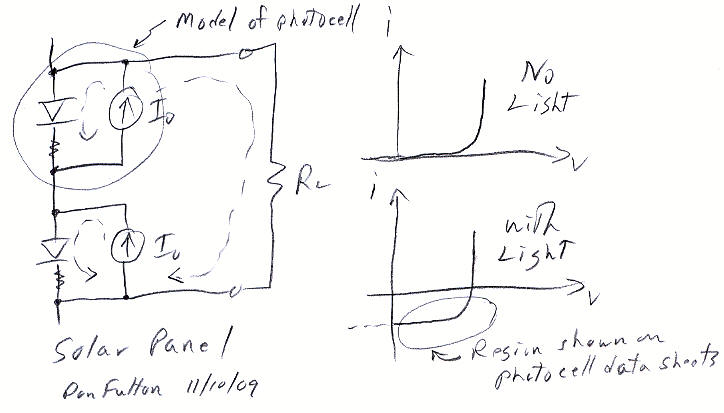

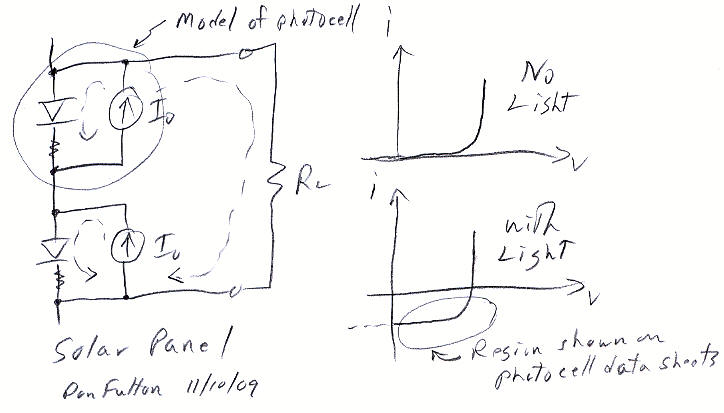

my solar panel circuit model & photocell i-v plots

GE 200 watt 5 x 3 ft solar panel

Oil statistics

Ethanol overview

Cellulosic

Ethanol

Ethanol articles

Methanol

Solar

Enhanced geothermal

Coal articles

Barrel

42 gals of crude oil

Barrel of oil yields 21 gal of gasoline (approx)

+ many other products

world oil usage

85 mil barrel/day

(31 bil barrel/year)

US oil usage

24 mil barrel/day

US oil production

5 mil barrel/day (2008) 9 mil barrel/day

(2014)

4 mil barrel increase due to shale production

US gasoline usage 7.8 mil barrel/day

(120 bil gal/yr)

World oil trade is about 50% of world oil usage. 42% of world oil trade (18 mil barrel/day) from Saudia Arabia, Iraq, Kuwait, and Iran passes through the relatively narrow (30 miles wide) Straits of Hormuz.

---------

(updated 9/30/07)

Current US ethanol production

0.51 mil barrel/day (7.8 bil gal/yr)

Oil displaced by current ethanol

0.33 mil barrel/day (1.4% of US oil usage)

Under construction US ethanol production

0.31 mil barrel/day

Fraction of US corn crop used for ethanol

18%

Corn price (70% of ethonal cost)

3.27/bushel (1.60/bushel in 2005)

Ethanol federal subsidy

51 cent/gal

Tariff on ethanol imports

54 cent/gal

Ethanol plants

129 (+ 80 more under construction)

Leading ethanol refiner

ADM

Units

mmgy = mil of gal (of ethanol)/year

Ethanol thermal equivalent

0.67 x gasoline (1.5 gal of ethanol

replaces 1.0 gal of gasoline)

Gas stations selling E85 (85% ethanol)

1,000 in US (of 180,000 total)

E85 capable (flex fuel) cars in US

4 mil

E85 capable manuf cost

$100 to $200/car

Standard car engines

10% ethanol (legal limit)

Bottom line --- As of 2007 we are 'burning through' (as one wag put it) 18% of our corn crop (& doubling corn prices) to achieve 1.4% of our oil needs.

Politicians, our saviorsWhere does all the ethanol go?

In 1973 President Richard Nixon created Project Independence, which set a national goal that, within seven years (1980), the United States would develop “the potential to meet our own energy needs without depending on any foreign energy sources.” And I remember Jimmy Carter in an address from the white house looking into the TV cameras and pledging that in the future the per cent of oil the US imports was going to decline.T. Boone Pickens nails it

Pickens said every president since Richard Nixon has said, "Vote for me, and we'll be energy independent." "Nobody ever did anything", he said, noting that we've actually become more dependent. "Nobody's ever been held accountable for those statements. ... Nothing's ever done."

Ethanol glut? (10/1/07)

NYT and Wall steet journal report ethanol prices have dropped 30% while

gasoling is still rising with spot prices up near $80/gal. Cause is not

enough distribution channels to support all the refineries coming on line.

Also with lower ethanol prices and much higher corn prices (70% of production

cost) the profitability of ethanol production has fallen sharply.

Oil price volatility

A NYT guest

editorialist (Ron Minsk, 2/1/07) makes an interesting point. He says that

even if the often stated energy policy goal of “eliminating the import

of Middle East oil” could be achieved (and it won't be), it would not insulate

America from world oil price volatility. With spare world oil capacity

disappearing (oil peaking) oil price instability is growing and could become

chaotic. Since there are almost no short-term substitutes for oil, oil

price instabilities flow right through to production costs.

"Even the use of alternative liquid fuel instead of oil-derived gasoline will not allow us to escape this volatility, because as direct substitutes for each other, gasoline and alternative fuels will be similarly priced. This means (from a price perspective) the percentage of oil we import is relatively unimportant. So while the domestic production of oil or alternative liquid fuels may be critically important for a lot of reasons, it won't do much to end (domestic) oil price fluctuations."Oil production & oil price

(4/29/08) Opec’s president (Chakib Khelil, Algeria’s energy minister) said, 'Oil prices could hit $200 a barrel (current spot oil price is $120/barrel), and there would be little the cartel could do to help.

Effect of Oil prices on production

Here is my

take on increasing oil prices --- Large, steadily increasing oil prices

are giving oil producing countries (as opposed to western oil companies)

an incentive not to increase production, but to cut it. For

example, suppose oil goes up in price, say, a modest 20% a year, then a

producing country can cut production 10%/yr and still increase their country's

oil revenue 10%/yr! Reducing production continues the trend of higher

prices. Oil is saved for the future and the standard of living can still

rise. From the producers point of view it's a sweet deal! Oil price increases

and resulting production cuts, whether driven by geology or the incentive

to cut production (it really doesn't matter), is still consistent with

peak oil theory.

Probably the counterbalancing incentive is loss of return from overseas investments due to the world being driven into recession and slow (to no) growth. It would be interesting to know the ratio of Saudi Arabia investment income to its oil revenues (9.45 mb/day x 365 day/yr x 120 dol/bar = 414 billion dollar/yr). Notice this incentive only exists for long time producers like the Saudi's with considerable investments. For newer (or corrupt) oil producing countries, like Nigeria, with little overseas investment they would be little affected by a few percent decrease in demand caused by recession.

Ethanol overview

----------------------------

Ethanol is a "grain alcohol" produced in US mostly from corn. (In

Brazil ethanol is called 'sugar alcohol'.) New corn strains are available

that are optimized for ethanol. It is a colorless liquid with low

toxicity that is miscible with water and easily biodegraded in the environment.

It burns well in car engines raising octane levels and lowering emissions,

but it's not as volatile as gasoline so it can make engines harder to start

in cold weather. Ethanol production from grain, as practiced in the United

States, creates four co-products: ethanol, DDGS (a high protein animal

feed), carbon dioxide (purified and sold for beverage use), and heat.

corn starch

=> ethanol

corn protein

=> animal feed (1/3 by weight of corn)

Producing the ethanol is relatively simple, it is a distillation process where the corn is finely ground and soaked in water with enzymes to separate the starch and convert it to sugar. The sugar is fermented into the ethanol and excess water is removed with a molecular sieve. From one bushel of corn you get 2.8 gallons of ethanol, 17 pounds of DDGS (distillers grain, a valuable animal feed product) and about 18 pounds of CO2.

E85 is 85% ethanol and 15% gasoline. Sold mostly in midwest. GM has 1.5 mil vehicles on road that will run on E85. One user comments on starting issues with E85, "My new 2005 Taurus FFV has starting difficulty in the morning when using E-85. It usually takes 3 attempts at cranking before it stays running. My 2005 chevy FFV pickup starts on first try every time."

Other countries produce ethanol from different sources, like sugar cane (Brazil), logging waste (Sweden), sugar beets (France) and sweet sorghum (India). Most ethanol now comes from starch/sugar in the plant material with only with limited ethanol produced from cellulosic material. Brazil is a leading ethanol producer and has replaced 40% (vs 1-2% in US) of its gasoline consumption with ethanol.

A big problem with ethanol is that it can't be shipped in pipelines. WSJ 'explains' the reason why is that it mixes with water and gets diluted as it moves through the pipe. Oil pipelines let in water?? Ethanol must be shipped by truck or train, or is made locally which explains why there are ethanol plants all over the place.

Negative side of ethanol (w/lots of links) http://www.energyjustice.net/ethanol/

Wikipedia overview article on ethanol http://en.wikipedia.org/wiki/Ethanol_fuel

Map of all ethanol refineries http://www.ethanolrfa.org/objects/documents/904/plantmap103106.jpg

Oil pipeline corrosion link (at Slate) http://www.slate.com/id/2147348/

John Deutch (MIT chemist) on ethanol (Wall St Journal

Editorial, spring 06)

-----------------------------------------------------------------------------------------------------

Food-crop ethanol -- natural enzymes breakdown

crop into simple sugars & fermented

Oil saved by 'ethanol from corn' -

"minimal"

a) not effective in long run

Cellulosic ethanol --- cellulosic material

not broken down my natural enzymes.

a) Chemical method (syngas). Breakeven at 50-70/barrel

b) Biotech method -- "merits genuine enthusiasm"

Need to engineer an organism that can breakdown

cellulose to sugar. Also an organism to improve

fermentation. Big job, but big payoff.

Energy input for cellulosic

ethanol will be less than for crop ethanol for two reasons:.

a) less fertilizer to grow

b) waste can be burned to evaporate the water

Land needed to displace

1 mil barrel of oil/day with switchgrass ethanol

25 million acres (39,000 squ miles or 200 mil x 200 miles)

This is 3% of 'available' crop, range, pasture land

Deutch's conclusion --- In next couple of decades we can displace 1 to 2 mil barrel of oil/day (4%-8% of current US oil usage) with cellulosic biomass ethanol, but not much more.

Ethanol used as oxgyenator

---------------------------------------------

In 2005/2006

ethanol is replacing MTBE nationally as fuel oxgyenator. Used in so-called

'reformulated' gasoline and in winter gasoline formulations. Oxgyenator

is 1.4% of fuel. MTBE (methyl tertiary-butyl ether) is a chemical reaction

of methanol and isobutylene. MTBE is produced in very large quantities

(over 200,000 barrels per day) and is almost exclusively used as a fuel

additive in motor gasoline. MTBE has been used in U.S. gasoline at

low levels since 1979 to replace lead as an octane enhancer (helps prevent

the engine from "knocking"). Since 1992, MTBE has been used at higher concentrations

in some gasoline to fulfill the oxygenate requirements set by Congress

in the 1990 Clean Air Act Amendments. Oxygen helps gasoline burn more completely,

reducing harmful tailpipe emissions from motor vehicles. Unlike ethanol,

MTBE can be shipped through existing pipelines.

Douglas Brent, the co-chairman of Permolex, said that building (ethanol) plants closer to areas densely populated with cars was ''the future of the industry.'' ''It's pretty easy to transport corn, pretty hard to transport ethanol,'' he added.

Net Energy Gain?

--------------------------------

"You

can't burn food, it's just stupid" ---(Bernie Karl, Chena Alaska

geothermal promotor, from the book, Earth the Sequel)

A. David Pimentel, a professor at Cornell University, published a paper in 2005 with Tad W. Patzek of the University of California, Berkeley stating that the corn-to-ethanol process powered by fossil fuels consumes 29 percent more energy than it produces. The results for switchgrass were even worse, the paper said, with a 50 percent net energy deficit.

Arthur J. Ragauskas, a professor at the Georgia Institute of Technology and the co-author of a positive study about ethanol that appeared in the journal Science in January, said the nation could replace a third of its current fuel demands by focusing on cellulosic ethanol from forest products and agricultural residue. Mr. Slunecka of the Ethanol Promotion and Information Council said that Dr. Pimentel's calculations did not account for the increasing efficiency of ethanol plants and rising yields of corn per acre.

Ethanol can be made through the fermentation of many natural substances, but sugar cane offers advantages over others, like corn. For each unit of energy expended to turn cane into ethanol, 8.3 times as much energy is created, compared with a maximum of 1.3 times for corn, according to scientists at the Center for Sugarcane Technology here and other Brazilian research institutes

Are biofuels really renewable?

An article in June 2009 Scientific American points out that the world's supply of phosphorus, a major component of fertilizer, is getting dangerously low. Of the the three elements in fertilizer, nitrogen is pulled from the air, but potassium and phosphorous are mined. There's lots of potassium around, but not so phosphorous. US is world's 2nd largest producer and 65% of our phosphorous comes from a few mines near Tampa Florida (bone valley) whose end is coming. 40% of the known world's supply of phosphorus deposits are in Morocco.

When human and animal waste were used for fertilizer, phosphorus just circulated around. But now wastes and fertilizer are almost completely decoupled. The result is that phosphorus used for fertilizer all eventually ends up in the sea, some in direct run off and others thorough waste treatment, and eventually it sinks to the sea bottom where it entombed in the seabed.

We can't produce food without phosphorous. We have maybe 50 to 100 year supply, but 'peak phosphorous' could happen in 30 years. On top of everything else, idiot bifuels are using huge amounts of the stuff. A June 2008 article said phosphate rock had increased in price 700% in the last 14 months. "The risk of a future phosphorus shortage blows a hole in the concept of biofuels as a 'renewable' source of energy. Ethanol is not truly renewable if an essential fundamental element is, in reality, growing more scarce."Cellulosic Ethanol

When you hear politicians spouting off about how great cellulosic ethanol is, just remember cellulosic ethanol doesn't exist (as of now) as a practical technology. Fundamental breakthroughs are needed, and they may, or may not, occur!Cellulosic ethanol, the kind produced from nonfood plant matter, has some advantages over food-based ethanol. Because cellulosic ethanol is derived from plant waste, wood chips or wild grasses like miscanthus and switchgrass, it would not require costly cultivation; that would mean savings on labor, pesticides, fertilizers and irrigation. And it is superior to corn-derived ethanol in reducing greenhouse gas emissions.Where is the all-electric car? -- A fully electric car required fundamental breakthroughs in battery technology and a ton of money was spent on battery research. Batteries have slowly improved, but the hoped for big breakthroughs in battery technology never happened.

According to WSJ (6/29/06 ) a lot of work is being done to upgrade the efficiency of corn ethanol by using cellulosic methods to process more of the corn. There has been good progress in lowering cost of cellulosic enzymes and new digesting bugs are available. In last five years enzymes cost per gal of ethanol has dropped from $6 to 50 cents. A cocktail of two dozen enzymes are used! 15% more ethanol will come from using the cellulose in the hull and more gain from using stalk and leaves. Altogether it may be possible to double the amount of ethanol from corn.

With gas at $3/gal and federal subsidies the corn ethanol manuf are making big bucks, 35% returns according to WSJ, so there is lots of new investment in the industry. ADM and other big players using 100m in federal dollars plan to open one or two 'hybrid' prototype plants in the next couple of years. Ethanol production is expected to increase the price of corn in 2007 by 20% (WSJ).

On the downside getting fementable sugar from cellulose with a good yield is a tough problem. People have been working on the cellulose problem for many years and as much as a billion dollars has already been spent!

Search phrases: 'xylose sugar' (cellulose sugar), 'zymomonas mobilis' ( improved Dupont bug ).

Methanol

Another alcohol,

besides ethanol, that can be used as a fuel for cars is methanol, sometimes

called wood alcohol. Just as ethanol mixed 85%/15% with gasoline is a fuel

for cars and called E85, methanol mixed 85%/15% with gasoline is also a

fuel for cars and called M85. China is already using a billion gallons

of methanol for (transport) fuel.

Methanol is made today from fossil fuels, but it is potentially a biofuel, because its starting raw material, 'syngas', can be obtained by heating a wide variety of organic materials including cellulose and plant waste. Syngas is primarily carbon monoxide (CO) and hydrogen (H2) mixed with some CO2 and is now commercially obtained by partially burning natural gas (and sometimes coal). Syngas with a catalyst produces methanol.

I never heard of methanol as a fuel option until early 2008. Methanol as a potential oil replacement technology began to be pushed in 2005 by a Nobel prize winning chemist George A. Olah, now a professor at Univ of Calif. He has patents pending on new ways to make methanol and has written a book. Another new book (Zubrin) also pushing methanol. Zubrin's book has 31 five star Amazon reviews, and Olah's book has 9 five star reviews. There's also a Wikipedia site on the 'methanol economy.'

Beyond

Oil and Gas: The Methanol Economy by Olah

Energy

Victory: Winning the War on Terror by Breaking Free of Oil by

Zubrin

http://en.wikipedia.org/wiki/Methanol_economy#Methanol_production

Methanol's atomic makeup is very close to methane. Methane is one carbon with four hydrogen (CH4). Methanol from an atomic viewpoint is just methane with an added atom of oxygen (CH3OH). Ethanol is one oxygen added to a slightly heavier hydrocarbon than methane (C2H5OH).

Methanol has some advantages. It has high octane and can be burned in cars that are cheaply 'flex fuel' designed. It could also be used in fuel cells. The claim is make that it can be shipped in pipelines, but I also read it absorbs water and isn't this why ethanol can't be shipped in pipelines?. A minor problem (in the big picture) is that methanol has only about 75% the energy content of ethanol (which is 0.67 of gasoline), so gas tanks in methanol powered cars would need to be twice the size of gasoline powered cars (for same range).

The idea is to produce methanol as a transportable and storable fuel, replacing oil. It's clearly has huge advantages over hydrogen for this purpose. Interestingly there is more hydrogen in a gallon of methanol than a gallon of liquid hydrogen. The idea is to 'burn' uranium or get energy from other renewable energy sources to break apart water to first get hydrogen.

CO2 + H2 => methanol

Here is the

cool part. The future raw materials for making methanol are hydrogen (some

energy source is needed to break apart water) and CO2. CO2 is the input

for making a transportable fuel! Don't sequester the CO2 from a fossil

fuel power plant, capture it and make methanol from it!. (However, it seems

to me that raw materials CO2 +H2 have got to be less efficient than using

syngas, which is CO + H2). In the future (wild speculation here)

CO2 might be pulled directly from the atmosphere to make methanol, which

of course when burned would return the carbon, making the cycle carbon

neutral.

Solar

I'm reading

a book called Earth: The Sequal that is basically a discussion of

many new developing energy technologies. Its chapter on solar opens with

an interesting claim, to wit, capturing solar energy with 10% efficiency

on just 100 miles square in a southwest desert could potentially provide

the US with all of its electricity. Is this true?

The book has the following solar numbers:

Annual kwh from a 3 Kw panel (Las Vegas)

6,500 kwh/yr

Av power (24 hr)/peak power (Las Vegas)

(eq to full power for 6 hr/day av)

25%

3 Kw home solar panel installation

$21,000

'Standard' (large) plant

A good way to think

of US electricity generating capacity is to think in terms of 1 Gw (or

1,000 Mw) plant equivalents. A typical nuclear plant is in fact just about

1 Gw. Wikipedia says in 2006 the US had 103 nuclear plants with a 'nameplate'

capacity of 105 Gw, which is 1.02 Gw/plant.

US electricity capacity

Nuclear plants

in the US, says Wikipedia, had 9.82% of nameplate electrical capacity,

but provided 19.4% of the electricity, which translates to electrical usage

of about 500 Gw with a peak capacity of about double that at 1,000 Gw,

or 1,000 large power plant equivalents. A poster at ClimateProgress (Feb

2008) confirms this, saying "Current US generating capacity is just

over 1 million MW", which is equivalent to 1,000 standard (1 Gw) plants,

and online capacity is expected to increase about 10% of the next five

years.

US electrical (av) usage (2006)

500 Gw

US nameplate (peak) capacity (2006)

1,000 Gw

100 miles square

Let's calculate

out the book's peak and average power output of 100 miles square (10^4

sq mi) of captured solar @ 10% efficiency: Since the average number is

intended as a replacement for base capacity, the implication is that some

means is available (hot water and compress air are two possibilities) to

store energy overnight so the daily cycle can be smoothed.

Solar power (bright sunlight, earth's surface)

1,000 watt/m^2

Peak power @ 10% efficiency of 100 miles square

10^4 sq mi x (1.61 km/mi)^2 x (10^3 m/km)^2

x 100 w/m^2 = 2.6 x 10^4 x 10^6 x 10^2 watt

2,600 Gw peak

650 Gw av @ 25% usage)

Area for a standard 1,000 Mw (1 Gw) solar plant

While bright sunlight is 1,000 w/m^2, the average power from a solar

plant is only 25w/m^2. This is based on assumptions of 10% solar cell efficiency,

which yields electrical power from the cells of 100 w/m^2 when the sun

is shining, but this needs to be reduced by four, to 25 w/m^2, for an assumed

6 hours of daylight (and ignoring storage losses!). Dividing 1,000 by 40

we find a 1,000 Mw plant occupies 40 square km (1,000 Mw/25 w/m^2 = 40

x 10^6 m^2 = 40 km^2 = 15.6 miles^2. Or rectangular area of about 4 miles

on a side. Big, but not outrageous, this could easily be lived with.

Personal observationsMojave Solar Park

In spring 2008 I spent two week driving around the state of Arizona. Southern AZ is mostly deserts and low mountain chains. The many 'valleys' between the mountains in southern AZ are mostly flat and totally empty. While driving across these desert expanses, often 25 miles by 25 miles between town, I was doing the calculation in my head, so how many 'standard' power plants would fit in this valley? Answer about 40 (@ 10% capture)! (625 sq miles/15.4 sq miles/plant = 40.6).Of course, it would take a lot of transmission lines leaving the valley to carry the power out. I see one or two (more?) tower lines leaving a dam like Glen Canyon, which is little more than one standard plant.

Developing about 20 such desert valleys would result in 800 plant equivalents (80% of the 1,000 plant equivalents we now have) replacing all the coal, oil, and gas power plants.

Since the 550 Mw rating is probably peak (storage is not yet developed and solar developers always like to use the bigger peak number) and the plant will cover nine sq miles (16 sq miles/Gw peak), when I work the capture efficiency it is only about 1/4 of the numbers calculated above. This implies the capture efficiency in terms of land area is quite low only about 1/4 x 10% = 2.5%. Of course, conserving land area at present is not that important, what is important to solar developers now is to minimize cost, and as a cost saving measure this plant is to reuse some old infrastructure that was originally built for a coal fired plant in the Mojave.

Scientific American

Scientific

American had a major article on solar power in Jan 2008. The authors argue

the US aim to have installed by year 2050 3,000 Gw (peak or av?) of solar

power, which at 14% efficiency they figure would cover an area of 30,000

square miles (173 miles square) in the southwest desert and should use

compressed air in caverns for overnight storage. 30,000 sq miles is three

times the book's area of 100 miles square and at 14% efficiency would yield

3 x 650 Gw av x (14%/10%) = 2,730 Gw av, so their 3,000 Gw value is probably

average.

A Solar Grand Plan, Scientific American, Jan 2008

So we get reasonable agreement the book's 650 Gw av, Wikipedia's current 500 Gw (av) usage, and Scientific American projected (av) electrical power needs for year 2050 of 3,000 Gw that provides for a 4.3% annual growth in electrical power between now and 2050.

Generating power locally

There are real advantages

in having power generation (fairly) close to users, such as less distribution

loss and better grid stability. Also if the US was to become dependent

on solar power from the southwest, then consider the rights of way conflicts

and huge costs to build a nationwide network of high voltage distribution

towers. In this light a poster at ClimateProgress (link below) makes a

lot of sense when he recommends the following (non-carbon) emphasis:

Southwest

solar

Midwest

wind

Southwest & Northwest

nuclear

http://climateprogress.org/2008/02/29/power-plants-costs-double-since-2000-efficiency-anyone/

Costs

How much does

a large (1 Gw) power plant cost?

TVA is planning to build two 1.25 Gw nuclear plants (AP1000 'advanced passive' reactors from Westinghouse) for 3 billion each, equivalent to 2.4 billion per standard (1 Gw) plant. Working some numbers we can estimate that the capital invested in the present 1,000 large US plants is roughly 2.4 x 10^9/plant x 10^3 plants = 2.4 x 10^12 dollars (2.4 trillion dollars). So if a similar investment went to, say, solar panels how much capital would that be per panel.

2.4 x 10^12

dollars/{10^4 sq mi x (1.61 x 10^3 m/mi)^2}

= 2.4 x 10^12 dollars/{2.6 x 10^10 m^2}

= 92 dollars/m^2

In other words if the capital currently invested in power plants were to be transitioned (over 40-50 years) to 10% efficient solar panels covering 100 miles square we would have about 100 dollars to buy a 1 meter square panel.

So how much do solar panels cost now? Hard to price online, but I found a retail offer of 3,150 watt system (with inverter) system (18 panels) for $15,907. If the panels were a m^2 @ 15% efficiency, there would be 3150w/150w = 21 panels @ m^2 size, so cost (retail) per meter of panel is about $15,907/21 = $757 per m^2. Now of course with solar the fuel is free, but distribution costs would be high. I read that currently about half the cost of electricity is generation and half distribution.

Bottom line --- Hip shot analysis says that transitioning the same level of investment in electrical capacity we have now to solar panels would provide (roughly) $100 for a square meter of panel, but a square meter of (silicon) solar panel today costs (about) $750 or x7.5 times higher. There's the challenge. But if over time solar's cost could be reduced by, say, a factor of two or so, and maybe coal's cost will rise (x1.3 -1.5) due to carbon capture, then solar's cost penalty might close to x2-3 over coal. Thus while solar electricity would be expensive, its cost would not be outrageously high and certainly could be afforded when fossil fuels run out!

Negatives

Nathan

Myhrvold, former chief technology officer at Microsoft now working on solar

power, makes two interesting points.

One, the green house gas emissions to build a build a solar plant are about x3 higher (he doesn't detail why) than building a coal plant. So you need to operate the solar plant for three years just to get even with a coal plant. He says if we build huge amounts of solar plants over the next 30 to 50 years, building more and more each year. All these extra emissions add up, so the lower emission benefit doesn't really kick in until solar construction flattens out and this could be in 30 to 50 years. Bottom line very little short term (30 to 50 years) benefit to solar, the emission benefit is in the out years.

Two, in the desert the albedo is pretty high (.4 to .5), but solar panels are nearly black. So a large solar field roughly doubles the solar energy absorbed from sunlight. 10% or so goes to electricty and the other 90% is heat dumped into the atmosphere. (Off the top of my head I would think that globally this effect would be pretty small, but it sure would make the desert area of the solar field pretty hot.)

Large solar installations

Aug 2008 ---

A massive 800 MW solar phototvoltagic plant is announced in New

York Times. 800 Mw is x10 to x20 than the few existing large solar fields.

800 mw is the peak power, the average is about four times smaller. Headline:

PG&E (Calf utility) Signs Massive 800 MW PV Solar Deals With

OptiSolar, SunPower" Optisolar is to provide 550 mw of solar panels and

SunPower 250 mw.

March 2009 --- OptiSolar announces it is shutting down and laying off all its 200 employees! They had 600 employees a few months earlier at the end of 2008. The story says, "First Solar bought its most valuable assets--its hundreds of megawatts of utility-scale PV deals in the pipeline" I later found an article on what happened to the 322 million (private) investment in OptiSolar.

OptiSolar was a startup that attempted to enormously scale up volume (cells, glass making, frames etc) all the basic steps in amorphous silicon solar panel (5.5% efficient) manufacture to drasticlly cut costs. They also had grandiose plans to build and operate the solar parks themselves, meaning they would be selling their solar panels to themselves, and were buying up land and rights. The model was high volume, highly automated DRAM semiconductor plants that typically cost a half billion dollars to build.

http://www.greentechmedia.com/articles/read/inside-optisolars-grand-ambitions-6029/

First Solar appears to be the most successful solar panel manuf. They have been added to the S&P 500. Their web site lists only one solar panel! It's a small 50 to 70 watt (about 4 ft x 2 ft) panel build cadmium sulfide with efficiency of 9 to 10%. Their panels are used in 6 mw (Rote Jahne), 8 mw, 40 mw all in Germany, 10 mw in Nevada, 5 mw in Spain. There is no mention on the First Solar site (Nov 2009) of the PG&E planned 800 mw plant!

The SunPower site link to utility projects is dead!

PG&E site says, May 2009 signed for a 110 mw plant from BrightSource Energy at Ivanpah, Calif. But this is not photovoltaic. BrightSource is a US Israeli company doing solar thermal using a central tower with mirrors.

In March 2009 PG&E they announce a new 500 mw five year plan. PG&E will build themselves a lot of 1 mw to 20 mw solar photovoltaic fields totally 250 mw. They will contract for the other 250 mw.

Solar panels & photocell physics

Here's a simple

circuit model of a solar panel. Left is two photocells connected in series

and right the curve tracer i-v plot of a photocell with and without light.

I looked online for a good model and couldn't find one, so I worked it

out and drew it up. A pn type photocell is basically just a diode that

squirts out current. (I read there is another type of photocell that has

no pn junctions, but at this point I don't know anything about them.) The

lower right quadrant (4th quadrant?) of my i-v plot with light is what

is used on solar panel datasheets, except it's flipped (positive current

for an active photocell being out, while for a passive diode it's in).

my solar panel circuit model & photocell i-v plots

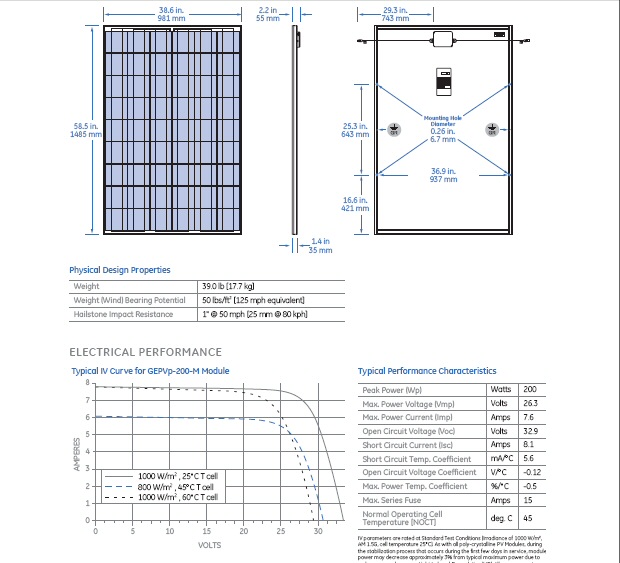

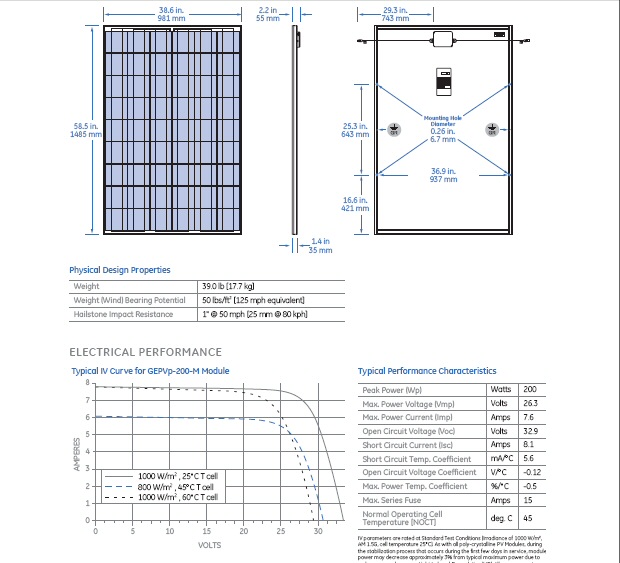

GE 200 watt 5 x 3 ft solar panel

A photocell model is very simple, just a ideal diode with a small series resistor in parallel with a light induced current source. This simple model matches the i-v characteristics shown on real solar panel data sheet (above) quite well. When no load is connected, all the light induced current cycles around through the diodes so the panel voltage is maxim due to the series resistors. As current is drawn externally, current is diverted from the diodes so the voltage sags a little. When the voltage sags enough to turn off the diodes, the current (see the GE datasheet I-V curve above) is remarkably constant.

From the model I noticed something interesting that must be of practical importance, but I found only one reference to it in a web search. In this model there is no (good) way for the current to divert around a dark cell. The one reference I found was somebody saying two solar installers told him that one bird crap could reduce the "efficiency" of a solar panel by 90%. In a big solar panels there are a lot of cells in series, probably 50 cells x 1/2 V/cell for 200 watt 5 x 3 ft, 26 volt GE panel (above). What the circuit model shows is that it current from lighted cells would break down the dark photocell diode. I don't know what the breakdown voltage is, but it's probably pretty low, say 5V. So breakdown might not be too bad, a loss say of 25 W (5A x 5V = 25 watts) from a 200 W panel, but still at 25 watt dissipation the dark cell would get pretty hot.

There is however a simple fix for tolerating a dark cell, just add an anti-parallel diode, probably by integrating it in (though it could be added externally). Whether this is done or not I don't know.

I guessed right. The professor (below) shows a photocell with a -15V breakdown, and for his (lower power than GE) 50 cell panel a single dark cell causes a 70% loss of power, and it is in danger of burning up. He says the manufacturers do use anti-parallel diodes to fix this problem (this allows the cell breakdown voltage to be high). Here's the lecture with data (it's a .pdf, but for some reason it displays as slides)With more reading I find panel specs with no "bypass diode". Wikipedia appears to say use of anti-parallel diodes is spotty.http://wireless.ictp.it/school_2006/lectures/Ermanno/PowerIssues.pdf

"Many Photovoltaic cells' electrical output is extremely sensitive to shading. There are some non-traditional solar cell manufacturers, thin-film a:Si, that have installed bypass diodes between each cell that minimize the effects of shading and only lose the power of the shaded portion of the array. When even a small portion of a cell, module, or array is shaded, while the remainder is in sunlight, the output falls dramatically due to internal 'short-circuiting' (the electrons reversing course through the shaded portion of the p-n junction)." Wikipedia (Photovoltaic array) on shading and by-pass diodespn junction photocell physics

In a photocell light increases the minority carriers in proportion to the photons absorbed. Note it makes no difference if the photon is absorbed in P or N region since it make a hole-electron pair. Short terminals and then turn on light. It's easy to see the forward bias current is unaffected because the terminal voltage is unaffected (V = 0). But the minority current (swept by the E field) increases in proportion to the increase in minority carriers caused by the light, and it flows out of P terminal in the external short. This explains the 0V points decreasing in current as light strengthens.

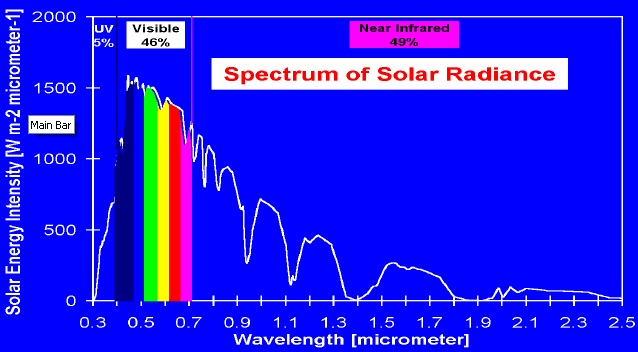

bandgaps vs efficiency

The efficiency

of single junction photocells (most of the market) is pretty simple. Each

semiconductor has a bandgap (measured in volts). The theoretical maxim

efficiency of a cell illuminated with monochromatic light with eV

photons that are just slightly above the bandgap is very high (about 85%).

But sunlight is far from monochromatic, it's a fairly wide quasi-blackbody

spectrum with about half the energy in the infrared below visible light.

Thermo-photovoltaics --- How to theoretically exploit high monochromatic efficiencyWith a solar spectrum all photons with lower ev (lower frequency) than the bandgap are unable to knock an electron free, so either pass through or are absorbed as heat. All higher ev photons will make one hole-electron pair, but only the fraction of the ev at the bandgap tributes to the electrical power. For example, a photon at 2ev of the bandgap contributes half its energy to electricity and half to heat. The maximum theoretical efficiency of single gap cells, first calculated by Shockley in 1961, is about 31% (without concentration).

Work is going on to exploit high monochromatic efficiency of photocells. Exotic thermophotovoltaic systems envision concentrating (wide spectrum) solar energy onto heat emitters that get real hot and reradiate the energy in a narrow band matched to photocells.

Below shows Si with its bandgap of about 1.1 ev is not too bad. It converts the upper end of the infrared efficiently and and about half the energy in visible photons.

![]()

solar spectrum in ev, bandgap of various semiconductors

in eV

This plot shows where in the solar spectrum is the energy. About half is visible photons, about half below visible in infrared, and just 5% above visible in the ultraviolet.

Solar spectrum in terms of energy

source: http://www.physics.rutgers.edu/grad/627/P627F08_Lect16.pdf

Thin film photocells (2nd

generation photocells)

The active

absorber in non-silicon thin film photocells can be really thin. CdTe (cadmium

telluride) thickness is 10 um (1% of a mm, 10^-5 m). The amount of semiconductor

material needed per watt is reduced by x50 to x100 times compared to standard

Si photocells. A fundamental reason some non-silicon cells can be so thin,

is that that they are much more opaque than silicon, more than x10 more

absorbent.

CdTe is the speciality of USA (Ohio) company First Solar who manufactured 200 MW of CdTe solar panels in 2007, about 9% market share. They built the big 6 MW solar field in Germany. The only have one product a 75 watt, 10% efficient panel (1.1A @ 68V, 116 cells, no bypass diode). Cadmium is a byproduct of zinc production.

Not sure how CdTe photocells work, but my guess is the equivalent of a bandgap 'bend' of a pn junction is achieved by sandwitch (one is vapor deposited on top of the other) of two different semiconductor materials. First Solar has an extremely thin top layer of CdS (100 nm) @ 2.5 ev bandgap on 10 nm of CdTe with 1.5 ev of bandgap. (however, the implication is that the 1.5 ev CdTe is really doing the work?) In same talk Triple junction cells actually have three pn layers of stacked (bandgaps of 0.65 V, 1.4 V, 1.86 V)

Wikipedia (Cadmium telluride photovoltaics)3rd generation solar cells

Wikipedia crosssection does show what appears to be a pn junction. The top layer is actually a transparent conducting layer made of tin oxide SnO2 (part of the terminal in lieu of a metal grid). Under this is the thin CdS and it is 'n' doped, and against it the thicker CdTe that is 'p' doped. However, it's a pn junction different from a silicon pn junction because here the two materials have very different bandgaps. A junction with different band gaps is called a heterojunction. The are widely used in lasers and very high frequency transistors. Lots of quantum tricks can be played to control carriers. Nano techniques can be used to change bandgaps (apparently) within same material. Some of the Wikipedia analysis of the heterojunction junction is textbook quantum well type analysis. (In a silicon pn diode the band gap is the same on both sides, called a homojunction, a word I don't remember ever hearing.)

Dye-sensitized solar cells (DSCs) are currently being explored as ultra-low-cost solar cells. DSCs utilize three main components to perform photo-electro conversion which are metal oxide semiconductor nanostructures, dye, and electrolyte. A dye is used to create electron hole pairs and other two materials transport theses photogenerated charge carriers to the electrodes.Diode structure is key to charge separation

Charge separation

A key issue is what

mechanism

in various types of photocells does charge separation: drift (E field)

or diffusion (gradient). Diffusion is mentioned as being the key mechanism

only in 3rd generation photocells like die types.

Photocell slide reference (included CdTe crosssection

slide #10)

http://www.physics.rutgers.edu/grad/627/P627F08_Lect16.pdf

Quantum dots

So called

'quantum dots' are nm size particles that exploit quantum principles. In

principle the 'effective bandgap' depends on the particle size, so a range

of bandgaps is possible by mixing different types of quantum dots. Another

theoretical

advantage is that via quantum principles (exploiting excitons, see below)

a photon with ev say x3 the effective bandgap can create x2 or x3 hole

electron pairs. This pushes the theoretical efficiency of the panel high

and theoretically allows small bandgaps to be used to pull energy from

infrared while still working fairly efficiently with high ev of visible

photons. Still a third theoretical advantage is that a tightly order grid

of quantum dots via quantum coupling & tunnelling might be able to

pass along energy very efficiently. The usual reference for this is the

highly efficient ("non-radiative") way photosynthesis passes energy from

antenna molecules to the reaction centers via quantum coupling.

"An immediate optical feature of colloidal quantum

dots is their coloration."

color (emission and absorption) is controlled by particle

size

(Wikipedia -- Quantum dots)

Quantum dots are now widely used in dyes for biological analysis because they are x20 times brighter and x100 times more stable than traditional dyes.

What is sometimes called 3rd generation solar cells use other means than pn junctions to separate photon created hole-electron pairs. One of these methods in the R&D stage is to put quantum dots (say a nm size particles of semiconductor like CdSe) in a conductive matrix. (One tiny R&D Solar company takes about potentially achieving 6% efficient solar panels this way. The economic potential would be low cost manufacturing because the liquid matrix could just be screen printed.)

What?More reading shows how to separate charges, especially from multiple excitons from a high ev photon, is one of the major engineering challenges. Calculated maximum theoretical effiency with quantum dots for unconcentrated sunlight is 44% vs 31% for single silicon pn junctions.

I first though I understood this, writing "the dots are so small that some reasonable fraction of hole and electron pairs diffuse? to the conducting matrix". But upon reflection this makes no sense. An electron coming out of one side of the dot and an electron going in another side (eq to hold coming out) cancel. There needs to be a voltage, or some means in the matrix, to separate hole and electron.Separating charges with quantum dots is 'tricky'

-- "Quantum dots produce "excitons," consisting of electrons loosely bound to positive holes. Solar cells employing quantum dots must dissociate the excitons into electrons and holes that must then migrate to the cell terminals without recombining."

Combining quantum dots with pn junctions

The separation

problem is why another approach to using quantum dots is to put them in

an intrinsic layer inside between p and n layers. In this way the quantum

dots can absorb (making say a small band gap for infrared absorption) with

the electric field of the pn junction doing the charge separation.

A solar cell of this type would be expensive, but potentially have higher

efficiency.

Exciton (11/09)

I had never

heard of an 'exciton' until I started reading about quantum dots. Turns

out an exciton is a loosely bound hole - electron pair that acts

like a low mass particle. In a semiconductor its energy (vibrational energy

probably) is about 0.1 ev, but it can be as high as 1 ev in some materials.

They have fairly long lifetimes, as long as msecs in some materials. (Though

a paper I read showed more like 50 nsec for CdSe nano-particles) The electron

is prevented from falling into the hole because of the inability to lose

energy. An exciton can be created directly by a photon. If the energized

electron pops out yet remains loosely bound to the hole it has just created,

then we have an exciton.

I read that in ordinary solar cells they speak of the photon first creating an excitron, which is then separated by the E field of the pn junction. The interesting thing is that an exciton being mobile allows energy to be transported through a material, but consisting of an electron and hole there is no current flow.

In quantum dots the mechanism of high energy photons generating more than one electron is described as the photon first creating a high energy excitron , and then the exciton lowers its energy by creating additional excitons. But a news report in 2008 indicated many researchers (including from MIT) found the effect is much weaker than first reported in 2004 (which was up to seven electrons/photon). New reports are the multiplier is only 1.25 to 1.4, indicating it probably would not be of practical use in photocells.

graphic showing comparing how a high energy photon

creates:

(left) hole-electron pair

(right) (supposedly) multiple excitons (bound hole-electron

pairs)

http://www.sciencemag.org/cgi/content/full/322/5909/1784a

NJ mounts 200,000 solar panels on power poles (update

4/28/11)

NYT

ran a front page article on a huge number of 5 x 2.5 ft (220 watt) solar

panels being mounted on 1/4th of the 800,000 poles of suburban NJ electric

utitlity, which is working to meet a state law mandating more power from

renewables. The thrust of the article were people complaining about the

look of the large panels which are mounted only 15 feet above ground.

220 watt solar panels on 200,000 poles in NJ

NYT front page 4/28/11

The article (as usual) quotes only the peak power of the panel and states that the 200,000 panels will put out 40 Mw. Of course, this is peak power and the average in NJ is probably 6 to 8 times lower! Also there was no mention in the article of the need for 200,000 inverters, so I posted the comment below (of > 400 comments!) to address these issues.

I'm a power engineer, so I can add some perspective. The 220 watt number quoted for the panel is the power in bright sunlight. What counts is the average power. Even in the southwestern desert bright sun exists (on average) 6 of 24 hours, which reduces the average power of this type of panel to 55 watts. In northern, cloudy NJ the panel's average power will be substantially lower, maybe 30 watts. If panels are mounted on 200,000 poles (200,000 separate installations), then the average power from all of them is 6 Mw (6 million watts). A standard (baseload) power plant is rated for 1,000 Mw, so the power from all these solar panels is the equivalent of 0.6% power plant. Yup, less than 1% of a baseload power plant, that's the nature of solar, it is a diffuse energy source.

Then there is the matter of reliability. Each solar panel is putting out low voltage DC (not AC). While unmentioned in the article, to connect it to the grid there must be included with the panel an 'inverter', which converts DC to AC (and steps up the voltage). Electronics can be pretty reliable if well designed (think hybrid cars), but there is no way these [panels + inverters] are going to have the long term reliability of things on the pole like the transformer, and everyone knows pole transformers blow up every now and then. (Donald E. Fulton 4/28/11)I checked the utility's (PSE&G) web site. They have a long FAQ on the pole project. Nowhere do they mention the inverter. They give the lifetime of the panels as 20 years. They say this: "The pole-attached solar program is the first of its kind and is the largest (40 Mw) pole-attached solar installation in the world." Half of the proposed 200,000 panels are already installed. Another 40 Mw of panels is to put in four NJ sites. "All four sites will utilize crystalline solar panel technology and have monitoring and communications functionality."

Economics

A 2009 article

says the budget to install the 200,000 panels is 773 million, which works

out to $3,865 per panel. At 30 watt av a panel output is 0.72 kwh/day or

263 kwh/yr. If the a khw can be sold for 10 to 20 cents, then the value

of a panel's output is 26 to 52 dollars/yr. This is a ridiculously low

playback of 1% of so of the invesment, and even over its 20 year expected

live never comes close to paying back the original investment. So I posted

this too:

Let's work some numbers on the economics. A 2009 Star-Ledger article quotes PSE&G as saying the budget for the 200,000 pole panels is 773 million. This works out to $3,865 per panel (purchase + installation). At 30 watt av per panel (see my previous post) this is 0.72 kwh/day or 263 kwh/yr. Say a khw is worth 10 to 20 cents, then the value of a panel's output is 26 to 52 dollars/yr. This is a ridiculously low return of 1% of so per year, and even over its expected 20 year lifetime a panel never comes close to paying back its original cost. (Donald E. Fulton 4/28/11)No mention of whose solar panels are being used in NJ, but I did find this on a 12 Mw Ohio solar field with 159,000 panels (eq to 75 watt panels) that has been built by PSEG solar a subsidiary of PSEG.Correction --- The $3,865 per panel seemed awfully high. So when I dug into it, I found the 773 million covered an additional 80 Mw of installation. The cost of the 40 Mw panel part of the project was 264 million or 1,320 per panel. This makes the annual return 3% or so, still very low.

-- First Solar supplied the 159,200 solar panels, most produced at their Perrysburg, OH manufacturing facility. SMA America of Rocklin, CA supplied the 16 Inverters that convert the DC power generated by the solar panels to AC power for export to the grid. MTC Transformers of Wytheville, VA provided the 8 Transformers that increase the voltage to make it grid compatible. Schletter Inc. of Tucson, AZ supplied the racking systems that supports the solar modules.

Enhanced geothermal

systems (7/08)

Al Gore's concern for global warming has begun to morph into a combo concern

for global warming and energy shortages. Recently he gave a highly publicized

speech pushing for the US to convert its total electrical electrical supply

production over the next decade to 'carbon free' sources: "sun,

the winds and other environmentally friendly sources of power".

Nuclear?Anyway one of the three technologies that (apparently) Gore and the green's are pushing (besides solar and wind) is geothermal. One nice feature of geothermal, unlike solar and wind, is that it is continuous, so it naturally makes for base load plants. The (new) geothermal technology being pushed is a technique called is 'Enhanced Geothermal Systems', sometimes called 'Engineered Geothermal Systems' (EGS). This is different from the type of existing geothermal power now used in few places in the world like Iceland, which are near volcanos and where below ground heat is close and very hot. This source of geothermal power is very limited and mostly tapped out.

Whether 'environmentally friendly' includes (in Gore's mind) nuclear power is apparently an exercise for the reader. I read Gore's big 7/17/08 energy speech, and it's quite amazing. He repeatly talks abou the need for being 'bold' in addressing this problem, but the word 'nuclear' never comes out of his mouth. He doesn't say shut down the nuclear plants (currently providing about 20% of US electrical power) or build more, he just says nothing. Oh, yes! the political courage of the 'green' wing of the Democratic party.The next day the NYT reported ( maybe someone asked Gore a question) that his position on nulear power was leave the nuclear plants open, but build no more.

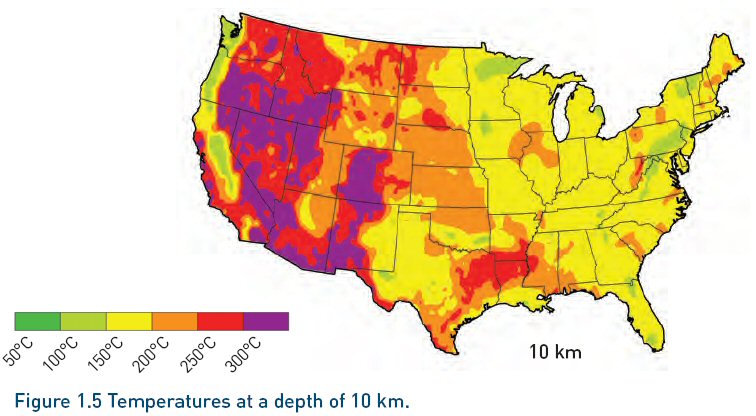

Enhanced geothermal involves drilling down to (about) 10 km (6.25 mile) and injecting water to tap the 300C heat in the rocks. A 10 km hole is doable, but it's deep. This is deeper than 'ultra deep' oil and gas wells, which in the report are shown as mostly 6-7 km. The report says 'only two or three wells' have ever been drilled in the US that are even close to 10 km. Rocks at 10 km are below most sedimentary rocks and are mostly igneous granite, often called basement rocks.

The heat in rocks at this depth is due to the out flow of heat from deeper in the earth and to decay of radioactive elements within the rocks at this depth, mostly uranium, thorium and potassium (no ratio was given). The heat is brought up in the form of heated water that is used to run turbines. The waste heat is dumped into the air with (large) cooling towers. The cooling towers need to be large, because due to the low temperature of the operating fluid the waste heat is high, two or three times higher than a nuclear plant with the same electrical output. Also the report assumes that in most locations surface water needs to be available to run the plant, both for injection and to cool the cooling tower. Clearly this is a problem in much of the American West.

There are several (small) geothermal power plants in the Imperial Valley of CA, which coexist with intensive farming. One plant is 50 Mw.Rocks of this temperature (300 C) at this depth are thought to exist over a large areas of the American West (see map below). I tracked down what appear to be the major reference on enhanced geothermal. It's a 372 page document, called "The Future of GeoThermal Energy" published by MIT in 2006 (written by a panel of 12 chaired by Jefferson Testor, a chemist at MIT).

http://geothermal.inel.gov/publications/future_of_geothermal_energy.pdf

Temperatures from 200 C (?) and higher are usable.

(from MIT report "Enhanced Geothermal Systems", 2006)

Skimming the report I found a few interesting number and facts, which of course, the politicians never mention. For a standard 1,000 Mw plant the (surface) area required is 21 km^2. This 1,000/21 = 47.6 w/m^2. For perspective the (minimum) area for a solar plant, based on the recoverable energy in sunlight, is in the neighborhood of 25w/m^2 (1,000 w/m^2 x 10% efficiency x 1/4 to yield continuous power), so enhanced geothermal plants, like solar, are big. The geothermal plant coming in at about 1/2 the area of a solar plant!

How energy effective?At another point in the report the sustainable extractable power is given as only 26 millewatts per cubic meter of rock reservoir. This is a tiny number, but of course volume scaling results in a much rosier outlook. Scaling 26 mw/m^3 to a cubic km gives 26 Mw/km^3. Scaling up to a 1,000 Mw plant we would need 38 cubic km of rock reservoir (1,000/26 = 38). A 38 km^3 reservoir is basically consistent with the claimed surface area of 21 km^2 for a 1,000 Mw plant since (21 km^2 x 1.8 km deep = 38 km^3).

A key question to ask of any new energy source is what fraction of the potentially recoverable energy you need to expend to recover it. In other words how much energy does it take to do the drilling and processing compared to the energy recovered. This is an indication of its real cost and allows potential new energy sources to be compared. I did not see this important point addressed in the report.For example, if you need to expend the energy equivalent of 101 barrels of oil to drill and recover the equivalent energy of 100 barrels of oil, then this energy store is totally unusable. It's crazy to drill. This is exactly the case in some of the old oil wells in the Gulf of Mexico that recently got destroyed in a hurricane. While they were OK, it was profitable to keep pumping them, but they will not be redrilled because the cost to redrill exceeds the profit that can be recovered.

Shhh, geothermal is non-renewable

From what

I see in the report these plants are taping what is essentially a non-renewble

resource!

In many ways it is a lot like drilling for oil. The most suitable areas

are those with rocks that have high porosity and permeability (permeability

is interconnected pores) and high thermal conductivity. But the report

says we know from oil and gas drilling that most heat is in rocks with

low permeability, so the goal of EGS is to figure out how to tap this heat.

The preferred sites would have water at depth, though if water is available

on the surface it can be pumped in. The average heat flow through the earth's

crust is very low, given in the report as 59 mw/m^2. Note the heat power

flowing up from below is about 4,000 times less than heat power coming

in from above (1/4 x 1,000 w/m^2/0.059 w/m^2 = 4,237). Footnotes in the

report assume new holes will drilled every five years (one reason the surface

area is so big), and the plant lifetime is only 20 years! This translates

into plants that need to slowly crawl across the surface to reach new hot

rocks.

Renewable claimSince these rocks are not very hot, this is low quality heat, meaning a lot of heat in a big mass. Thus conversion efficiencies are limited by thermodynamics (Carnot cycle). A footnote in the report says the conversion efficiency (no temp was given) was assumed to be 10% (for a 'binary' plant).

The greens, having dedicated themselves to 'renewable' sources of energy, desperately want to claim this energy source is renewable, and in fact I have seen it so labeled with the explanation that it's renewable because of continuing decay of radioactive material. This, of course, is total nonsense. This is heat mining plain and simple. It's no more renewable on the time scale of man than is oil and gas.Gore in his big energy speech cleverly avoids mentioning the fact that (enhanced) geothermal is not renewable. Another example of Gore boldness.

Heat capacity of rocksFunding for EGS in the US is poor. The Dept of Energy recently reduced their EGS budget from 20 million to zero. In 2007 congress put back in 90 million, but the dept of Energy still only has 30 million of this in its 2009 budget vs 400 million for coal. However, Germany, as with solar, is spending quite a bit on EGS. Canada is spending almost zero on EGS, putting all its money into oil from tar sands.

To illustrate the heat stored in rocks the report gives this simplistic (their name) example: a volume of rock 14 km x 14 km x 1 km deep (200 km^3) if cooled 200C (250C to 50C) would release heat equal to the total energy consumption in the US for a year.

Where are the oil & gas companies?

This seems

(to me) to be a natural business for the oil companies (& oil service

companies) to expand into. Do they have any interest in this business?

Not that I have seen. This either indicates that the technology is still

poorly developed, meaning a lot of R&D, time, and risk taking are required,

or the underlying economics are just not that good.

============================================================

Switch Grass

----------------------

The Grass Station

By CONSTANCE CASEY (NYT) February 11, 2006

And yes, ethanol can be made from switch grass, which grows in abundance on the prairies of the Great Plains. If grass had ambition (besides wanting to propagate), the panicum virgatum might see itself as a cure for global warming and a savior of the family farm. If burning compressed switch grass really does work to reduce the use of fossil fuels, it would reduce the carbon we release into the air. Then farmers could find new profits in growing the stuff. And the more, the better. Switch grass, like every other plant, takes carbon dioxide out of the air and uses it to build plant tissue.

Switch grass cleans water as well as air; its wide-spreading roots filter out pesticides, herbicides and excess fertilizer before they reach the waterways. Up in Manitoba, Canada, where they care deeply about staying warm, they're experimenting with stoves that burn pellets of switch grass.

Family farmers know that switch grass is easy to grow. It doesn't complain about growing in sand; it doesn't mind clay either. It's tolerant of floods as well as of droughts. It would work as part of the effort to restore the Louisiana wetlands that can help protect New Orleans from hurricanes.

Switch

grass is native to most of North America, from Canada to Texas. Let's

not forget that switch grass is beautiful and looks great in floral arrangements.

On the very same day the president spoke, I got the latest Brooklyn Botanic

Garden handbook, ''Designing Borders for Sun and Shade,'' in the mail.

The handbook strongly recommended switch grass as part of a perennial border.

There's ''Dallas Blues,'' ''Alamo,'' and the prettiest, wine-red ''Shenandoah.''

The handbook suggests combining switch grass with asters, sunflowers and

black-eyed Susans for an all-native garden with a nice prairie feel.

---------------------------------------------------------------------------

For Good or Ill, Boom in Ethanol Reshapes Economy of Heartland

NYT, June 25, 2006

This article was reported by Alexei Barrionuevo, Simon Romero and Michael Janofsky and written by Mr. Barrionuevo.

Dozens of factories that turn corn into the gasoline substitute ethanol are sprouting up across the nation, from Tennessee to Kansas, and California, often in places hundreds of miles away from where corn is grown. Once considered the green dream of the environmentally sensitive, ethanol has become the province of agricultural giants that have long pressed for its use as fuel, as well as newcomers seeking to cash in on a bonanza.

The modern-day gold rush is driven by a number of factors: generous government subsidies, surging demand for ethanol as a gasoline supplement, a potent blend of farm-state politics and the prospect of generating more than a 100 percent profit in less than two years. The rush is taking place despite concerns that large-scale diversion of agricultural resources to fuel could result in price increases for food for people and livestock, as well as the transformation of vast preserved areas into farmland.

Even in the small town of Hereford, in the middle of the Texas Panhandle's cattle country and hundreds of miles from the agricultural heartland, two companies are rushing to build plants to turn corn into fuel. As a result, Hereford has become a flashpoint in the ethanol boom that is helping to reshape part of rural America's economic base.

Despite continuing doubts about whether the fuel provides a genuine energy saving, at least 39 new ethanol plants are expected to be completed over the next 9 to 12 months, projects that will push the United States past Brazil as the world's largest ethanol producer. The new plants will produce 1.4 billion gallons a year, a 30 percent increase over current production of 4.6 billion gallons, according to Dan Basse, president of AgResources, an economic forecasting firm in Chicago. By 2008, analysts predict, ethanol output could reach 8 billion gallons a year.

For all its allure, though, there are hidden risks to the boom. Even as struggling local communities herald the expansion of this ethanol-industrial complex and politicians promote its use as a way to decrease America's energy dependence on foreign oil, the ethanol phenomenon is creating some unexpected jitters in crucial corners of farm country. A few agricultural economists and food industry executives are quietly worrying that ethanol, at its current pace of development, could strain food supplies, raise costs for the livestock industry and force the use of marginal farmland in the search for ever more acres to plant corn.

"This is a bit like a gold rush," warned Warren R. Staley, the chief executive of Cargill, the multinational agricultural company based in Minnesota. "There are unintended consequences of this euphoria to expand ethanol production at this pace that people are not considering." Mr. Staley has his own reasons to worry, because Cargill has a stake in keeping the price of corn low enough to supply its vast interests in processed food and livestock.

But many energy experts are also questioning the benefits of ethanol to the nation's fuel supply. While it is a renewable, domestically produced fuel that reduces gasoline pollution, large amounts of oil or natural gas go into making ethanol from corn, leaving its net contribution to reducing the use of fossil fuels much in doubt. As one of the hottest investments around, however, few in farm country want to hear any complaints these days about the risks associated with ethanol. Archer Daniels Midland, the politically connected agricultural processing company in Decatur, Ill., and the industry leader that has been a longstanding champion of transforming corn into a fuel blend, has enjoyed a doubling in its stock price and profits in the last year. One ethanol producer has already sold shares to the public and two more are planning to do so. And the get-rich-quick atmosphere has drawn in a range of investors, including small farm cooperatives, hedge funds and even Bill Gates.

For all the interest in ethanol, however, it is doubtful whether it can serve as the energy savior President Bush has identified. He has called for biofuels — which account for just 3 percent of total gasoline usage — to replace roughly 1.6 million barrels a day of oil imported from the Persian Gulf.

New Jobs, New Life

To fill that gap with corn-based ethanol alone, agricultural experts say that production would have to rise to more than 50 billion gallons a year; at least half the nation's farmland would need to be used to grow corn for fuel. But that isn't stopping out-of-the-way towns looking for ways to pump life into local economies wracked by population loss, farm consolidation and low prices from treating the rush into ethanol as a godsend.

"These projects are bringing 100 new jobs to our town," said Don Cumpton, Hereford's director of economic development and a former football coach at the high school. "It's not as if Dell computer's going to be setting up shop here. We'd be nuts to turn something like this down."

That the United States is using corn, among the more expensive crops to grow and harvest, to help meet the country's fuel needs is a testament to the politics underlying ethanol's 30-year rise to prominence. Brazilian farmers produce ethanol from sugar at a cost roughly 30 percent less.

But in America's farm belt, politicians have backed the ethanol movement as a way to promote the use of corn, the nation's most plentiful and heavily subsidized crop. Those generous government subsidies have kept corn prices artificially low — at about $2 a bushel — and encouraged flat-out production by farmers, leading to large surpluses symbolized by golden corn piles towering next to grain silos in Iowa and Illinois.

While farmers are seeing little of the huge profits ethanol refiners like Archer Daniels Midland are banking, many farmers are investing in ethanol plants through cooperatives or simply benefiting from the rising demand for corn. With Iowa home to the nation's first presidential caucuses every four years, just about every candidate who visits the state pays obeisance to ethanol. "There is zero daylight" between Democrats and Republicans in the region, said Ken Cook, president of Environmental Working Group, a nonprofit research policy group in Washington, and a veteran observer of agricultural politics. "All incumbents and challengers in Midwestern farm country are by definition ethanolics."

The ethanol explosion began in the 1970's and 1980's, when ADM's chief executive, Dwayne O. Andreas, was a generous campaign contributor and well-known figure in the halls of Congress who helped push the idea of transforming corn into fuel.

Ethanol can be produced from a number of agricultural feed stocks, including corn and sugar cane, and someday, wheat and straw. But given the glut in corn, the early strategy of Mr. Andreas was to drum up interest in ethanol on the state level among corn farmers and persuade Washington to provide generous tax incentives. But in 1990, when Congress mandated the use of a supplement in gasoline to help limit emissions, ADM lost out to the oil industry, which won the right to use the cheaper methyl tertiary butyl ether, or MTBE, derived from natural gas, to fill the 10 percent fuel requirement.

Past Scandal

Adding to its woes, ADM was marred by scandal in 1996 when several company executives, including one of the sons of Mr. Andreas, were convicted of conspiracy to fix lysine markets. The company was fined $100 million. Since then, ADM's direct political clout in Washington may have waned a bit but it still pursues its policy preferences through a series of trade organizations, notably the Renewable Fuels Association.

Some 14 months ago the company hired Shannon Herzfeld, a leading lobbyist for the pharmaceutical industry. But she is not a registered lobbyist for ADM and said in an interview that the company was maintaining its long-held policy that it does not lobby Congress directly. "Nobody is deferential to ADM," contended Ms. Herzfeld, who says she spends little time on Capitol Hill.

But ADM has not lost interest in promoting ethanol among farm organizations, politicians and the news media. It is by far the biggest beneficiary of more than $2 billion in government subsidies the ethanol industry receives each year, via a 51-cent-a-gallon tax credit given to refiners and blenders that mix ethanol into their gasoline. ADM will earn an estimated $1.3 billion from ethanol alone in the 2007 fiscal year, up from $556 million this year, said David Driscoll, a food manufacturing analyst at Citigroup.

[And the company may be concerned by the recent statement by Energy Secretary Samuel W. Bodman, who suggested that if prices remain high, lawmakers should consider ending the ethanol subsidy when it expires in 2010. "The question needs to be thought about," he said on Friday.]

ADM has huge production facilities that dwarf those of its competitors. With seven big plants, the company controls 1.1 billion gallons of ethanol production, or about 24 percent of the country's capacity. ADM can make more than four times what VeraSun, ADM's closest ethanol rival, can produce.

Last year, spurred by soaring energy prices, the ethanol lobby broke through in its long campaign to win acceptance outside the corn belt, inserting a provision in the Energy Policy Act of 2005 that calls for the use of 5 billion gallons a year of ethanol by 2007, growing to at least 7.5 billion gallons in 2012. The industry is now expected to produce about 6 billion gallons next year.

The phased removal of MTBE from gasoline, a result of concerns that the chemical contaminates groundwater and can lead to potential health problems, hastened the changeover. Now, government officials are also pushing for increasing use of an 85-percent ethanol blend, called E85, which requires automakers to modify their engines and fuel injection systems.

In the ultimate nod to ADM's successful efforts, Mr. Bodman announced the new initiatives in February at the company's headquarters in Illinois. "It's been 30 years since we got a call from the White House asking for the agriculture industry, ADM in particular, to take a serious look at the possibilities of building facilities to produce alternative sources of energy for our fuel supply in the United States," said G. Allen Andreas, ADM's chairman and Dwayne Andreas' nephew.

Now, ADM is betting even more of its future on ethanol, embracing a shift from food processing to energy production as its focus. In April, it hired Patricia A. Woertz, a former executive from the oil giant Chevron, as the company's new chief executive. While ADM has pushed ethanol, rivals like Cargill have been more skeptical. To Mr. Staley, ethanol is overpromoted as a solution to the nation's energy challenges, and the growth in production, if unchecked, has the potential to ravage America's livestock industry and harm the nation's reliability as an exporter of corn and its byproducts.

Threat to Food Production

"Unless we have huge increases in productivity, we will have a huge problem with food production," Mr. Staley said. "And the world will have to make choices." Last year corn production topped 11 billion bushels — second only to 2004's record harvest. But many analysts doubt whether the scientists and farmers can keep up with the ethanol merchants. "By the middle of 2007, there will be a food fight between the livestock industry and this biofuels or ethanol industry," Mr. Basse, the economic forecaster, said. "As the corn price reaches up above $3 a bushel, the livestock industry will be forced to raise prices or reduce their herds. At that point the U.S. consumer will start to see rising food prices or food inflation."

If that occurs, the battleground is likely to shift to some 35 million acres of land set aside under a 1985 program for conservation and to help prevent overproduction. Farmers are paid an annual subsidy averaging $48 an acre not to raise crops on the land. But the profit lure of ethanol could be great enough to push the acreage, much of it considered marginal, back into production.

Mr. Staley fears that could distract farmers from the traditional primary goal of agriculture, raising food for people and animals. "We have to look at the hierarchy of value for agricultural land use," he said in a May speech in Washington. "Food first, then feed" for livestock, "and last fuel."

And even Cargill is hedging its bets. It recently announced plans to nearly double its American ethanol capacity to 220 million gallons a year. Meanwhile, the flood of ethanol plant announcements is making the American livestock industry nervous about corn production. "I think we can keep up, assuming we get normal weather," said Greg Doud, the chief economist at the National Cattlemen's Beef Association. "But what happens when Mother Nature crosses us up and we get a bad corn year?"

Beyond improving corn yields, the greatest hope for ethanol lies with refining technology that can produce the fuel from more efficient renewable resources, like a form of fuel called cellulosic ethanol from straw, switchgrass or even agricultural waste. While still years away, cellulosic ethanol could help overcome the concerns inherent in relying almost exclusively on corn to make ethanol and make the advance toward E85 that much quicker.

"The cost of the alternative — of staying addicted to oil and filling our atmosphere with greenhouse gases, and keeping other countries beholden to high gasoline prices — is unacceptable," said Nathanael Greene, senior policy analyst at the Natural Resources Defense Council in New York. "We have to struggle through the challenges of growing and producing biofuels in the right way."

But the current

incentives to make ethanol from corn are too attractive for producers and

investors to worry about the future. With oil prices at $70 a barrel

sharply lifting the prices paid for ethanol, the average processing plant

is earning a net profit of more than $5 a bushel on the corn it is buying

for about $2 a bushel, Mr. Basse said. And that is before the 51-cent-a-gallon

tax credit given to refiners and blenders that incorporate ethanol into

their gasoline. "It is truly yellow gold," Mr. Basse said.

---------------------------------------------------------------------------------------

Drive to make fuel from plants gets a boost

By Gareth Cook, Globe Staff | July 4, 2006

A new federal report concludes that the ability to make fuel efficiently from virtually any kind of plant is within reach, offering the promise of a technology that could dramatically benefit the environment, slash dependence on foreign oil, and one day even reorder the global balance of power.

The Department of Energy report, to be released soon, offers a road map for moving from today's technology that makes the fuel ethanol from cornstarch to a new approach using cellulose, the main ingredient in most plants. That would greatly increase the country's ability to produce ethanol, which can easily be used in most automobiles, and create unexpected sources of energy from the rice paddies of California to the paper mills of northern New England. ``I think this is very doable," said Sharlene C. Weatherwax, a program manager in the department's Office of Science, which helped prepare the report. ``This is not a blue-sky exercise for us."

The report lays out an ambitious plan, a kind of Manhattan Project for biofuels, for solving the central obstacle: the high cost of production. The report, prepared in consultation with top scientists in academia, industry, and the government, envisions solving the underlying scientific problems over the next five years, followed by a 10-year program of transferring these advances to industry.

Scientists cautioned that it is impossible to predict how rapidly they will progress, but the report will add momentum to a field that has suddenly become very hot. President Bush called for the development of cellulosic ethanol in his State of the Union address in January, singling out switchgrass, a tall grass that grows on the North American prairie, as a potential source. In the past few months, Goldman Sachs and Silicon Valley venture capitalists as well as Bill Gates have been investing in cellulosic ethanol companies. Several companies are seeking to build experimental cellulosic ``biorefineries" around the world, and the Energy Department to support efforts to build them in America.