against the advice of his

advisors he has invested most of his family money in a single Canadian

railroad stock. It goes bankrupt with an implied loss of all (or most)

of his investment. The scene where he learns about this is a mini-investment

classic. He has not followed his investment, so it comes as a total shock.

He first blames his advisor, who retorts we recommended against, then he

says, because of the war "everyone says" there will be a lot of goods to

move so railroads will do well, can't lose, and he has picked a railroad

in developing Canada far from war damage.

(Below is from Forbes magazine online 1/6/13)

“Investing

in one enterprise, wasn’t that foolish?” his wife, Cora, asks him. Indeed.

Diversification is key to any sensible allocation strategy. Lord Grantham

had relied too much on other people’s forecasts. He, in fact, violated

a key rule that Benjamin Graham would espouse a decade later in The Intelligent

Investor ... These investing blunders, of course, were not the first time

that the Crawleys have proved to be a family possessed of considerable

wealth, but little financial wisdom. Lord Grantham’s father made a serious

estate planning mistake. The deceased pater familias created an entail

that allowed the family inheritance to pass only to a male heir. It was

virtually unbreakable; to do so would have required a bill from Parliament.

Unfortunately, the earl had no grandsons, meaning the fortune would go

to a complete stranger. Worse still, most of that inheritance came not

from the Crawleys, but Robert’s wife, an American heiress."

Value companies

are slower growing companies identified by having lower price/book (p/b)

ratios. All indexes (like S&P 500) can be divided into a value

part and a growth part. At Vanguard you can buy not only the whole index

(Vfinx),

but also the value part (Vivax)

and the growth part (Vigrx)

separately. So an easy way to tilt toward value is just put extra money

into the value part of an index.

Finance professors

Fama & French have documented that returns on value stocks tend to

be a little (few percent) higher on average than growth stocks with no,

or almost no, increase in risk (volatility). The reason for this is thought

to be emotion. Some investors just get too attached to sexy fast growing

companies and think their fast growth will continue longer than it usually

does.

A caution --- For the last five or

six years value stocks having been doing far better than growth stocks,

more than would be expected long term, so don't be surprised if the advantage

begins to shift to growth stocks for a few years.

Asset allocation

Financial

experts generally say the most important investment decision you

make is deciding how to divide your money among asset classes, how much

in stock, bonds, real estate, etc. I agree. Over the long term this one

decision largely determines your risk and return. A classic stock/bond

split is 50/50. TIAA/CREF has long advised 50/50, but splits ranging

from 20/80 to 80/20 can make sense depending on age and risk tolerance.

100% stock?---

A lot of people put 100% of their investment funds in stocks, but this

can be quite risky. The major problem with this strategy is the likelihood

of bailing out when the market is way down. With all your money in stock

loses in a steep and/or sustained market decline can be too much to bear

causing you sell out with the market way down making your losses permanent.

Advantage

of buying on the way down --- I have discovered that doing some buying

as the market declines (new money or shifting from bonds to stock, classic

rebalancing) has a surprising sickological benefit. When I

had a dollar cost average plan in place (buying every two weeks for a year),

I found myself cheering for the market to go down before each scheduled

stock purchase. It's strange, even though the declining market was costing

me money, you like to buy low, to get a bargain. The surprising (counterintuitive)

result of rebalancing this way is you can be happy if the market goes up

and happy if the market goes down!

Expected returns

One

argument goes...

'Don't expect

your annual gains to average 9% to 10%, which you always see quoted

as the market historical return. P/E ratios are much higher now

than they were historically. This means you can't avoid buying in high,

so your gains will be less.

Corollary...

The corollary

to lower future stock returns (due to high P/E) is bonds will probably

be more competitive with stocks. This strengthens the case to include

bonds in your portfolio (at all ages). Having 33% to 50% of your assets

in bonds will substantially reduce risk, and the cost for this safety will

be lower.

On the other

hand...

Markets are

radically different now than they were in most of the 20th century, greatly

expanded, especially overseas, much more liquid and transparent, and trading

costs have dropped dramatically. This means you have the ability to diversify

and keep costs low (if you are smart enough to take advantage of it!) that

were not available to earlier generations of investors.

Wild cards

....

Nuclear terrorism --- If a nuclear bomb goes off in Karachi there

will probably be a hiccup in the market, but if it goes off in New York

City hold on to your braces because your going to find out how risky investing

in stocks can be! Keep this risk in mind when deciding on your asset

allocation between equities and bonds.

Oil production peaking --- Will the economy slow down (a lot) at $100/barrel

or $200/barrel?

Demographic bulge in US and much of the developed world --- All those (soon

to be) old people need to sell stocks to live on. Will there be enough

buyers? Jeremy Siegel hopes the answer to the demographic problem

is that China and India will be get rich enough fast enough to buy equities

being sold by the aging developed world. Note, this means the US balance

of trade deficit from a market perspective is a good thing.

We need to sell assets to the developing world to hold up our markets.

No one really knows

how much, if any, market improvements temper the strong argument that future

returns are going to be lower than historical averages due to high P/E's.

For me, I'm

happy if I can make 6% in a year.

Simple, low cost, diversified portfolio

The consensus

of just about every investment professional who has no ax to grind (this

does not include your local mutual fund or annuity salesman!) is that for

most people the best way to invest is stick with low cost index funds.

Check out Vanguard index funds. Vanguard has lots of different types of

index funds, so it's easy to diversify, and all their funds have low cost.

You'll be very well diversified if you divide your investments among these

Vanguard equity and bond index funds:

Vtmsx

Vanguard Total total stock market index

Vgtsx

Vanguard Total international stock index

Vbmfx

Vanguard Total bond market index

Vipsx

Vanguard Inflation protected securities (TIPs)

For more diversification a little money can also go into

these two index funds adding real estate and emerging market equities.

Vgsix

Vanguard REIT index

VeiexVanguard

Emerging market index fund

For a tilt toward value and small cap stocks consider

these two index funds. Small cap stocks on average grow faster than large

cap stocks (which dominate the big indexes), but have higher volatility,

which you need to diversify away.

Vivax

Vanguard Value index (value part of S&P 500)

Naesx

Vanguard Small Cap index (Russell 2000)

Footnote -- Do I invest like this? Well, sort of. I own

a lot of the funds above, but I diversify more. I consider investing (partly)

a hobby. I like doing it. But I have an advantage here, I am an engineer.

I am familiar with 'noise'. I am comfortable with standard deviation

and random variables. I know how to read specifications, to compare, to

analyze.

Bill Bernstein (see below) started off thinking he could teach anyone

the math and techniques of conservative investing, but after writing a

couple of books he found all his friends were telling him they got lost

reading his books. He later came to the conclusion that only engineers

and financial professional were really able to do it right Hence,

the simplified approach recommended above, which captures most of the advantages

while avoiding most of the hassle.

Read these books

You will benefit

hugely by reading two or three investment books. Here are four good ones.

A

Random Walk Down Wall Street: Completely Revised and Updated Eighth Edition

by Burton G. Malkiel

Common

Sense on Mutual Funds: New Imperatives for the Intelligent Investor

by John C. Bogle

The

Four Pillars of Investing : Lessons for Building a Winning Portfolio

by William J. Bernstein

The

Bogleheads' Guide to Investing by The Bogleheads' Guide to Investing

by Taylor Larimore, Mel Lindauer, Michael LeBoeuf, John C. Bogle

Malkiel is

a classic text and a good start. Bogle is founder of Vanguard. Bernstein

is one of the best investment guru's around (and he's a medical doctor!).

Boglehead book is by major contributors to the Vanguard forum on Morningstar.

Morningstar.com

is the best place to get mutual fund information because its standardized

format allows fund numbers to be easily found and compared.

A little bull

When investing,

a little bull is nice.

Wall street has its bull.

Here is my own personal little bull.

Appendix

News update

Interesting info on the relationship between housing and economy from NYT

(11/8/07)

US consumer spending (annual)

9,800 billion

Consumer spending % of economy

70%

'Home equity withdrawals' (annual)

840 billion (2004-2006)

(cap gains, refinanced mortgagees,

(8.6% of economy)

home equity loans)

Home eq withdrawal used for personal

310 billion (2004-2006)

consumption (annual)

Article says

recently (summer/fall 2007) home equity withdrawals are down 33% to 45%

from earlier levels. This has the potential to reduce consumer spending

1.3% to 3%. One 'expert' says a 2% reduction could cause a recession.

Microcap stocks (4/25/08)

I had a look

recently under the hood (so to speak) of a couple of microcap stocks, not

because I wanted to buy them, but because I was following up on the DBK

Solar scam being run by con man/crackpot inventor, Darry Boyd. Now there

are thousands of microcap stocks, and I don't have clue if the two I checked

out are in any way representative, but still it was both interesting and

revealing. Both are classified as 'penny' stocks and trade OTC (Over the

Counter), and fall in the orbit of the San Francisco PR/investor relations

firm Capital Group

Communications, Inc (about whom I have my doubts).

Natco International,

symbol: ncii, capitalization 8 to 16 mil --- Looking at its SEC filings

I find this 'company' consists of one man, who is up to his eyeballs in

debt, who rents a tiny office (in Canada), doesn't pay himself any salary,

and states (in his filings) that he has "no business". His current liabilities

are 2.7 mil. His only 'listed' asset is a loan for 1.45 mil. But it turns

out the company he gave the 1.45 mil to (for a merger deal that fell through)

won't give it back, so Natco is suing them for its return. And this company

is capitalized at 8 mil! Yikes.

As

best as I can figure, the only thing that a company like this has to sell

is its SEC registration. It turns out that a quick and cheap was for a

private company to go public it to take over a tiny SEC registered company

like this. Bizarrely this is called a "reverse merger" (why?).

In Feb 2008 Natco announces

it is planning to merge with this energy company (Lassen Energy) who have

this great solar panel technology, and it's going to increase the value

of the company. Of course, I know that Lassen Energy is just another (one

man) company of con man/crackpot inventor Darry Boyd, and that their technology

claims are totally fraudulent. In April a second announcement is made that

the merger is moving forward and that Lassen has three months to convince

Natco that the technology is real. Of course looking at the filing I find

this is nothing more than Boyd doing his faked 3,000 watt solar panel demo

again. So Feb to July the public is jerked around by false claims, which

briefly have doubled the capitalization to 16 mil.

GeoBioEnegy

(formerly

Better BioDiesel), symbol: gboe, capitalization 6 mil ---- This is

a company headed by the former president of the AZ state senate (Kenneth

R. Bennett) that makes all kinds of noises on its web site about being

in the hi tech bio fuels business. Sounds impressive until you look at

the filings. Basically another one (or two) man company, with no sales,

no business, and debt up to their eyeballs. Recent business announcements

are that they are buying (merging) with two fuel distribution companies,

claimed to be doing 30 mil & 12 mil gross revenue. It looks to me like

this is another example of a tiny, essentially bankrupt, company selling

their SEC registration along with their phony hi-tech aura and name. The

pitch to the fuel companies, who will probably end up owing almost all

of the merged company, is probably that they gain SEC registration and

the aura of being a high tech company, so the value of their businesses

will rise. (It turns out that the AZ state president just joined the company

in Mar 2008, and prior to this he ran a local oil delivery business.)

(8/24/08 update)

Four months after joining the company an SEC filing says Bennett is gone.

The company share price is now down to under one penny (3/4 of a

penny. That's right, it's no longer even a penny stock!). Also GeoBioEnegy

is gone from the Capital Group Communications site, but not to worry, because

P2Solar with their fraudulent solar technology is still listed.

Off balance sheet scam (8/24/08)

What's

the difference between the US government and Enron? Aren't Fanny &

Freddie really just US government off balance sheet scams? (only

slightly tongue in cheek)

Enron famously

kept much of its debt off its books, using tricky accounting to hide it

in off balance sheet entities that were supposedly independent, but in

reality weren't. Until one day with its share price sinking triggers tripped

and the debt had to be moved onto Enron's books, leading to its bankruptcy.

Hasn't the

government been doing the same thing with Fanny Mae and Freddie Mac? The

US debt 'officially' (see US

dept clock) as of today is 9, 625 billion dollars. But hidden away

off the books in the supposedly independent companies of Fanny and Freddie

is another 5,200 billion in debt (NYT). The stock of Fanny and Freddie

are down 95% from their highs because stockholders fear they will be wiped

out if, or when, the government takes over the companies. The press is

now saying this is almost certain to happen because the companies can no

longer raise capital by issuing equity with their existing stock nearly

worthless.

Seems to me

that a so-called 'bailout' of Freddie and Fanny should result in their

debt moving onto the US governments books. Gone will be the fig leaf of

their being independent. The fed debt should jump from 9.6 trillion to

14.8 trillion if the accounting is done honestly. Wanna bet it won't be?

Housing risk (9/08/2008)

Charlie Rose

today had a sobering panel on the future of housing . An economics professor

at New York University on the panel (Nouriel Roubini) said housing prices

have already dropped 25% and are still dropping, and he expects the bottom

to be 40% or so at the end of next year. At that price level 40% of homes

with mortgages will be 'underwater', meaning they have negative equity!

(Charlie asked him to confirm this, which he did.) He says, consider all

the 2nd homes, vacation homes, and condos bought on speculation (there

is a lot of this in hot markets like Florida) that were bought with zero

down. US mortgages are 'non recourse', meaning the bank can't come after

you if it takes a loss, so there will be a big incentive to put the keys

in the mail to the bank. The result he says will be hundreds of billion

dollars of loss for the financial system. This loss will be in addition

to the current subprime mortgage losses of 300 billion. It's another disaster

coming!

Here is the Charlie Rose link (40% comment @ 13 min)

Panelists: Floyd Norris (NYT), Mohamed El-Erian (Pimco),

Gretchen Morgenson (NYT), Nouriel Roubini.

http://www.charlierose.com/shows/2008/9/8/1/a-discussion-about-the-takeover-of-fanny-mae-and-freddie-mac